MrJohnRoss

Market Veteran

- Reaction score

- 58

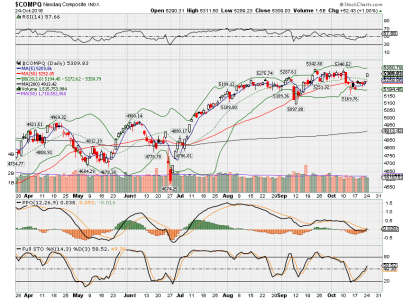

A bit of a black swan event today with investors finally waking up to the problems at Deutsche Bank (DB).

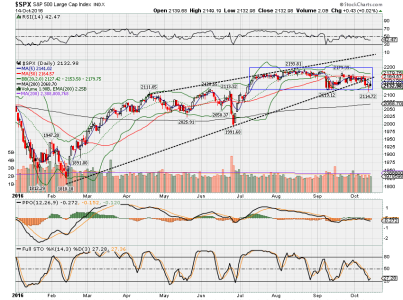

Note the massive down volume on today's rout. About 11X the normal volume on a drop of 6.67%. Just seems like yesterday that problems like this were shrugged off, and the market just kept climbing higher. Perhaps investors risk appetite is waning? Harumph.

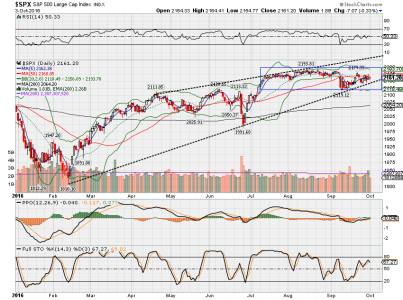

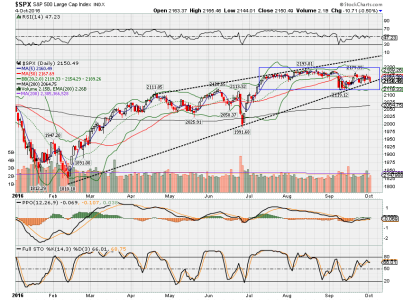

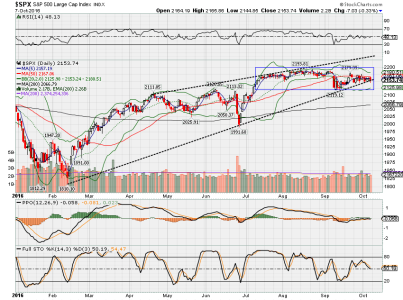

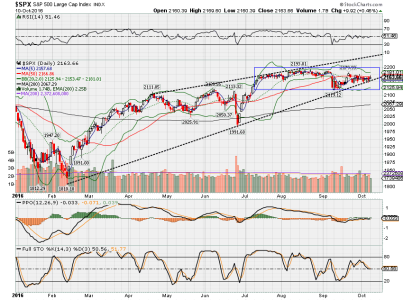

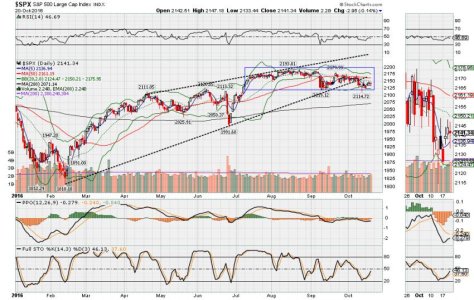

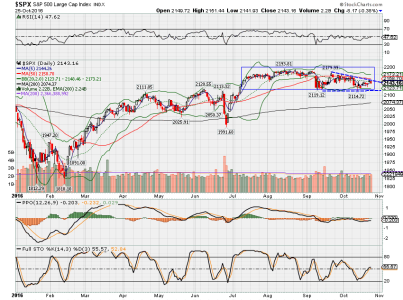

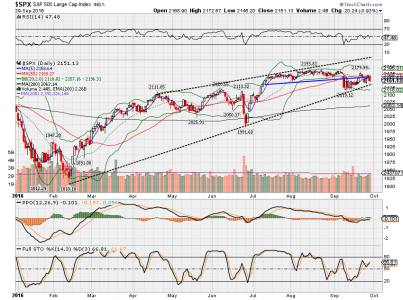

Meanwhile, the S&P isn't looking all that well either:

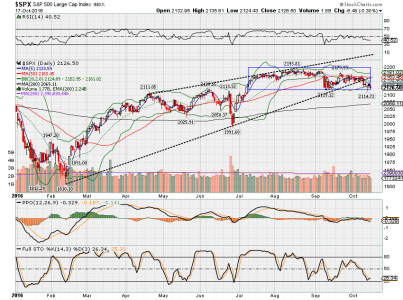

Higher volume on today's drop, which isn't a good sign. Looks like prices are having trouble clearing that 50 DMA.

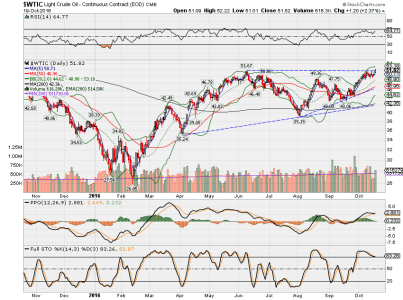

Meanwhile, WTIC was up another 1.66% today, but it didn't help. WW, you share my opinion as well; the oil glut is not going to go away anytime soon, IMHO, but there's plenty of manipulation to get prices to bounce around for those in high places to capitalize on.

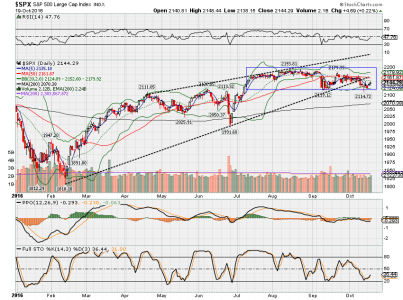

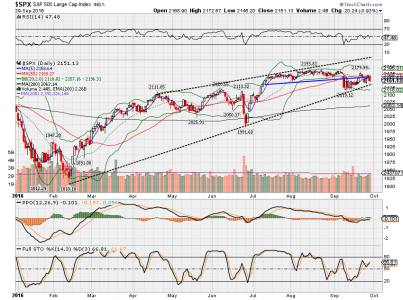

Two of the oscillators I track have now switched to the bearish camp, and my composite system now reads -1, a mild sell signal. As such, I will most likely head to the sidelines tomorrow, unless we see a large rally early on, which is highly unlikely.

Good luck!

Note the massive down volume on today's rout. About 11X the normal volume on a drop of 6.67%. Just seems like yesterday that problems like this were shrugged off, and the market just kept climbing higher. Perhaps investors risk appetite is waning? Harumph.

Meanwhile, the S&P isn't looking all that well either:

Higher volume on today's drop, which isn't a good sign. Looks like prices are having trouble clearing that 50 DMA.

Meanwhile, WTIC was up another 1.66% today, but it didn't help. WW, you share my opinion as well; the oil glut is not going to go away anytime soon, IMHO, but there's plenty of manipulation to get prices to bounce around for those in high places to capitalize on.

Two of the oscillators I track have now switched to the bearish camp, and my composite system now reads -1, a mild sell signal. As such, I will most likely head to the sidelines tomorrow, unless we see a large rally early on, which is highly unlikely.

Good luck!