MrJohnRoss

Market Veteran

- Reaction score

- 58

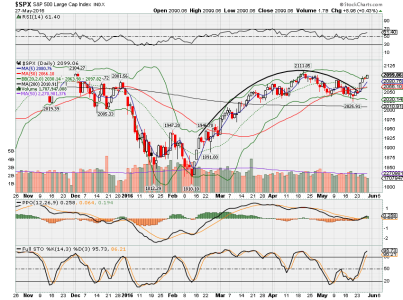

Here's a quick look at the 60 minute chart of the S&P:

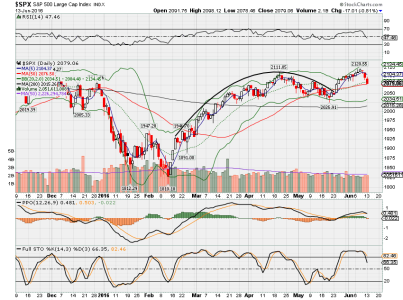

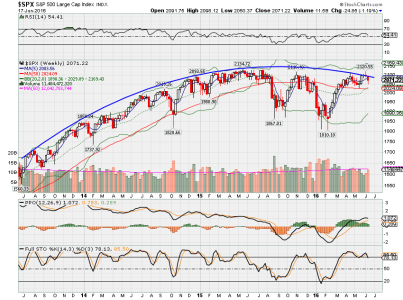

As I stated previously, prices couldn't stay in the channel forever. It was a surprise to see such a strong breakout to the upside. On 5/19, I said "Possible shooting star on the VIX today, which may indicate a reversal in the near future", which is exactly what happened, which caused my VIX timing system to flip to a buy signal. The others soon followed.

We're still in short term overbought territory (RSI, PPO, BB), so we may see a pullback or at least some consolidating in the short term. It's a positive to see prices close at the high of the day, but short term traders should be taking profits here, not buying into it at this point.

System reading remains at +3, a strong buy signal.

As I stated previously, prices couldn't stay in the channel forever. It was a surprise to see such a strong breakout to the upside. On 5/19, I said "Possible shooting star on the VIX today, which may indicate a reversal in the near future", which is exactly what happened, which caused my VIX timing system to flip to a buy signal. The others soon followed.

We're still in short term overbought territory (RSI, PPO, BB), so we may see a pullback or at least some consolidating in the short term. It's a positive to see prices close at the high of the day, but short term traders should be taking profits here, not buying into it at this point.

System reading remains at +3, a strong buy signal.