MrJohnRoss

Market Veteran

- Reaction score

- 58

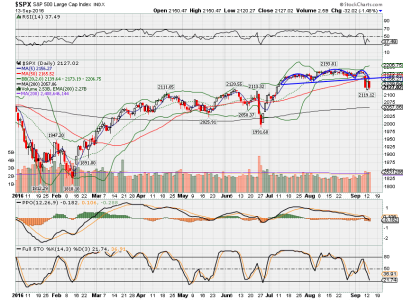

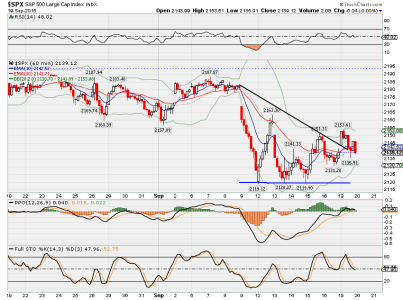

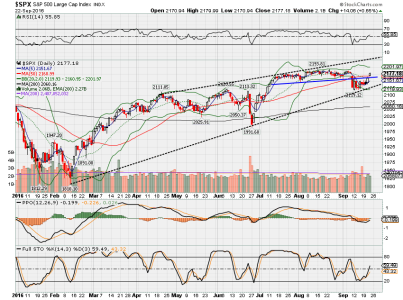

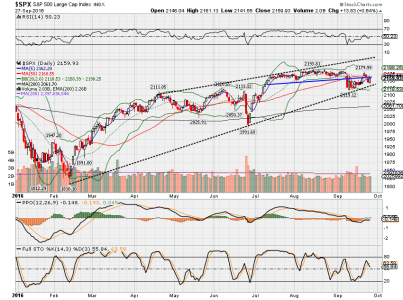

S&P lost 52 points on the week, and is short term oversold. On the 60 min chart, the S&P has a RSI under 16, which is very oversold. Although futures are pointing to a lower market tomorrow morning (Dow -111 points as of this post), I wouldn't be surprised to see buyers step in to take the market higher by closing.

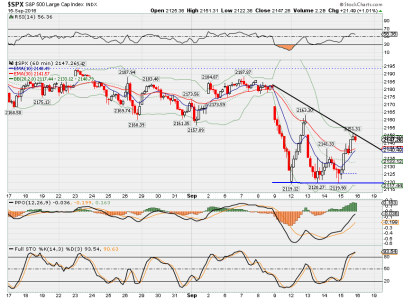

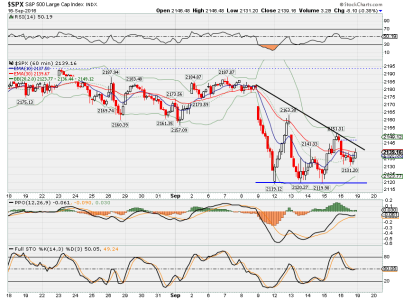

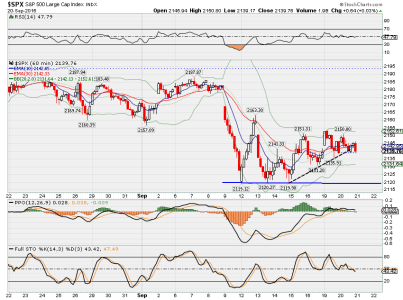

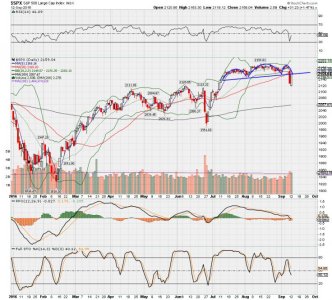

As expected, we got our oversold bounce. Here's how the S&P looks now, from the broken neckline:

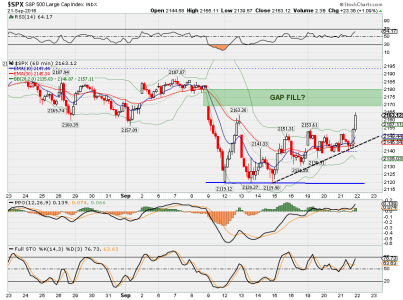

Looks like we've bounced back up to previous support at the neckline. (Previous support becomes resistance). If the market can take that neckline out convincingly, then the bulls have the upper edge. If not, expect more downside in the near future.

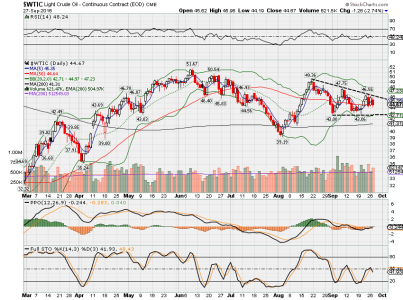

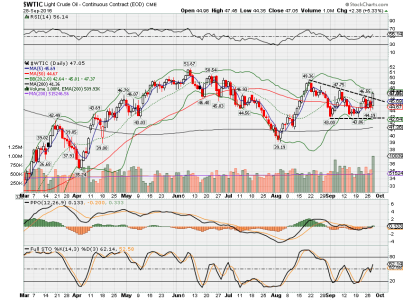

Oil looks like it's continuing it's volatile move lower, so my guess is the market will follow suit. I find it rather amazing that the Fed merely hints at a rate hike, and the market tanks, and the next trading day, they ease up the talk, and the market skyrockets. Ridiculous.

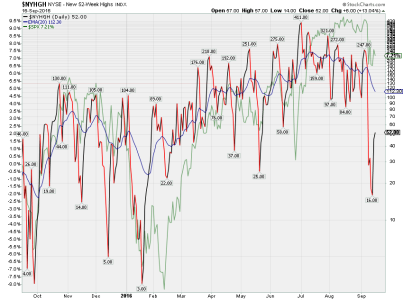

Composite system remains at -3.

Good luck!