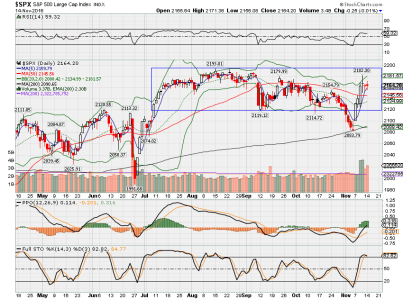

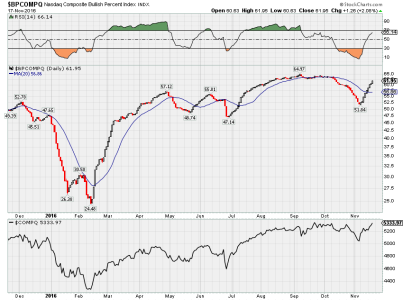

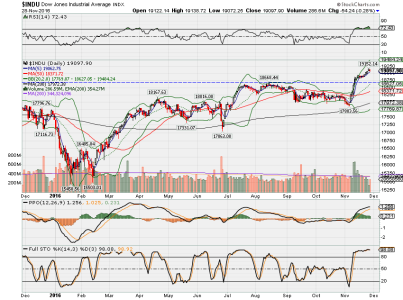

Another record setting day for small caps (RUT), the Dow, Mr Tran, and the S&P 500. In the meantime, interest sensitive stocks are getting creamed. One look at the Utilities Index will show that.

With the dollar rising along with interest rates since Trump's win, rotation has been away from bonds and safe havens, and towards higher risk stocks, esp small caps.

Rather than show more charts of how well some of the indices are doing, I also like to look at how some of the poor performers are doing.

The F Fund is looking terrible. I was thinking it might be forming a bottom a few days ago, but it just keeps dropping. See chart below:

Another big 35 basis point drop today. RSI is very oversold, but it may not matter. My guess is that AGG won't find support until it reaches strong support in the 105-106 area, which is another 2% lower from here. Death cross is about to occur as well.

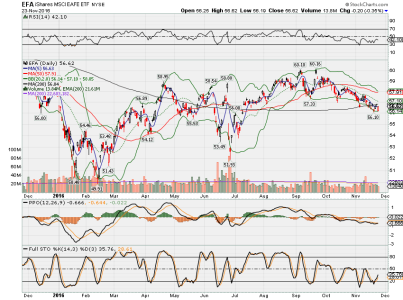

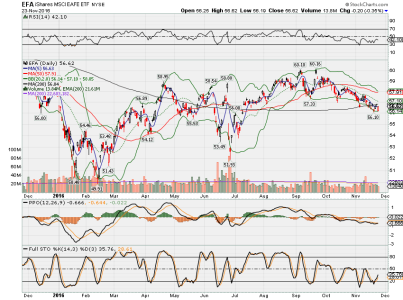

Meanwhile, EFA (I Fund) is also looking very poorly (see chart below):

It's been all downhill since September. Prices are now below the 50 and 200 DMA. PPO is flatlining in the negative zone like a patient in cardiac arrest. Possible support in the 54 area, about 2% lower from here.

I would not want to be a buyer of either one of these funds at this point, but that's just me. No signs of a turnaround at this point in time. Their day will come, it's just not today, IMHO.

Meanwhile, my composite system remains at +3, but my VIX system is getting closer to a possible turn-around, as Mr VIX looks like it may bounce around the bottom a little before turning back up. However, cycle analysis suggests an intermediate term rise in stocks possibly through mid January of next year. That certainly would be nice.

Hope everyone reading this has a wonderful Thanksgiving with family and friends. No matter what your circumstances, or how many problems you have, (and believe me, we all have problems) don't forget to count your blessings.

JR

I'm not totally disappointed though as I was able to get back into positive territory, so for the time being, I'm on the sidelines waiting for that next entry.