-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MrJohnRoss' Account Talk

- Thread starter MrJohnRoss

- Start date

FogSailing

Market Veteran

- Reaction score

- 61

Get well John!! Agree with you on oil. I think it stays propped up through today. Retail sales weren't good news and the dollar is tanking...Good news is that oil price is holding for now...just hope SPX doesn't fall below the 2177 support level today...

FS

FS

MrJohnRoss

Market Veteran

- Reaction score

- 58

Hope you're feeling okay John, thanks for your updates too, much appreciated!

Alright John this is no time for injuries, But then again when is it a good time for injuries. Heehee... hope it's nothing serious just some ol folks stuff get well quick as you can

Get well! Feel Better! Rest up...

Praying for you John. Get well soon! :flowers1:

Get well John!! Agree with you on oil. I think it stays propped up through today. Retail sales weren't good news and the dollar is tanking...Good news is that oil price is holding for now...just hope SPX doesn't fall below the 2177 support level today...

FS

Hang in there John!!

Hoping for a quick recovery from your injury.

Hope you recover quickly.:smile:

pmaloney, weatherweenie, nnuut, FogSailing, ravensfan, Whipsaw, GUCHI, JamesE, Thank you all for your well wishes, it's much appreciated. Back injury, hope to be swinging a pick axe and shoveling dirt again in a day or two. It's a b*tch when you can't even put your own socks on. :blink:

MrJohnRoss

Market Veteran

- Reaction score

- 58

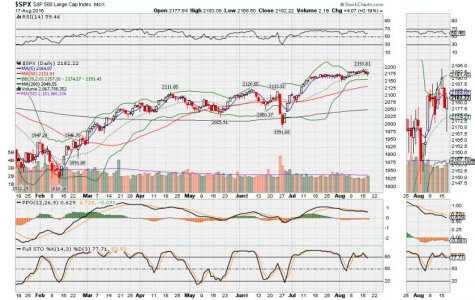

Bullish rising wedge on the 60 minute chart. We should see resolution this coming week.

Continued speculation of a possible production ceiling for oil sent WTIC higher. Even though stocks were moderately lower today, they ended the week slightly higher (up 0.05%) as measured by the S&P.

For the week, (in descending order), EFA was up 1.82%, Nasdaq was up 0.23%, Dow was up 0.18%, RUT was down 0.12%, and Tran was down 0.75%.

Oil was up 6.44%, while gold was down 0.09%, and silver was down 0.58%.

Composite system remains at -3, a solid sell signal.

Continued speculation of a possible production ceiling for oil sent WTIC higher. Even though stocks were moderately lower today, they ended the week slightly higher (up 0.05%) as measured by the S&P.

For the week, (in descending order), EFA was up 1.82%, Nasdaq was up 0.23%, Dow was up 0.18%, RUT was down 0.12%, and Tran was down 0.75%.

Oil was up 6.44%, while gold was down 0.09%, and silver was down 0.58%.

Composite system remains at -3, a solid sell signal.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Credit Bubble Bulletin Weekly Commentary - Doug Noland

..."It is not hyperbole to posit that global securities markets are in the midst of a historic short squeeze and the greatest ever market dislocation. And it’s not unreasonable to suggest that this is a sadly fitting climax to the world’s most spectacular inflationary Bubble.

Yet through the façade of unprecedented perceived global wealth, one can begin to more clearly identify the the Scourge of Inflationism: “It tears apart the whole fabric of stable economic relationships. Its inexcusable injustices drive men toward desperate remedies. It plants the seeds of fascism and communism. It leads men to demand totalitarian controls.”

It’s been akin to a wreaking ball. We’ve seen the general population unknowingly surrender wealth to Inflationism. In the face of so-called disinflation, millions have suffered at the hand of inflating costs for housing, health care, tuition and insurance, to name a few. We’ve seen these serial booms and busts take a terrible toll on many workers, families and communities. We witnessed many lose much of their retirements – and faith in the markets - in two major stock market busts. Millions lost much of their life’s savings during the collapse of the mortgage finance Bubble. Millions of students have taken on tremendous loads of debt to finance higher education and vocational training. Millions have been lured by (years of) low monthly payments into purchasing homes, automobiles, vacation properties, recreation vehicles, etc. that they cannot afford.

Inflationism has seen real wages for much of the workforce stagnate or worse over the past decade. Inflationism and his accomplice malinvestment are the culprits behind pathetic productivity trends and declining living standards. Worse yet, Inflationism and his many cohorts are fomenting disturbing social, political and geopolitical turmoil. And reminiscent of the Weimar hyperinflation, central bankers somehow remain oblivious that their operations are of primary responsibility. If people don’t these days trust central bankers, politicians, Wall Street, and governments and institutions more generally, just wait until the Bubble bursts."

..."It is not hyperbole to posit that global securities markets are in the midst of a historic short squeeze and the greatest ever market dislocation. And it’s not unreasonable to suggest that this is a sadly fitting climax to the world’s most spectacular inflationary Bubble.

Yet through the façade of unprecedented perceived global wealth, one can begin to more clearly identify the the Scourge of Inflationism: “It tears apart the whole fabric of stable economic relationships. Its inexcusable injustices drive men toward desperate remedies. It plants the seeds of fascism and communism. It leads men to demand totalitarian controls.”

It’s been akin to a wreaking ball. We’ve seen the general population unknowingly surrender wealth to Inflationism. In the face of so-called disinflation, millions have suffered at the hand of inflating costs for housing, health care, tuition and insurance, to name a few. We’ve seen these serial booms and busts take a terrible toll on many workers, families and communities. We witnessed many lose much of their retirements – and faith in the markets - in two major stock market busts. Millions lost much of their life’s savings during the collapse of the mortgage finance Bubble. Millions of students have taken on tremendous loads of debt to finance higher education and vocational training. Millions have been lured by (years of) low monthly payments into purchasing homes, automobiles, vacation properties, recreation vehicles, etc. that they cannot afford.

Inflationism has seen real wages for much of the workforce stagnate or worse over the past decade. Inflationism and his accomplice malinvestment are the culprits behind pathetic productivity trends and declining living standards. Worse yet, Inflationism and his many cohorts are fomenting disturbing social, political and geopolitical turmoil. And reminiscent of the Weimar hyperinflation, central bankers somehow remain oblivious that their operations are of primary responsibility. If people don’t these days trust central bankers, politicians, Wall Street, and governments and institutions more generally, just wait until the Bubble bursts."

- Reaction score

- 2,643

Get well, John. We need you around here!

http://www.tsptalk.com/mb/member-milestones/25774-mrjohnross-now-has-3000-posts.html :35:

http://www.tsptalk.com/mb/member-milestones/25774-mrjohnross-now-has-3000-posts.html :35:

DreamboatAnnie

TSP Legend

- Reaction score

- 912

Hello Mr John Ross, I hope you are feeling better since your injury on Thursday and especially that the pain is easing away. I will say a little prayer for you. Get rest and hang in there! You have many friends here wishing you a quick recover. DBAnnie

:flowers1:

:flowers1:

MrJohnRoss

Market Veteran

- Reaction score

- 58

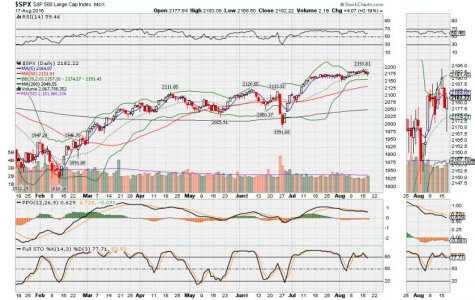

Just a quick update on the 60 min chart:

Gap higher at the open, and the first two hours looked good. The rest of the day was a slow sell-off. The last hour was especially weak, which is not a good sign. Volume was below average. Never the less, the S&P managed to close 0.28% higher. You can thank the oil markets for the boost. WTIC was up 2.81% today, but is hitting the 50 DMA, so we'll have to see if it becomes resistance.

These low trading range days are unusual. Daily BB width is very narrow, which may suggest an upcoming big move. Which direction is anyone's guess, but it's been hard to fight the bulls all summer. Eventually this market will change, but I just don't see a catalyst for that change yet.

Composite system is now at -1, a hold/sell signal.

Gap higher at the open, and the first two hours looked good. The rest of the day was a slow sell-off. The last hour was especially weak, which is not a good sign. Volume was below average. Never the less, the S&P managed to close 0.28% higher. You can thank the oil markets for the boost. WTIC was up 2.81% today, but is hitting the 50 DMA, so we'll have to see if it becomes resistance.

These low trading range days are unusual. Daily BB width is very narrow, which may suggest an upcoming big move. Which direction is anyone's guess, but it's been hard to fight the bulls all summer. Eventually this market will change, but I just don't see a catalyst for that change yet.

Composite system is now at -1, a hold/sell signal.

MrJohnRoss

Market Veteran

- Reaction score

- 58

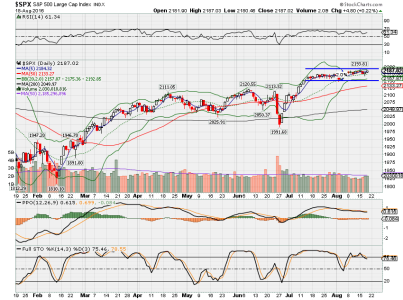

Failed breakout from the bullish rising wedge:

Gap down at the open, and rally attempts throughout the day failed. Prices have now broken the uptrend line from Aug 2. We also closed at the LOD, which is very bearish.

You would think that with oil trading higher today, stocks would follow suit. WTIC was up 1.84% to $46.58/barrel. Another bad sign for stocks.

All of this may mean nothing if the CB continues to pump the markets higher.

Utilities look like they are sliding down a slippery slope, even though interest rates aren't going drastically higher. What's up with that? Not a good sign.

Composite system now stands at -3, a strong sell signal.

Gap down at the open, and rally attempts throughout the day failed. Prices have now broken the uptrend line from Aug 2. We also closed at the LOD, which is very bearish.

You would think that with oil trading higher today, stocks would follow suit. WTIC was up 1.84% to $46.58/barrel. Another bad sign for stocks.

All of this may mean nothing if the CB continues to pump the markets higher.

Utilities look like they are sliding down a slippery slope, even though interest rates aren't going drastically higher. What's up with that? Not a good sign.

Composite system now stands at -3, a strong sell signal.

MrJohnRoss

Market Veteran

- Reaction score

- 58

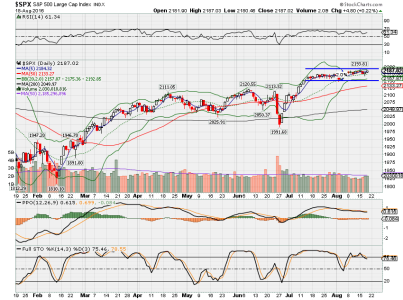

Daily view of the S&P. It just looks like the market can't get any traction here, and looks to be stalling. A little higher, a little lower, but basically going nowhere.

The PPO had a bearish crossover at the end of July, and it's looking like it's accelerating downward lately. Only 58% of S&P stocks are above their 20 DMA, and 68% above their 50 DMA. Those numbers look to be falling each day. To me, it sure appears like momentum is waning a bit.

WTIC notched another 21 cents higher, so the climb continues. That has helped prop up the market.

WTIC is now hitting the upper BB, so we may see a pullback or consolidation soon.

Composite system remains at -3, a strong sell signal.

The PPO had a bearish crossover at the end of July, and it's looking like it's accelerating downward lately. Only 58% of S&P stocks are above their 20 DMA, and 68% above their 50 DMA. Those numbers look to be falling each day. To me, it sure appears like momentum is waning a bit.

WTIC notched another 21 cents higher, so the climb continues. That has helped prop up the market.

WTIC is now hitting the upper BB, so we may see a pullback or consolidation soon.

Composite system remains at -3, a strong sell signal.

MJR how you feeling ol man? I often get up from sitting and find myself saying ol man, why I don't really know. Anyway hope your progressing forward. I mean ol man in the fondest way, after all ol is earned thru time. I'm in the same boat so keep on keep n on. Heehee

MrJohnRoss

Market Veteran

- Reaction score

- 58

Daily view showing the 2% range we've been in for over a month.

Mr Market seems to be biding his time, waiting for the catalyst to make him move one way or the other. Momentum continues to peter out.

The falling dollar is helping oil head higher, which has been about the only fuel for the market lately. WTIC up another 2.88% today.

VIX fell hard today, all the way down to 11.43, which caused my VIX system to switch to bullish. Also noted that the Utilities have put in a couple of up days, which is bullish. The Trannies are also moving a little higher, also bullish.

Composite system now at -1, a sell/hold position.

Good luck!

Mr Market seems to be biding his time, waiting for the catalyst to make him move one way or the other. Momentum continues to peter out.

The falling dollar is helping oil head higher, which has been about the only fuel for the market lately. WTIC up another 2.88% today.

VIX fell hard today, all the way down to 11.43, which caused my VIX system to switch to bullish. Also noted that the Utilities have put in a couple of up days, which is bullish. The Trannies are also moving a little higher, also bullish.

Composite system now at -1, a sell/hold position.

Good luck!

MrJohnRoss

Market Veteran

- Reaction score

- 58

MJR how you feeling ol man? I often get up from sitting and find myself saying ol man, why I don't really know. Anyway hope your progressing forward. I mean ol man in the fondest way, after all ol is earned thru time. I'm in the same boat so keep on keep n on. Heehee

Almost good as new. Thanks for the good words. AAPL is making a nice run.

konakathy

Market Veteran

- Reaction score

- 41

AAPL is making a nice run.

Yes, it is ! I bought at $92 and I'm at a gain of 18% since April. I've read that some analysts think it will go up to $120 per share. I'm keeping a watchful eye on the price; don't want to get greedy. I think after Apple releases the new iPhone this fall it may be a good time to sell. Yay! More travel money!

Glad you're on the mend. Back injuries and knee problems suck. It's an awful feeling when you're immobile.

About time as far as I'm concerned it has some ground to make up this year.Almost good as new. Thanks for the good words. AAPL is making a nice run.

Similar threads

- Replies

- 0

- Views

- 86

- Article

- Replies

- 0

- Views

- 126