FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

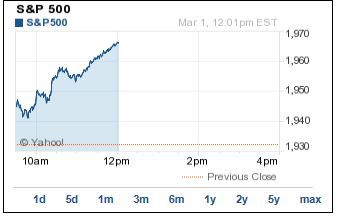

Sidestepping last week has put me almost 4% above the S&P for just this month (nearly 5% better than S-fund for Feb) if today's levels hold.

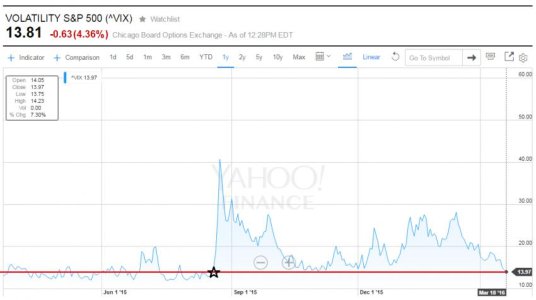

My system is screaming for me to get back IN. However, the charts are are showing at least another 1-2% downtrend beyond today's current lows before we get any kind of bounce.

Not sure what I'm going to to do. You can't go wrong going back in on bloodbath days...but how much more blood makes the difference whether you hit a single or hit a homer.

Gotta hand it to Cramer and the "Fibonacci Queen" chart segment he showed 2 weeks ago on Jan 26th (below). They nailed it...saying that the short term rally would not get past last Thursday (Feb 4th). And sure enough, Friday was our 1st free-fall day.

My system is screaming for me to get back IN. However, the charts are are showing at least another 1-2% downtrend beyond today's current lows before we get any kind of bounce.

Not sure what I'm going to to do. You can't go wrong going back in on bloodbath days...but how much more blood makes the difference whether you hit a single or hit a homer.

Gotta hand it to Cramer and the "Fibonacci Queen" chart segment he showed 2 weeks ago on Jan 26th (below). They nailed it...saying that the short term rally would not get past last Thursday (Feb 4th). And sure enough, Friday was our 1st free-fall day.

We've been on a decent run-up from the most recent low in January, but the charts are not looking bullish right now, and Feb to early March have produced some of our worst market lows in recent memory (March 2009 and March 2003).

Cramer's "Off the Charts" had the Fibonacci Queen saying that any rally from the recent lows would have a tough time getting past the mid 1900's and time-wise should not last beyond this week. Worth a peek...good chart work (below)

http://www.cnbc.com/2016/01/26/cramer-charts-predict-sp-bounce-will-end-soon.html

Will get out while the going is good. Well actually given some of the losses I've absorbed maybe should re-phrase "while the going is only bad, but not yet catastrophic."