MrJohnRoss

Market Veteran

- Reaction score

- 58

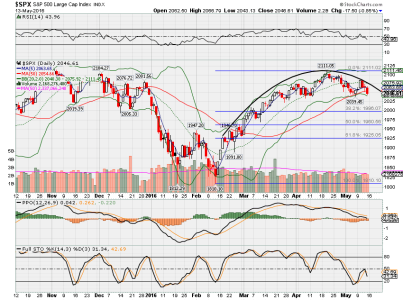

Hourly chart of the S&P:

Prices remain within the parallel blue channel lines, with little change today. Wouldn't be surprised to see a counter-trend rally attempt to tag the upper channel line over the next few days. The 10 sma has crossed the 30 sma, which is a short term bullish signal, but as you can see from the chart, the last time it crossed upwards, the counter-trend rally didn't last long (maybe a day or two). For now, the trend is down, and you're fighting it if you're trying to go bullish with these crossovers, unless you see a deeply oversold condition, which we don't have here.

The dollar has been re-gaining some strength lately, which might be causing the PM's to lose some luster. I noticed NUGT was down over 20% today, and oil (USO) looks like it's weakening as well. Note the possible bearish rising wedge on USO, which was broken to the downside today. Also note that the PPO had a negative crossover last week. I'd be cautious in the short term if you're long oil or oil related stocks.

Prices remain within the parallel blue channel lines, with little change today. Wouldn't be surprised to see a counter-trend rally attempt to tag the upper channel line over the next few days. The 10 sma has crossed the 30 sma, which is a short term bullish signal, but as you can see from the chart, the last time it crossed upwards, the counter-trend rally didn't last long (maybe a day or two). For now, the trend is down, and you're fighting it if you're trying to go bullish with these crossovers, unless you see a deeply oversold condition, which we don't have here.

The dollar has been re-gaining some strength lately, which might be causing the PM's to lose some luster. I noticed NUGT was down over 20% today, and oil (USO) looks like it's weakening as well. Note the possible bearish rising wedge on USO, which was broken to the downside today. Also note that the PPO had a negative crossover last week. I'd be cautious in the short term if you're long oil or oil related stocks.