coolhand

TSP Legend

- Reaction score

- 530

Well, the bulls had a great week, last week. The C fund was up more than 2.6% and the S fund soared for almost 6%.

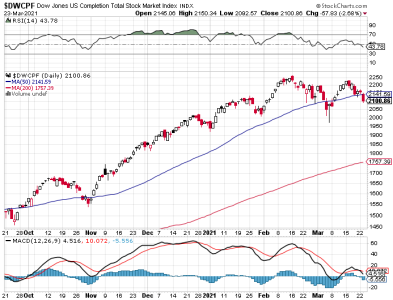

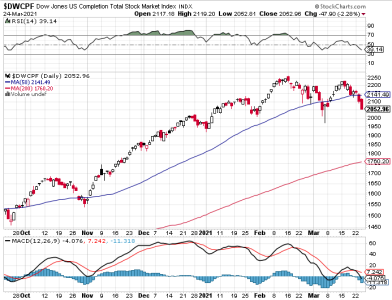

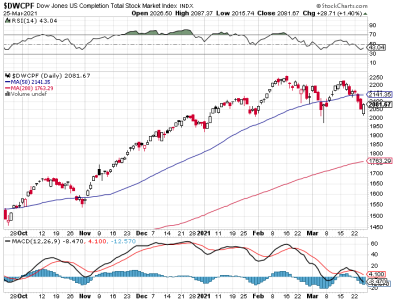

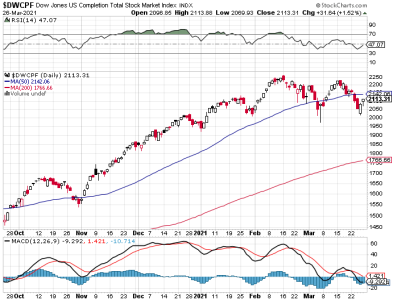

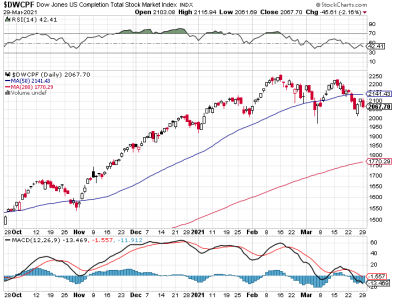

Price on the S&P is sitting at an all-time closing high, though not by much. Price on the DWCPF still has not tested its all-time high from almost a month ago and it was up more than double the S&P. I find that a bit troubling, but maybe it will play catch up with the S&P. Momentum is still rising (of course) and after its previous long move lower (momentum) maybe it has legs on this bounce.

Cumulative breadth rose again on Friday and the chart is looking bullish, though its due for a dip any time now.

We know that NAAIM is now leaning bearish heading into the new week. The TSP Talk sentiment came in very bullish. There were very few bears in the survey. I know I am calling us smart money, but that kind of lopsided reading has the chance to be problematic. We'll have to see how this plays out. The TSP survey won the last time NAAIM was leaning the other way.

I remain modestly bullish, but hardly complacent.

Price on the S&P is sitting at an all-time closing high, though not by much. Price on the DWCPF still has not tested its all-time high from almost a month ago and it was up more than double the S&P. I find that a bit troubling, but maybe it will play catch up with the S&P. Momentum is still rising (of course) and after its previous long move lower (momentum) maybe it has legs on this bounce.

Cumulative breadth rose again on Friday and the chart is looking bullish, though its due for a dip any time now.

We know that NAAIM is now leaning bearish heading into the new week. The TSP Talk sentiment came in very bullish. There were very few bears in the survey. I know I am calling us smart money, but that kind of lopsided reading has the chance to be problematic. We'll have to see how this plays out. The TSP survey won the last time NAAIM was leaning the other way.

I remain modestly bullish, but hardly complacent.