-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Hindenburg Omen

- Thread starter Show-me

- Start date

coolhand

TSP Legend

- Reaction score

- 530

James48843

TSP Talk Royalty

- Reaction score

- 970

August 23, 2010, 2:01 PM ET

Yes Folks, Hindenburg Omen Tripped Again

The Hindenburg Omen reared its ugly head late last week, signaling more doom and gloom as stocks plod along amid the dog days of summer.

The Omen, a technical indicator which uses a plethora of data to foreshadow a stock-market crash, was tripped again on Friday, marking the second time since Aug. 12 it has occurred. (It also came close on Thursday, but one of its criteria fell short.)

The latest trigger has prompted the Omen’s creator, Jim Miekka, to exit the market. “I’m taking it seriously and I’m fully out of the market now,” Miekka, a blind mathematician, said in a telephone interview from his home in Surry, Maine. “I would’ve probably stayed in until the beginning of September,” depending on how the indicators varied. “That was my basic plan, until the Hindenburg came along.”

more: http://blogs.wsj.com/marketbeat/2010/08/23/yes-folks-hindenburg-omen-tripped-again/

( I am moving out today. )

Yes Folks, Hindenburg Omen Tripped Again

The Hindenburg Omen reared its ugly head late last week, signaling more doom and gloom as stocks plod along amid the dog days of summer.

The Omen, a technical indicator which uses a plethora of data to foreshadow a stock-market crash, was tripped again on Friday, marking the second time since Aug. 12 it has occurred. (It also came close on Thursday, but one of its criteria fell short.)

The latest trigger has prompted the Omen’s creator, Jim Miekka, to exit the market. “I’m taking it seriously and I’m fully out of the market now,” Miekka, a blind mathematician, said in a telephone interview from his home in Surry, Maine. “I would’ve probably stayed in until the beginning of September,” depending on how the indicators varied. “That was my basic plan, until the Hindenburg came along.”

more: http://blogs.wsj.com/marketbeat/2010/08/23/yes-folks-hindenburg-omen-tripped-again/

( I am moving out today. )

Last edited by a moderator:

Bullitt

Market Veteran

- Reaction score

- 75

I wonder how the creator feels about this attention since he seems like a humble guy to me. As for the Wall Streeters who say 'bah Humbug' to this signal, understand this: We have been in a downtrend for the past 4 months.

Take a look at how commercial the Omen has become, but some astute TSP'ers were able to start threads about it before the Omen jumped the shark. (chart courtesy Google Trends) Parabolic.

Take a look at how commercial the Omen has become, but some astute TSP'ers were able to start threads about it before the Omen jumped the shark. (chart courtesy Google Trends) Parabolic.

- Reaction score

- 2,621

That's one reason why I mentioned in my commentary this week, that it may not "work" this time. I mentioned that I saw it on a Drudge Report headline and Glenn Beck mentioned it on a show this past week. Glenn has been pretty good with some political and economic predictions, but I don't think I want to hear him giving technical indicators.

It's kind of like when our barbers were recommending buying shares of .com stocks - time to sell.

By the way, I am currently out of stocks and would actually like to see a little crach / sell-off to take advantage of. But this type of bearish exposure scares me to think that I may not get that chance.

It's kind of like when our barbers were recommending buying shares of .com stocks - time to sell.

By the way, I am currently out of stocks and would actually like to see a little crach / sell-off to take advantage of. But this type of bearish exposure scares me to think that I may not get that chance.

Steel_Magnolia

TSP Analyst

- Reaction score

- 20

CXO Advisory Group, which tries to objectively analyze financial ideas using scientific methods, published an article recently on the Hindenburg Omen.

http://www.cxoadvisory.com/technical-trading/hindenburg-omens/

The article couches its conclusion in the proper scientific weasel-words, but bottom line according to CXO is that the omen is of dubious help.

"In summary, evidence from simple tests of a publicly available set of “confirmed” Hindenburg Omens suggests the possibility of usefulness, but reservations regarding small sample size and potential sample bias are strong."

Maggie

http://www.cxoadvisory.com/technical-trading/hindenburg-omens/

The article couches its conclusion in the proper scientific weasel-words, but bottom line according to CXO is that the omen is of dubious help.

"In summary, evidence from simple tests of a publicly available set of “confirmed” Hindenburg Omens suggests the possibility of usefulness, but reservations regarding small sample size and potential sample bias are strong."

Maggie

Show-me

TSP Legend

- Reaction score

- 104

Simply the Hindenburg has a 25% chance of a major market decline. With all the attention it may effect the short term dynamics, but the intermediate term to long term seem to show real risk.

FOMC is posturing in advance, hmmmmm. I love statements like GDP was revised down but was better than expected. My take, you were wrong not once but twice. Why should we believe you this time?:nuts:

FOMC is posturing in advance, hmmmmm. I love statements like GDP was revised down but was better than expected. My take, you were wrong not once but twice. Why should we believe you this time?:nuts:

- Reaction score

- 2,621

Agree. This is their way of saying, the market was selling off on the rumor of a downward revision, but you can buy the news since it was not as bad as we thought. But if that's the good news, we could be in trouble.FOMC is posturing in advance, hmmmmm. I love statements like GDP was revised down but was better than expected. My take, you were wrong not once but twice. Why should we believe you this time?:nuts:

bmneveu

TSP Pro

- Reaction score

- 92

Albertarocks' TA Discussions

This guy is saying the first official HO signal since August, 2010 came today, and just barely at the close. I followed the blog pretty closely today as he updated a few times throughout with the Highs/Lows count. Seems pretty legit. And the stats he posts are pretty scary. They are based on past performance of the signal, so no speculation. Here is his clearest description of the odds:

Major Crash - 27% probability

Selling panic of at least 10-15% - 39% probability

Sharp decline of at least 8-10% - 54% probability

Meaningful decline of at least 5-8% - 77% probability

Mild decline of at least 2-5% - 92% probability

The HO signal is an outright miss - 7.7% probability (one out of 13 times)

This guy is saying the first official HO signal since August, 2010 came today, and just barely at the close. I followed the blog pretty closely today as he updated a few times throughout with the Highs/Lows count. Seems pretty legit. And the stats he posts are pretty scary. They are based on past performance of the signal, so no speculation. Here is his clearest description of the odds:

Major Crash - 27% probability

Selling panic of at least 10-15% - 39% probability

Sharp decline of at least 8-10% - 54% probability

Meaningful decline of at least 5-8% - 77% probability

Mild decline of at least 2-5% - 92% probability

The HO signal is an outright miss - 7.7% probability (one out of 13 times)

- Reaction score

- 2,621

Hindenburg Omen Creator: ‘I’m Hunkering Down for Possible Rough Ride’

"In a chat with MoneyBeat Sunday evening, Jim Miekka — a blind former high-school physics teacher and the newsletter writer who devised the Hindenburg Omen — confirmed all the criteria were met on Friday that triggered the indicator. He said he’s still invested in the market, for now, and is waiting for “a strong up day this week” before he gets out of stocks and potentially starts shorting the market."

Hindenburg Omen Creator: 'I'm Hunkering Down for Possible Rough Ride' - MoneyBeat - WSJ

"In a chat with MoneyBeat Sunday evening, Jim Miekka — a blind former high-school physics teacher and the newsletter writer who devised the Hindenburg Omen — confirmed all the criteria were met on Friday that triggered the indicator. He said he’s still invested in the market, for now, and is waiting for “a strong up day this week” before he gets out of stocks and potentially starts shorting the market."

Hindenburg Omen Creator: 'I'm Hunkering Down for Possible Rough Ride' - MoneyBeat - WSJ

James48843

TSP Talk Royalty

- Reaction score

- 970

That's it. I'm bailing out.

The Hindenberg Omen has proven enough to me over time that I seriously think it bears paying attention to. Yes, it's playing on my fears- but I'll go with it today and bail out just based on the second occurance as outlined above.

Thanks for posting, Tom. I hadn't seen it before, and am bailing now.

The Hindenberg Omen has proven enough to me over time that I seriously think it bears paying attention to. Yes, it's playing on my fears- but I'll go with it today and bail out just based on the second occurance as outlined above.

Thanks for posting, Tom. I hadn't seen it before, and am bailing now.

bmneveu

TSP Pro

- Reaction score

- 92

Hindenburg Omen Creator: ‘I’m Hunkering Down for Possible Rough Ride’

"In a chat with MoneyBeat Sunday evening, Jim Miekka — a blind former high-school physics teacher and the newsletter writer who devised the Hindenburg Omen — confirmed all the criteria were met on Friday that triggered the indicator. He said he’s still invested in the market, for now, and is waiting for “a strong up day this week” before he gets out of stocks and potentially starts shorting the market."

Hindenburg Omen Creator: 'I'm Hunkering Down for Possible Rough Ride' - MoneyBeat - WSJ

That's 2 signals in exactly a month and a half.

James48843

TSP Talk Royalty

- Reaction score

- 970

FIVE instances of the Hindenberg Omen within a very short period of time.

Even the TV guys have noted it.

Cashin: Hindenburg Omen Now Raising Alert Flags - Video on NBCNews.com

Danger- danger- danger.

She's going down.

Even the TV guys have noted it.

Cashin: Hindenburg Omen Now Raising Alert Flags - Video on NBCNews.com

Danger- danger- danger.

She's going down.

- Reaction score

- 2,621

If you missed it, see today's commentary for prior instances of 5 HO signals in a 2 week period.

http://www.tsptalk.com/mb/blogs/tsptalk/2466-pause-another-omen.html

http://www.tsptalk.com/mb/blogs/tsptalk/2466-pause-another-omen.html

FIVE instances of the Hindenberg Omen within a very short period of time.

Even the TV guys have noted it.

Cashin: Hindenburg Omen Now Raising Alert Flags - Video on NBCNews.com

Danger- danger- danger.

She's going down.

View attachment 24071

if people expect it, it wont happen.

bmneveu

TSP Pro

- Reaction score

- 92

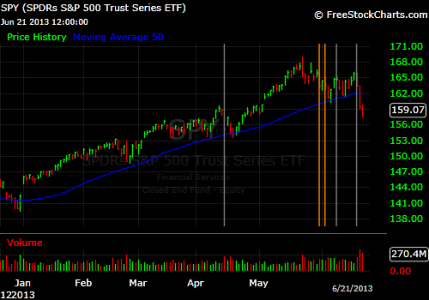

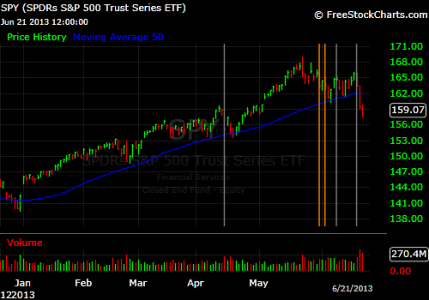

HO issued another signal this past Wednesday, June 19. Quite a cluster for something that doesn't officially happen very often (last official event was August 2010). And it will stop posting signals soon when the 50 day MA turns south, as it has to be moving up for the HO system to be "online" and able to issue a signal.

April 15th - First signal since August '10. The following 3 days also come very close to each recording a signal.

May 31st - Second signal issued. Too many days after first signal to start an official event (missed by 4 trading days).

June 4th - 3rd signal. Being within 30 trading days of previous signal, this "confirming" signal starts the official HO event.

June 10th - Another redundant signal.

June 13th - Very close to another.

June 19th - Another redundant signal.

FreeStockCharts.com - Web's Best Streaming Realtime Stock Charts - Free

Here are the stats again, based on past results:

Major Crash - 27% probability

Selling panic of at least 10-15% - 39% probability

Sharp decline of at least 8-10% - 54% probability

Meaningful decline of at least 5-8% - 77% probability

Mild decline of at least 2-5% - 92% probability

The HO signal is an outright miss - 7.7% probability (one out of 13 times)

Albertarocks' TA Discussions

June 4th was the official start of the HO event. The S&P closed at 1631 that day. On Thursday we hit a low of 1584, a sell off of 47 points, or 2.9%. The HO said there was a 92% chance of that happening. Unfortunately, odds are we are heading even further south. We have a 77% chance of dropping at least another 2-5%. Ouch.

April 15th - First signal since August '10. The following 3 days also come very close to each recording a signal.

May 31st - Second signal issued. Too many days after first signal to start an official event (missed by 4 trading days).

June 4th - 3rd signal. Being within 30 trading days of previous signal, this "confirming" signal starts the official HO event.

June 10th - Another redundant signal.

June 13th - Very close to another.

June 19th - Another redundant signal.

FreeStockCharts.com - Web's Best Streaming Realtime Stock Charts - Free

Here are the stats again, based on past results:

Major Crash - 27% probability

Selling panic of at least 10-15% - 39% probability

Sharp decline of at least 8-10% - 54% probability

Meaningful decline of at least 5-8% - 77% probability

Mild decline of at least 2-5% - 92% probability

The HO signal is an outright miss - 7.7% probability (one out of 13 times)

Albertarocks' TA Discussions

June 4th was the official start of the HO event. The S&P closed at 1631 that day. On Thursday we hit a low of 1584, a sell off of 47 points, or 2.9%. The HO said there was a 92% chance of that happening. Unfortunately, odds are we are heading even further south. We have a 77% chance of dropping at least another 2-5%. Ouch.

Similar threads

- Article

- Replies

- 2

- Views

- 294

- Replies

- 0

- Views

- 239

- Replies

- 0

- Views

- 134

- Replies

- 1

- Views

- 222

- Replies

- 0

- Views

- 940