MrJohnRoss

Market Veteran

- Reaction score

- 58

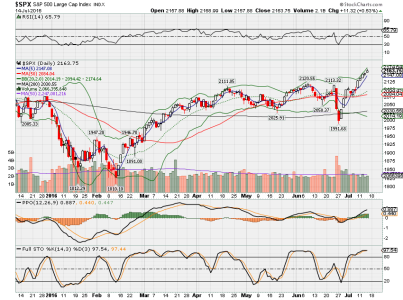

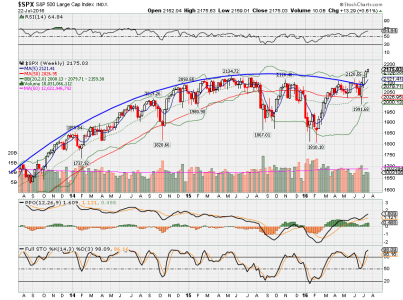

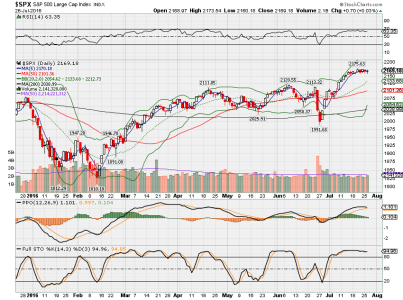

"I would be careful about chasing the market here. If I was long, today might have been a good day to take some chips off the table.

F Fund (AGG) is looking very toppy here, and I think a pullback is just beginning. Of course, I've been saying "overbought" for at least a week now. Ridiculous."

I agree JR! I was listening to one of the financial talking heads yesterday who commented that he could think of at least 100 reasons why the market should be declining yet it just keeps on going up! Then he stated that you can't argue with success! Now that's ridiculous!

Heh heh heh, Scout. Another way to put it: only price matters anymore.