- Reaction score

- 614

Stocks have spent the last two weeks enthusiastically retracing the price cuts of early November. Now the C-fund and S-fund sit within reach of new all-time highs. But how does the rapid recovery influence the forward-facing TSP investor?

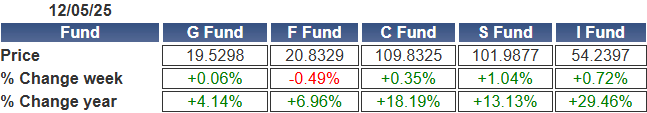

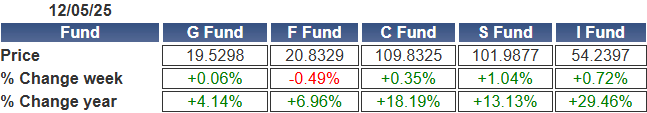

For the C-fund, Friday’s close at $109.83 marked its strongest finish since October 29th, when it set its record price at $109.98. That leaves the index just 0.14% shy of a fresh high. It has gained 5.13% in the last ten trading days, a sharp reversal from its November 20th low at $104.47.

Small caps have demonstrated even more force. The S-fund ended Friday at $101.99, less than 1% below its record of $102.95 set on October 27th. kkkit has surged 8.5% over the same ten-day stretch. While the S-fund has a bit more ground to cover to reclaim its high, its pace of recovery has outmatched the large-cap index.

An 8% move in two weeks should get any TSP investor’s attention. If you hold stock funds, you’ve likely noticed the jump in your balance—but a forward-thinking investor also weighs whether it’s time to protect newly gained, or newly recovered, capital. That leads to the natural question: How are AutoTracker members positioned into this strength?

Looking only at 615 Active AutoTracker members* we get an average allocation of:

The notable feature here is the 30% G-fund weighting. Even after a two-week snapback in equities, a sizeable portion of active members are keeping defensive capital on the sidelines. That may indicate one of two broader mindsets heading into the final three and a half weeks of December:

While the broader group of active AutoTracker members is balanced between caution and participation, a very different picture comes into focus when we narrow our lens to the Top 50 performers.

Their average allocation:

These are Active AutoTracker members who have accumulated 2025 returns between 19.3% and 42.8%. Compared to the average AutoTracker member, these Top 50 members seem less concerned with protecting their gains. Only 8 of the 50 hold a majority of their current allocation outside of stock funds.

Their allocations tilt decisively toward the S-fund, which holds nearly 38% of their collective weighting. This stands out given the recent small-cap surge: while many members remain hesitant to chase an 8.5% rally, top performers appear to view the S-fund’s momentum as an opportunity rather than a risk.

Most recently, six Top 50 Members made IFT last week. Four of the six used the IFT to increase their stock fund exposure. This included BHRUNIKH, nightman, and phlames who all moved from 100% G to 100% S-fund on Monday.

The remaining two members moved in the opposite direction, highlighting the strategic diversity even within the top tier. BigBully left the S-fund for a more conservative blend centered on the F-fund with some C-fund exposure. Tailgate, meanwhile, exited both the S and I-funds entirely, rotating into a 100% G-fund position. Their actions reflect a protective posture

Three-Month Daily Chart of the DWCPF (S-fund)

Whether you’re sitting in cash or fully exposed to stock funds, this is a good moment to evaluate both your positioning and your expectations for the market—and for your TSP balance. The Federal Reserve is expected to cut rates by 25 basis points this Wednesday. How you position yourself for that event should align with your risk tolerance and your optimism about the growth potential of the TSP stock funds. Do you believe a rate cut is already priced in, or do you see it as fresh fuel for buyers to keep pushing prices higher?

Early December also brings the Santa Claus Rally to mind. Since 1950, the S&P 500 has averaged a 1.3% gain during the seven-trading-day stretch that includes the final five days of December and the first two of January. While the rally isn’t guaranteed, that period has produced a positive return nearly 79% of the time. With those odds, some investors position their TSP accounts into stocks ahead of time, anticipating seasonal strength.

Reduce your guessing and join TSP investors who receive the Last Look Report every morning 30 minutes ahead of the IFT deadline. You'll get the latest snapshot of the TSP Talk AutoTracker trends and latest IFTs made by your peers tied with morning market action analysis. It's a daily opportunity to learn from your peers, recognize patterns, and make decisions with confidence instead of guesswork.

Subscribe Here

Thanks for reading.

*Members logged in to their account within a year.

For the C-fund, Friday’s close at $109.83 marked its strongest finish since October 29th, when it set its record price at $109.98. That leaves the index just 0.14% shy of a fresh high. It has gained 5.13% in the last ten trading days, a sharp reversal from its November 20th low at $104.47.

Small caps have demonstrated even more force. The S-fund ended Friday at $101.99, less than 1% below its record of $102.95 set on October 27th. kkkit has surged 8.5% over the same ten-day stretch. While the S-fund has a bit more ground to cover to reclaim its high, its pace of recovery has outmatched the large-cap index.

An 8% move in two weeks should get any TSP investor’s attention. If you hold stock funds, you’ve likely noticed the jump in your balance—but a forward-thinking investor also weighs whether it’s time to protect newly gained, or newly recovered, capital. That leads to the natural question: How are AutoTracker members positioned into this strength?

Looking only at 615 Active AutoTracker members* we get an average allocation of:

G: 30.5% | F: 2.4% | C: 27.1% | S: 25.5% | I: 9.5%

The notable feature here is the 30% G-fund weighting. Even after a two-week snapback in equities, a sizeable portion of active members are keeping defensive capital on the sidelines. That may indicate one of two broader mindsets heading into the final three and a half weeks of December:

- Skepticism about the durability of the rally—especially after a volatile November.

- A readiness to deploy cash if a late-month opportunity appears

While the broader group of active AutoTracker members is balanced between caution and participation, a very different picture comes into focus when we narrow our lens to the Top 50 performers.

Their average allocation:

G: 17.0% | F: 4.0% | C: 24.4% | S: 37.7% | I: 14.4%

These are Active AutoTracker members who have accumulated 2025 returns between 19.3% and 42.8%. Compared to the average AutoTracker member, these Top 50 members seem less concerned with protecting their gains. Only 8 of the 50 hold a majority of their current allocation outside of stock funds.

Their allocations tilt decisively toward the S-fund, which holds nearly 38% of their collective weighting. This stands out given the recent small-cap surge: while many members remain hesitant to chase an 8.5% rally, top performers appear to view the S-fund’s momentum as an opportunity rather than a risk.

Most recently, six Top 50 Members made IFT last week. Four of the six used the IFT to increase their stock fund exposure. This included BHRUNIKH, nightman, and phlames who all moved from 100% G to 100% S-fund on Monday.

The remaining two members moved in the opposite direction, highlighting the strategic diversity even within the top tier. BigBully left the S-fund for a more conservative blend centered on the F-fund with some C-fund exposure. Tailgate, meanwhile, exited both the S and I-funds entirely, rotating into a 100% G-fund position. Their actions reflect a protective posture

Three-Month Daily Chart of the DWCPF (S-fund)

Whether you’re sitting in cash or fully exposed to stock funds, this is a good moment to evaluate both your positioning and your expectations for the market—and for your TSP balance. The Federal Reserve is expected to cut rates by 25 basis points this Wednesday. How you position yourself for that event should align with your risk tolerance and your optimism about the growth potential of the TSP stock funds. Do you believe a rate cut is already priced in, or do you see it as fresh fuel for buyers to keep pushing prices higher?

Early December also brings the Santa Claus Rally to mind. Since 1950, the S&P 500 has averaged a 1.3% gain during the seven-trading-day stretch that includes the final five days of December and the first two of January. While the rally isn’t guaranteed, that period has produced a positive return nearly 79% of the time. With those odds, some investors position their TSP accounts into stocks ahead of time, anticipating seasonal strength.

Reduce your guessing and join TSP investors who receive the Last Look Report every morning 30 minutes ahead of the IFT deadline. You'll get the latest snapshot of the TSP Talk AutoTracker trends and latest IFTs made by your peers tied with morning market action analysis. It's a daily opportunity to learn from your peers, recognize patterns, and make decisions with confidence instead of guesswork.

Subscribe Here

Thanks for reading.

*Members logged in to their account within a year.

Last edited: