11/07/25

Wednesday's rally in stocks did not follow through on Thursday and the pullback off the all time highs continued yesterday. There is a lot of uncertainty in the air and the stock market is not fond of uncertainty. Yields and the dollar fell sharply but that didn't help, although if those trends are changing, it could help stop the bleeding in stocks.

I mentioned some of the uncertainty this past week with the Supreme Court being a major question mark as they listen to arguments on the President's tariff policy.

Obviously any change there could be a market mover, but as I suggested yesterday, stocks sold off in the first half of the year on the implementation of tariffs, so would they celebrate a reversal of the policy, or would the change be too disruptive to the market at this point?

We also have the uncertainty with the lack of economic data because of the government shut down. We have seen both weak and strong jobs data from private sources.

And the December interest rate cut is still on the table, but the Fed made it clear that it was not a foregone conclusion. The chances of a 0.25% Fed interest rate cut in December did jump yesterday from 62% to 71%.

That was likely due to the pullback in yields as the 10-year Treasury Yield as we saw weaker than expected jobs data in the layoff department. The $TNX is now back below the 50-day average and we can still say that it has made a lower high, even though the down trend off the July peak was broken recently.

The dollar also reversed lower on that weak data. Is this a peak or just a test of one of the breakout lines?

The longer term weekly chart of the dollar could be carving out a large bear flag. I had been anticipating the dollar trying to bottom, and I thought it could hurt the I-fund. The dollar did rebound for months, but the I-fund barely blinked. Unless something changes today, that could be a negative reversal on the current weekly candlestick, and that leaves the possibility of that being a bear flag. If this heads down to the bottom of the flag, I'd want to be involved in the I-fund.

The S&P 500 (C-fund) lost just over 1% yesterday and it is heading down toward the bottom of its channel again. The vertical red lines I drew represent the size of the current decline of the October peak. It is nearly identical in size (point-wise, not percentage-wise) to prior pullbacks to the bottom of the channel. Can it hold again? Eventually this channel will break, but will it do so in the bullish month of November, or does it have another bounce left in it?

The S&P 500 is now about 3% off its all time high. 3% declines have occurred 7.2 times per year since 1928. A 5% decline happens 3.4 times per year. We already had a 10% correction earlier this year and they historically occur 1.1 times per year. Of course stats don't predict the future.

From @RyanDetrick on X:

The momentum is definitely on the downside now and Hindenburg Omen Signals continue to trigger with yesterday being the 4th in recent weeks. These tend to accumulate come before market crashes, but we don't see a market crash after every signal or even series of signals. It is certainly a concern. The question is, will the market crash in November? I'm not sure that has ever happened before, and whenever the stock market has been up six months in a row, the 7th month is positive much more often than not. The stats are on the bulls' side but again, stats don't predict the future.

The DWCPF Index (S-Fund) broke down earlier this week from its ascending channel, tried to rebound but found resistance at the bottom of the channel. This isn't a great look and may need a positive catalyst to stop the bleeding.

ACWX (I-fund) is still holding up, and like the S&P 500, it is above support but heading toward the bottom of its channel. As I mentioned above, the dollar may be trying to peak here, but it's probably too early to say. A weak dollar would help.

BND (bonds / F-fund) rallied strongly as yields fell sharply on the weaker labor market data that was released yesterday. Like the S-fund chart, the bottom of the channel could try to act as resistance if this does head up.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Wednesday's rally in stocks did not follow through on Thursday and the pullback off the all time highs continued yesterday. There is a lot of uncertainty in the air and the stock market is not fond of uncertainty. Yields and the dollar fell sharply but that didn't help, although if those trends are changing, it could help stop the bleeding in stocks.

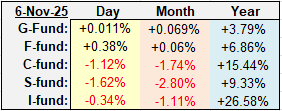

| Daily TSP Funds Return More returns |

I mentioned some of the uncertainty this past week with the Supreme Court being a major question mark as they listen to arguments on the President's tariff policy.

Obviously any change there could be a market mover, but as I suggested yesterday, stocks sold off in the first half of the year on the implementation of tariffs, so would they celebrate a reversal of the policy, or would the change be too disruptive to the market at this point?

We also have the uncertainty with the lack of economic data because of the government shut down. We have seen both weak and strong jobs data from private sources.

And the December interest rate cut is still on the table, but the Fed made it clear that it was not a foregone conclusion. The chances of a 0.25% Fed interest rate cut in December did jump yesterday from 62% to 71%.

That was likely due to the pullback in yields as the 10-year Treasury Yield as we saw weaker than expected jobs data in the layoff department. The $TNX is now back below the 50-day average and we can still say that it has made a lower high, even though the down trend off the July peak was broken recently.

The dollar also reversed lower on that weak data. Is this a peak or just a test of one of the breakout lines?

The longer term weekly chart of the dollar could be carving out a large bear flag. I had been anticipating the dollar trying to bottom, and I thought it could hurt the I-fund. The dollar did rebound for months, but the I-fund barely blinked. Unless something changes today, that could be a negative reversal on the current weekly candlestick, and that leaves the possibility of that being a bear flag. If this heads down to the bottom of the flag, I'd want to be involved in the I-fund.

The S&P 500 (C-fund) lost just over 1% yesterday and it is heading down toward the bottom of its channel again. The vertical red lines I drew represent the size of the current decline of the October peak. It is nearly identical in size (point-wise, not percentage-wise) to prior pullbacks to the bottom of the channel. Can it hold again? Eventually this channel will break, but will it do so in the bullish month of November, or does it have another bounce left in it?

The S&P 500 is now about 3% off its all time high. 3% declines have occurred 7.2 times per year since 1928. A 5% decline happens 3.4 times per year. We already had a 10% correction earlier this year and they historically occur 1.1 times per year. Of course stats don't predict the future.

From @RyanDetrick on X:

The momentum is definitely on the downside now and Hindenburg Omen Signals continue to trigger with yesterday being the 4th in recent weeks. These tend to accumulate come before market crashes, but we don't see a market crash after every signal or even series of signals. It is certainly a concern. The question is, will the market crash in November? I'm not sure that has ever happened before, and whenever the stock market has been up six months in a row, the 7th month is positive much more often than not. The stats are on the bulls' side but again, stats don't predict the future.

The DWCPF Index (S-Fund) broke down earlier this week from its ascending channel, tried to rebound but found resistance at the bottom of the channel. This isn't a great look and may need a positive catalyst to stop the bleeding.

ACWX (I-fund) is still holding up, and like the S&P 500, it is above support but heading toward the bottom of its channel. As I mentioned above, the dollar may be trying to peak here, but it's probably too early to say. A weak dollar would help.

BND (bonds / F-fund) rallied strongly as yields fell sharply on the weaker labor market data that was released yesterday. Like the S-fund chart, the bottom of the channel could try to act as resistance if this does head up.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.