JTH

TSP Legend

- Reaction score

- 1,158

I'm currently suffering from a form of Information Presentation Paralysis.

Core Message:

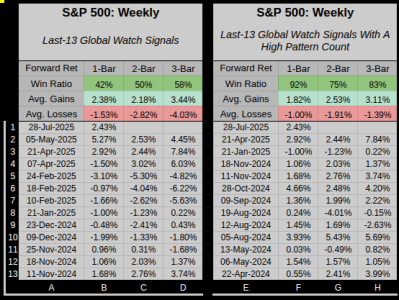

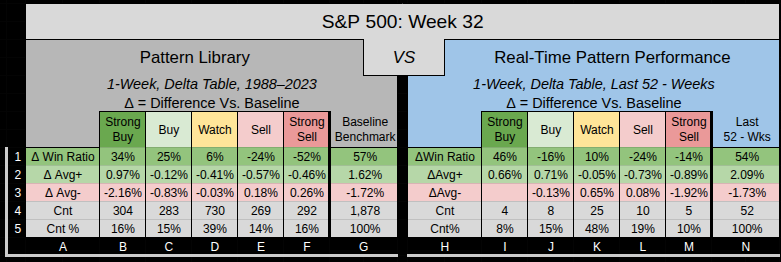

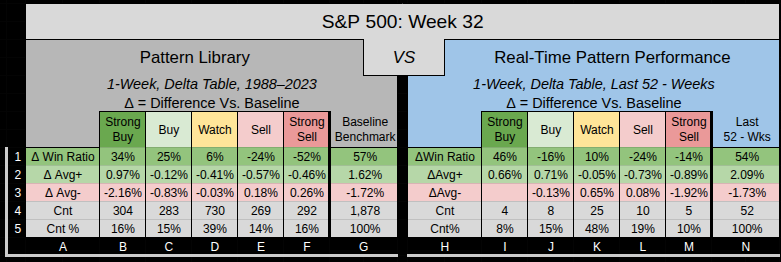

At face Value, Week-32 has generated a Global Watch Signal which is designed to encompass the middle 40% of all signals.

12-Year Stats

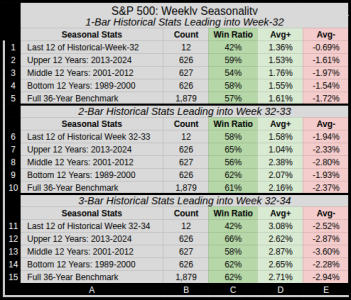

Seasonality shows a downside bias for both Week 32 & 33.

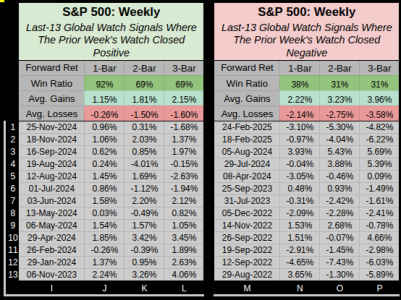

From each Chart Row-1 Column-C. Over the previous 12-years, our 1-3 Week Win Ratio is 42%, 58%. 42%

12-Year Stats

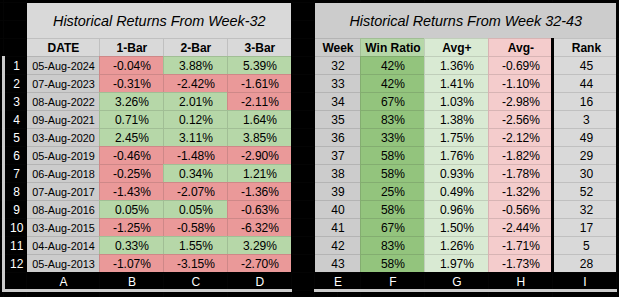

Left Chart: Over the past 2 years, Week-32 showed minor losses, with further downside escalation for the 2 & 3 bar performance.

Right Chart: Week-32 ranks 45th of 52, followed by Week-33 ranking 44th of 52.

That's it, we should have an exciting week if we can maintain some volatility...

Core Message:

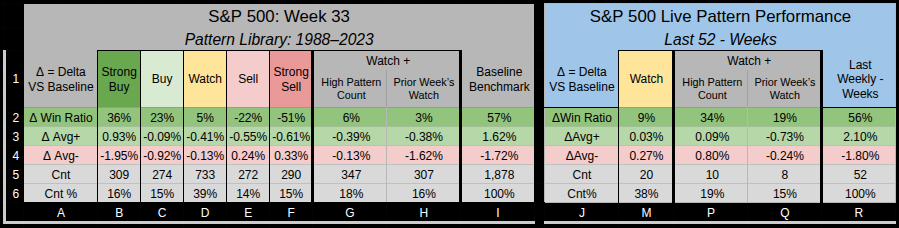

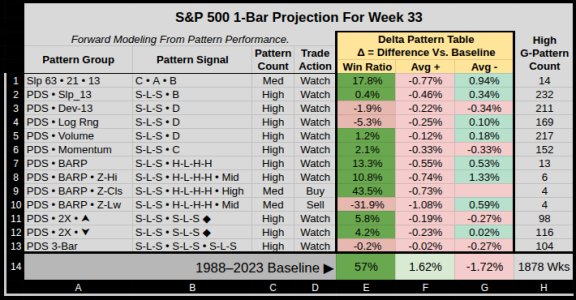

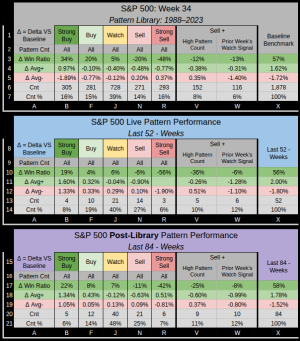

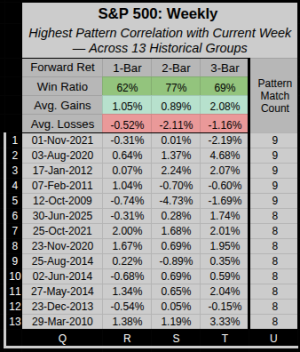

- At present a Global Watch Signal has a 66.7% directional alignment between the most recent 52-weeks and long-term pattern behavior

- Pattern metrics favor an upside bias with a weighted win ratio of 62.6%

- Seasonality is weak, the next 3 weeks are in the bottom 14th percentile

At face Value, Week-32 has generated a Global Watch Signal which is designed to encompass the middle 40% of all signals.

- Pattern Library displays a 6% edge over the 57% Benchmark Win Ratio.

- Last 52-Weeks display a 10% edge over the 54% Benchmark Win Ratio.

- We have a High 39% Pattern Count, which is in the upper 33rd percentile.

- Last-13 Global Watch with a High Pattern Count have a 69% Win Ratio

- Average Gains outpaced losses 1.99% vs -1.22%

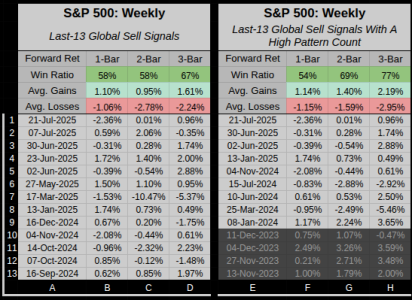

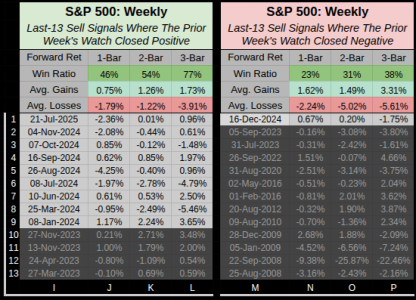

- The Prior Week-31 was a Global Sell Signal which closed down -2.36%

- The Last-13 Global Watch with a prior Sell have a 31% Win Ratio

- Losses outpaced gains -1.34% to 1.02%

- The Last-13 Global Watch with a prior Sell that closed down have a 62% Win Ratio

- Gains outpaced losses, 2.10% to -1.21%

- The Last-13 Global Watch with a prior Sell have a 31% Win Ratio

12-Year Stats

Seasonality shows a downside bias for both Week 32 & 33.

From each Chart Row-1 Column-C. Over the previous 12-years, our 1-3 Week Win Ratio is 42%, 58%. 42%

12-Year Stats

Left Chart: Over the past 2 years, Week-32 showed minor losses, with further downside escalation for the 2 & 3 bar performance.

Right Chart: Week-32 ranks 45th of 52, followed by Week-33 ranking 44th of 52.

That's it, we should have an exciting week if we can maintain some volatility...

Last edited: