FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

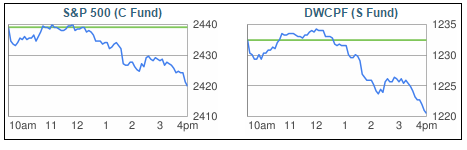

Whew...glad I locked in Monthly profits last week.

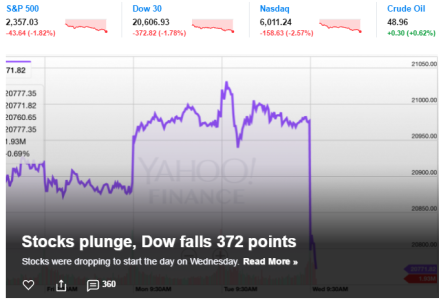

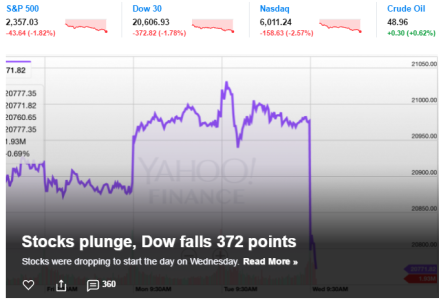

Reasons are likely a "Black Swan" geopolitical event. Impeachment odds, while not certain...have gone up significantly in the past 24 hrs.

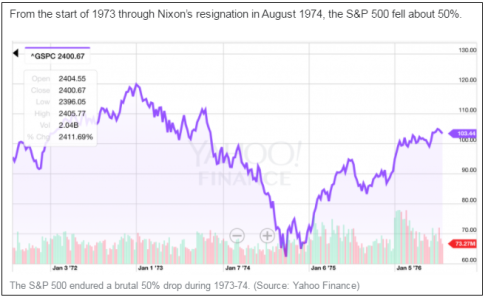

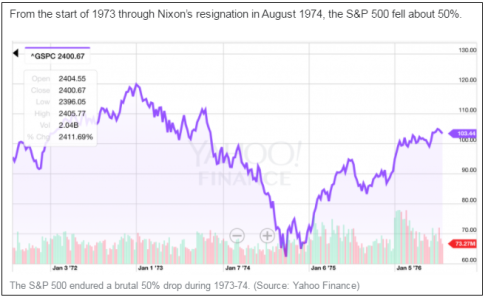

An analogue event...the Nixon Watergate Investigation...led to a yearlong bear market decline from previous highs...S&P dropping 50% in a year.

Interesting article:

Here's what the stock market did during Watergate — and why

https://finance.yahoo.com/news/heres-stock-market-watergate-133736317.html

Reasons are likely a "Black Swan" geopolitical event. Impeachment odds, while not certain...have gone up significantly in the past 24 hrs.

An analogue event...the Nixon Watergate Investigation...led to a yearlong bear market decline from previous highs...S&P dropping 50% in a year.

Interesting article:

Here's what the stock market did during Watergate — and why

https://finance.yahoo.com/news/heres-stock-market-watergate-133736317.html