MrJohnRoss

Market Veteran

- Reaction score

- 58

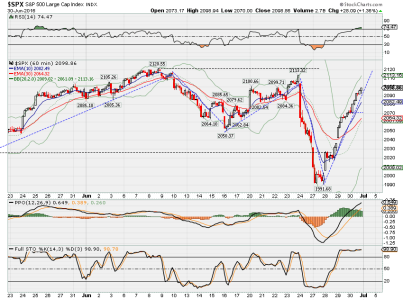

Gap down, gap down, gap up, gap up. That leaves us about where we were before the 20th, when the market rallied all week because the "experts" were forecasting a "no" vote on Brexit.

I would think that there is much more market risk today than there was two weeks ago, now that the EU is just beginning to crumble. This is a little like skating out further on the ice lake, even though you just heard a big crack. Nothing to worry about... yet.

We're slightly overbought at this point on the short term chart, but certainly could go higher without starting the engine on fire. Another few days of float up sounds about right, with end of quarter window dressing, and 4th of July holiday upcoming.

I now have two of my systems with bullish crossovers, so the composite system is reading +1, a mild buy signal. I will have to think about jumping back in, possibly for just the next few days to take us into the first part of the month.

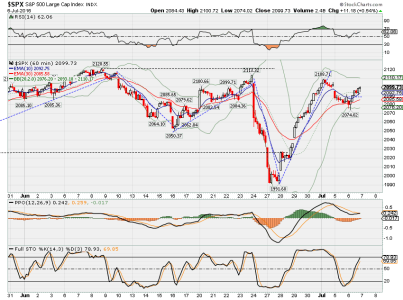

I would think that there is much more market risk today than there was two weeks ago, now that the EU is just beginning to crumble. This is a little like skating out further on the ice lake, even though you just heard a big crack. Nothing to worry about... yet.

We're slightly overbought at this point on the short term chart, but certainly could go higher without starting the engine on fire. Another few days of float up sounds about right, with end of quarter window dressing, and 4th of July holiday upcoming.

I now have two of my systems with bullish crossovers, so the composite system is reading +1, a mild buy signal. I will have to think about jumping back in, possibly for just the next few days to take us into the first part of the month.