Epic

TSP Pro

- Reaction score

- 365

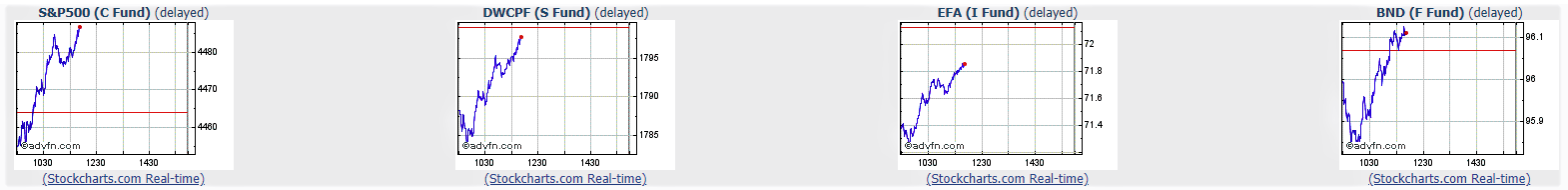

Don't be so hard on yourself. The rally is always behind you. We never know what's in front of us.

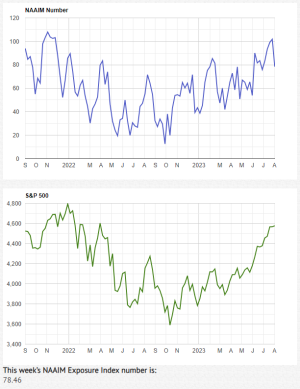

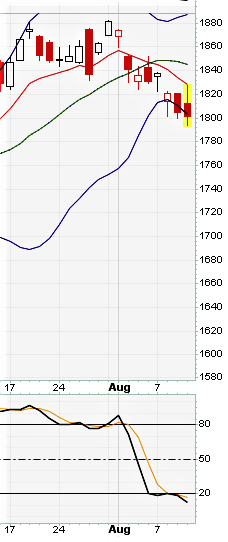

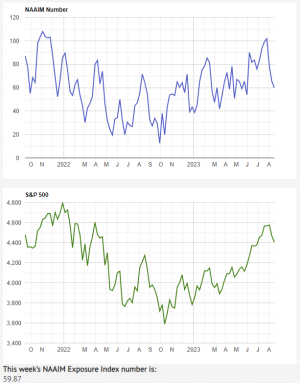

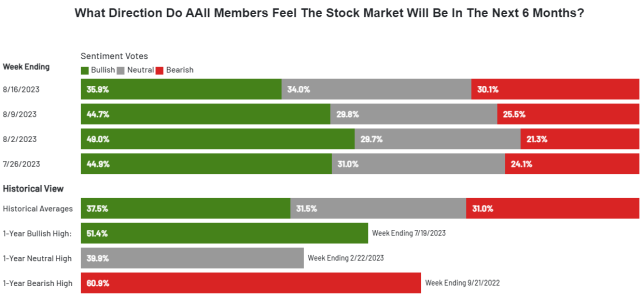

Yes, very true. Also, the slow climb up takes a lot more nerve to risk it all in this unpredictable economy, the way things happen just with someone's tone of voice (hawkish/dovish). Big losses can happen hard and fast. It all depends on how much your willing to risk it. I'm still not that confident in the way things are going. Still too sketchy for me.

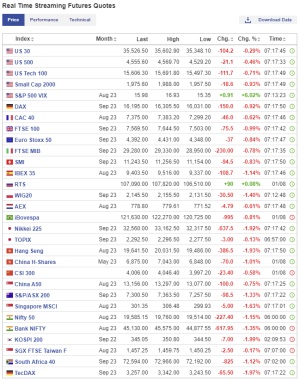

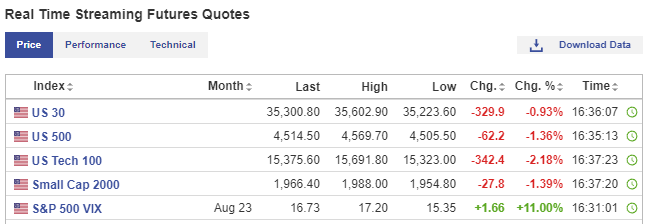

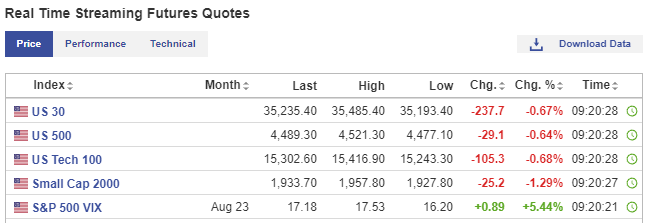

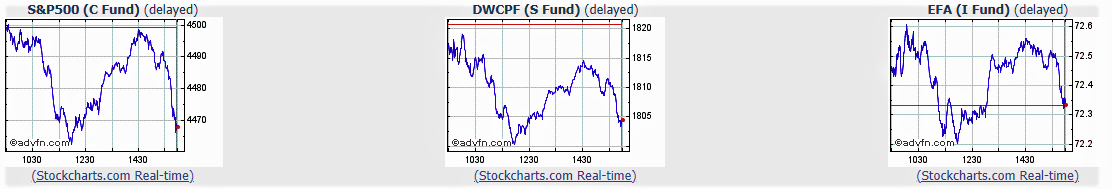

Just look at futures this morning. Asia tanked overnight. That's gonna have an impact. I'm sure.....

https://www.investing.com/indices/indices-futures