MrJohnRoss

Market Veteran

- Reaction score

- 58

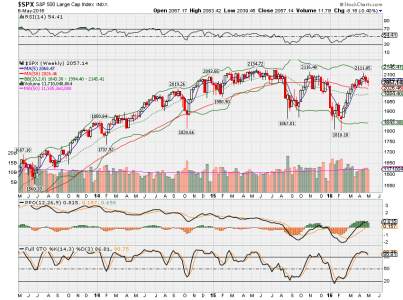

Long term monthly chart of the market:

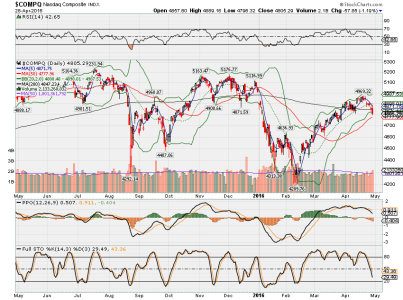

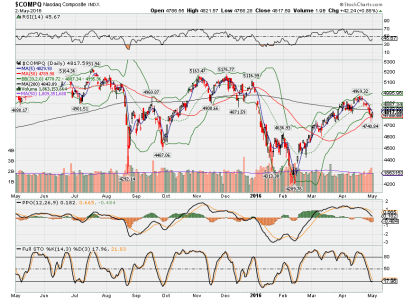

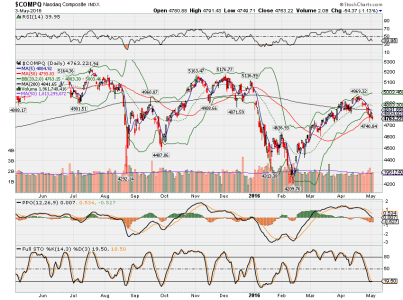

Seems that the market is struggling to make higher highs this week. We're in the resistance area of the previous highs from last November, so cautious investors are cashing out. We've got one more week to see how the final monthly candle prints on this chart. So far we're up 1.5% for the month, but anything can happen between now and next Friday. Short term momentum seems to be waning. Longer term, as viewed from this chart, suggests it may be wise to remain cautious.

Last October had a big white candle with an 8% gain which took it over the 12 month MA. That was followed by a flat November, which was followed by three big down months.

This year, we had March with a big white candle with a 6% gain which again took it over the 12 MMA. It's possible we may finish out this month flat or with another very small gain. How the month finishes may be an omen to how the next few months play out. I wouldn't be surprised to see a return to lower lows for stocks over the next few months.

USO is struggling to make new highs. The dollar looks like it may be strengthening. I'll be keeping my eye on the Fed for Hawkish clues, as well as a possibly strengthening dollar and how oil plays out next week.

Seems that the market is struggling to make higher highs this week. We're in the resistance area of the previous highs from last November, so cautious investors are cashing out. We've got one more week to see how the final monthly candle prints on this chart. So far we're up 1.5% for the month, but anything can happen between now and next Friday. Short term momentum seems to be waning. Longer term, as viewed from this chart, suggests it may be wise to remain cautious.

Last October had a big white candle with an 8% gain which took it over the 12 month MA. That was followed by a flat November, which was followed by three big down months.

This year, we had March with a big white candle with a 6% gain which again took it over the 12 MMA. It's possible we may finish out this month flat or with another very small gain. How the month finishes may be an omen to how the next few months play out. I wouldn't be surprised to see a return to lower lows for stocks over the next few months.

USO is struggling to make new highs. The dollar looks like it may be strengthening. I'll be keeping my eye on the Fed for Hawkish clues, as well as a possibly strengthening dollar and how oil plays out next week.