MrJohnRoss

Market Veteran

- Reaction score

- 58

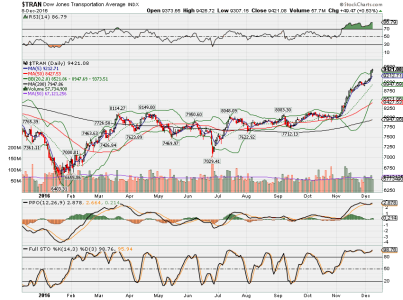

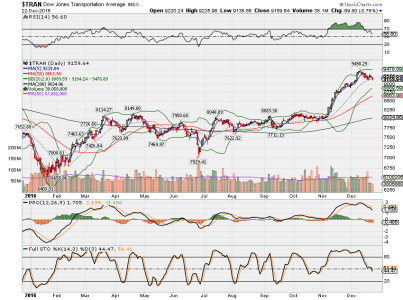

Looking at some charts tonight, and this one really caught my eye:

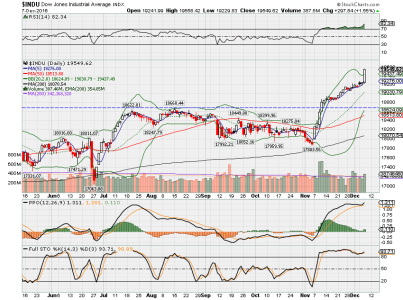

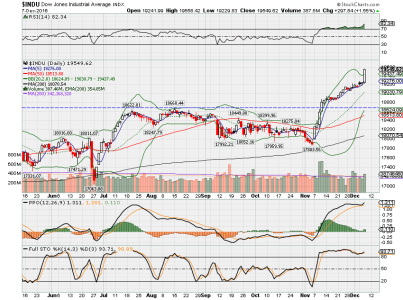

That is one massive white candle, and I think portends what could be a strong continuation rally to follow. As much as I would have liked to have been on board at yesterday's close, there's no way any system could have predicted the strength of today's move.

The only thing troubling about this chart is... yes, we could be "overbought". The RSI is now over 82, which is rare, and the PPO is also in rare high territory. So perhaps there may be limited upside potential in the next few days until prices rewind a bit in order to let the oscillators decompress.

The other chart that I found interesting was AGG, the bond fund:

I mentioned a few days ago that it looked like bonds might be forming a bottom, (and yields forming a top). It's sure looking like AGG might be getting a much needed reprieve, at long last. Bonds were deeply oversold on the RSI scale. It's good to see prices stabilize and begin to swing back higher.

The dollar continues to soften, which has helped the PM's and miners. WTIC continues to fall after hitting that upper resistance line. Wow, that's a tough nut to crack for oil prices.

Composite system is (of course) a solid +3. BPSPX and BPCOMPQ are both heading higher after their slight setback. Other internal indicators are looking positive as well. I'll keep my eye on short term indicators and report here if things change.

Good luck!

That is one massive white candle, and I think portends what could be a strong continuation rally to follow. As much as I would have liked to have been on board at yesterday's close, there's no way any system could have predicted the strength of today's move.

The only thing troubling about this chart is... yes, we could be "overbought". The RSI is now over 82, which is rare, and the PPO is also in rare high territory. So perhaps there may be limited upside potential in the next few days until prices rewind a bit in order to let the oscillators decompress.

The other chart that I found interesting was AGG, the bond fund:

I mentioned a few days ago that it looked like bonds might be forming a bottom, (and yields forming a top). It's sure looking like AGG might be getting a much needed reprieve, at long last. Bonds were deeply oversold on the RSI scale. It's good to see prices stabilize and begin to swing back higher.

The dollar continues to soften, which has helped the PM's and miners. WTIC continues to fall after hitting that upper resistance line. Wow, that's a tough nut to crack for oil prices.

Composite system is (of course) a solid +3. BPSPX and BPCOMPQ are both heading higher after their slight setback. Other internal indicators are looking positive as well. I'll keep my eye on short term indicators and report here if things change.

Good luck!