MrJohnRoss

Market Veteran

- Reaction score

- 58

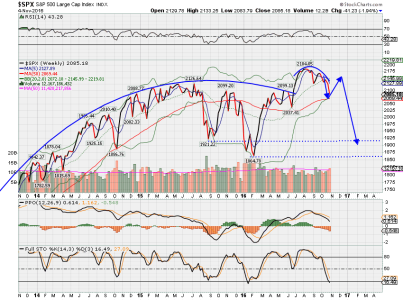

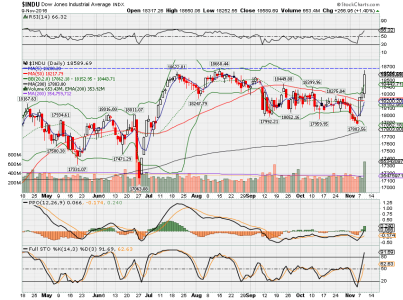

It's looking more and more like any hope for a short term rally is quickly fading.

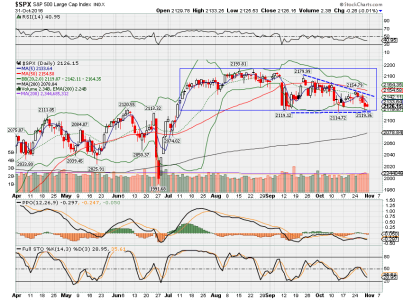

The 4% box is still in play, as is the bearish descending triangle. Stoch has crossed below the 50 line, which is bearish. The PPO, which was rising last week, is now rolling over into the negative. We're also falling further away from the 50 DMA. There really isn't much bullish news about this chart at all, except the 50 is above the 200.

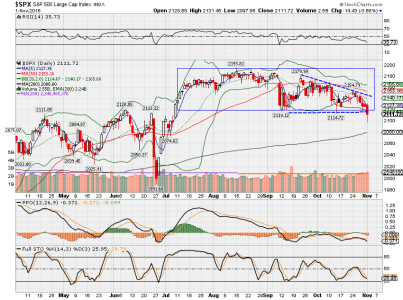

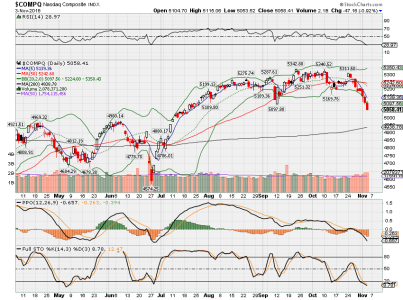

The S Fund even looks worse than the S&P, and the Nasdaq had a big bearish engulfing today to cross back under it's 50 DMA.

Oil has now officially failed it's test of resistance, and may be looking for support in the 47 area.

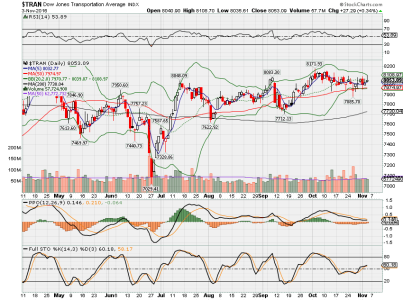

With WTIC falling, the dollar rising, and interest rates shooting higher, stocks are having a rough time going any higher.

Composite system now reads -3, a strong sell. As such, I will move to the sidelines tomorrow, and absorb yet another small loss. It's just the nature of the beast.

Good luck!

The 4% box is still in play, as is the bearish descending triangle. Stoch has crossed below the 50 line, which is bearish. The PPO, which was rising last week, is now rolling over into the negative. We're also falling further away from the 50 DMA. There really isn't much bullish news about this chart at all, except the 50 is above the 200.

The S Fund even looks worse than the S&P, and the Nasdaq had a big bearish engulfing today to cross back under it's 50 DMA.

Oil has now officially failed it's test of resistance, and may be looking for support in the 47 area.

With WTIC falling, the dollar rising, and interest rates shooting higher, stocks are having a rough time going any higher.

Composite system now reads -3, a strong sell. As such, I will move to the sidelines tomorrow, and absorb yet another small loss. It's just the nature of the beast.

Good luck!