MrJohnRoss

Market Veteran

- Reaction score

- 58

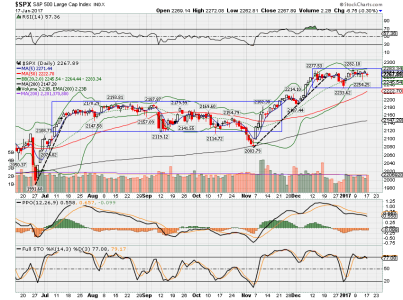

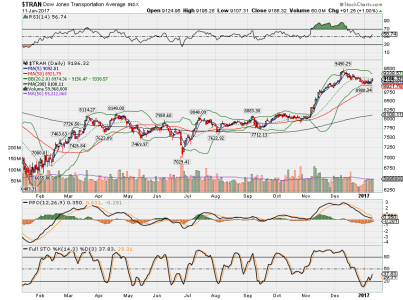

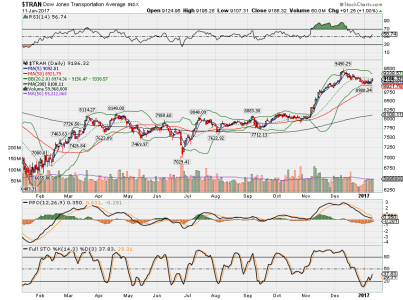

It still appears to me that the market is on shaky legs, not sure which way it wants to go. A number of oscillators I watch are heading south, but prices haven't really followed suit quite yet. On top of that, now Mr Tran is acting like he wants to perk up. See chart below:

There's still no clear trend up or down these last few days, as we've just been bouncing around. Futures are pointing to a lower open by about 52 points as of this writing, but that often times doesn't mean a whole lot.

My composite system is still reading a -1 sell signal, but my VIX system is looking like it's very near a sell signal as well. My cycle analysis also says we're very near an intermediate turning point in the days ahead.

Good luck!

There's still no clear trend up or down these last few days, as we've just been bouncing around. Futures are pointing to a lower open by about 52 points as of this writing, but that often times doesn't mean a whole lot.

My composite system is still reading a -1 sell signal, but my VIX system is looking like it's very near a sell signal as well. My cycle analysis also says we're very near an intermediate turning point in the days ahead.

Good luck!