coolhand

TSP Legend

- Reaction score

- 530

It was another one of those up and down days today that saw a mixed close.

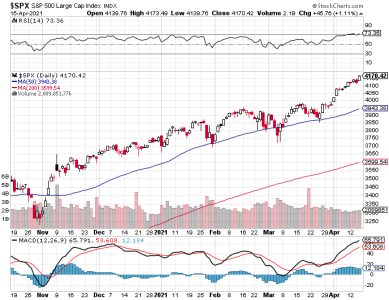

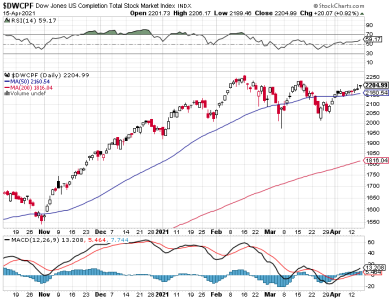

Volume was on the lighter side today. Price backed off the peak a bit more on the S&P. I get the impression that this index may be coiling for a upside break through resistance. The DWCPF bounced, but that does little to change the picture for this index, which remains below the 50 dma, but also above support in the 2020 area. Momentum is now flat on both charts, however momentum is still in positive territory on the S&P, but negative on the DWCPF.

Breadth ticked higher, but that doesn't change much. It's still rather neutral overall.

I remain neutral overall and modestly bullish on the S&P.

Volume was on the lighter side today. Price backed off the peak a bit more on the S&P. I get the impression that this index may be coiling for a upside break through resistance. The DWCPF bounced, but that does little to change the picture for this index, which remains below the 50 dma, but also above support in the 2020 area. Momentum is now flat on both charts, however momentum is still in positive territory on the S&P, but negative on the DWCPF.

Breadth ticked higher, but that doesn't change much. It's still rather neutral overall.

I remain neutral overall and modestly bullish on the S&P.