- Reaction score

- 521

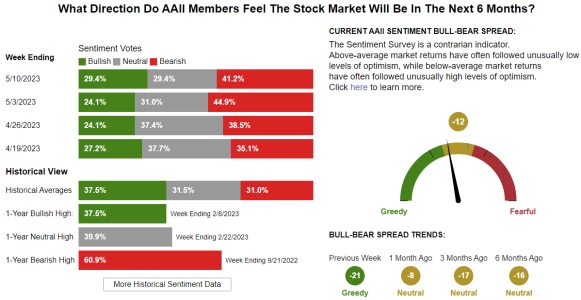

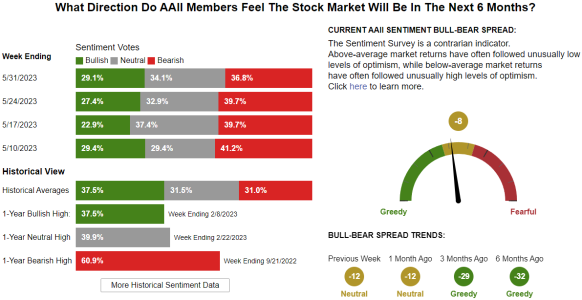

Very insightful, thanks for sharing. I wanted to throw a spotlight on the potential market paradox she describes at the 19:00 minute mark. In her opinion, current market prices are elevated because the market has already priced in future rate cuts by the Fed (pivot) in a reachable time frame. Yet she points out that the Fed is likely to hold rates higher as long as they can get away with, based on their own language. So, when that time frame is reached and the Fed has yet to cut rates, there will be a strong negative reaction in the market, which will likely be the catalyst for the Fed to cut rates.

In her words:

"The markets are discounting the pivot before the pain, but the pivot is going to be the consequence of the pain."