what do u think about this dumping by china?

Well, I'm probably not the best (or most knowledgeable) person to ask on this (just being honest). Possibly Tom or some of these other really smart market peeps have a better perspective, but..........

As I read the expanded article, it's quite apparent that they're not the only ones who are "de-risking" themselves AWAY from the U.S.

https://www.scmp.com/economy/china-...5083&module=perpetual_scroll_0&pgtype=article

"The reduction in US Treasury bills holdings between March 2022 and this past July – China dumped US$191.4 billion, Japan slashed US$116.5 billion, Ireland cut US$44.4 billion, Brazil shed US$8.6 billion and Singapore got rid of US$4.8 billion – was partly because of the slew of aggressive US interest rate hikes that have dampened bond prices."

Not all though:

https://markets.businessinsider.com...d-market-outlook-selling-american-debt-2023-8

"Japan also slashed its exposure to Treasury's in June, per Tuesday's data,

while both the UK and Belgium ramped up their spending on US government bonds by over $50 billion."

Also from that same article:

"It's the third straight month that Beijing has sold Treasury's and brings its total holdings to their lowest level since May 2009, per the South China Morning Post.

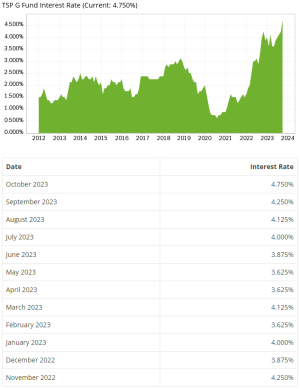

Bond prices have tanked in 2023, with 2-year yields jumping 169 basis points and returns on 10-year notes spiking 127 points as investors fret about the longer-term impact of the Federal Reserve's aggressive interest-rate hikes and the government's issuance of fresh debt.

China appears to be fueling the rout, with authorities locked in a geopolitical battle with the US and engaging in dedollarization, a co-ordinated effort to chip away at the buck's dominant role in international trade.

It's likely to carry on cutting its US debt holdings over the next few months, according to experts.

"The proportion of US debt in China's foreign exchange reserves is expected to continue decreasing," said Peking University economics professor Tang Yao told the state-run publication China Daily on Wednesday."

Last but not least, I'll quote this guy from the "Comment" section ( https://finance.yahoo.com/news/china-fuels-us-bond-rout-172720237.html ) who seems to sum it up fairly well:

"They were forced by circumstances to lower their US bonds holdings mainly due to the uncertainty of the continued strength of the US currency as indicated in the US huge gross national debts to buy for something more tangible like gold and oil. Japan, UK, Germany, etc. are also buying gold in huge quantities as a hedge."

:nuts:

:nuts: