If this panic follows the usual pattern I'd expect an initial low Monday or early Tuesday, then a strong 3-wave rally, then another fall to a low next Thursday or Friday...but the potential is there for something quite a bit worse.

This is one of the prettiest T's I've ever seen in small caps, and looks pretty ominous...

IWM - SharpCharts Workbench - StockCharts.com

Some scary looking symmetry here...

$SPXEW:$SPX - SharpCharts Workbench - StockCharts.com

(I'm not expecting anything like a 2008 crash here, in fact I still believe Craig Johnson's 2350 by year-end is doable)

And Peter Adams finally got the plunge he's been calling for weeks; but will it get as bad as he predicts? Time will tell. My system has me safely out for now, except sitting in the F fund hasn't been the usual safe haven since bonds are at the epicenter of this storm.... statistically, September is a great month for bonds though, so that's where I'll sit for a few more days and hope the fear of the Fed subsides soon...

Weekly Forecast: Week of September 5th, 2016

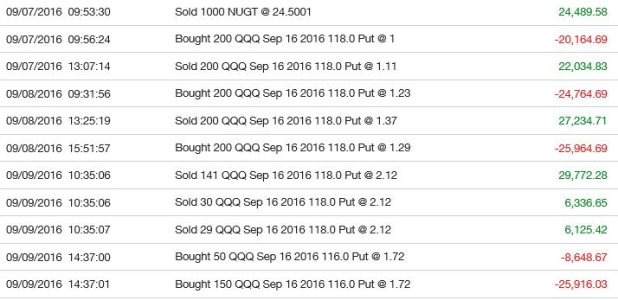

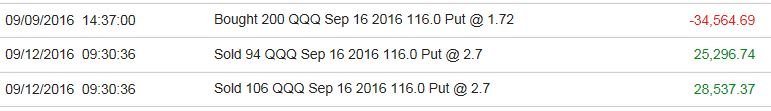

Oh, I don't want to get into a trade posting completion with Ripper, but for the record I sold the NUGT I held in two accounts at 24.50 a couple days ago for an 8% gain (thank goodness, I had a hunch from gurus I read that gold would correct further so I bailed out just in time)...then after waiting patiently for weeks for signs of volatility to show up I bought 200 contracts of $118 QQQ puts at the close yesterday, at $1.29...unfortunately I sold them early in the day today (at $2.12) for a relatively small gain to what I could have had (I had a doctor appointment and know better from past horror stories than to hold options in such an extreme market when you can't watch them, so I sold them for a mere 64% gain...if I'd held, by the close today they were at $4.12... a 224% gain!, argh, that would have been about enough profit in a single day ((4.12-1.29)*20,000 = $56,600) to buy my sweeties dream Audi Q5)....but at least I reloaded on the small rally with an hour to go in the day (200 contracts of $116 QQQ puts at $1.72) and will hopefully be adding to the retirement kitty Monday morning if the futures don't scream higher overnight Sunday. Thank you Wall Street Boys! A snippet from my account page...you gotta have a strong stomach for options, I've been doing it for about 14 years now and am finally getting the hang of it...

Now if my Cougs can upset the Broncos on the Smurf turf tomorrow that will make my weekend extra sweet!