-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

CH looks like some more selling in tech and S fund down quite a bit now.

This is probably healthy for consolidation? I hope so.

Sent from my iPhone using Tapatalk

Given the huge gains that the S fund has had, I would expect that when any selling does happen (like now) that the losses would be healthy too. We'll get another NAAIM update tomorrow, but they were buying with both hands last week.

coolhand

TSP Legend

- Reaction score

- 530

The bears tried to take the market down today, and while they had some success it was limited. Small caps got hit hard early, but the bulls countered with buying pressure; erasing about half of the losses on the DWCPF by the close. The bulls also managed to bring price back near the neutral line on the S&P.

Overall, we have limited damage on the charts. I would argue we don't really have any if we allow the market to breath a bit. Today was an exhale. However, I don't know if we have a bottom either, so the downside pressure may not be over just yet.

Cumulative breadth struggled a bit again today, but it's really holding up fairly well and does remain bullish; albeit under pressure.

NAAIM reports tomorrow, so we'll see if they are still as bullish now as they were a week ago. Till then, I remain bullish.

Overall, we have limited damage on the charts. I would argue we don't really have any if we allow the market to breath a bit. Today was an exhale. However, I don't know if we have a bottom either, so the downside pressure may not be over just yet.

Cumulative breadth struggled a bit again today, but it's really holding up fairly well and does remain bullish; albeit under pressure.

NAAIM reports tomorrow, so we'll see if they are still as bullish now as they were a week ago. Till then, I remain bullish.

crommie

Market Tracker

- Reaction score

- 9

Good evening CH, am I seeing things or do your charts from February 23, 2020 look eerily similar to today's? Your commentary also sounds similar which was followed by your ominous warning on the 24th about a switch being flipped. Any thoughts on history repeating? On a personal note, I hope that your family problems from a year ago resolved themselves for the better.

Sent from my SM-G892A using TSP Talk Forums mobile app

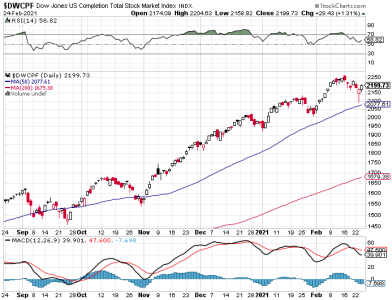

Last week, the market pulled back. The market has been fighting early weakness at the open of late, but so far the technical damage is nil.

View attachment 45474

View attachment 45473

The S&P fell almost 1.25% on the week, while the DWCPF only lost about 0.3%. The charts still look quite healthy.

View attachment 45472

Breadth dipped, but it remains bullish.

The CBOE closed bearish on Friday. That means selling pressure may bleed into Monday. TRIN and TRINQ were flat (neutral). NAAIM remains very bullish, so this weakness is not likely to last or do any serious technical damage.

Monday looks bearish, but I am looking for a turn back up at any time. I remain bullish.

Sent from my SM-G892A using TSP Talk Forums mobile app

coolhand

TSP Legend

- Reaction score

- 530

Good evening CH, am I seeing things or do your charts from February 23, 2020 look eerily similar to today's? Your commentary also sounds similar which was followed by your ominous warning on the 24th about a switch being flipped. Any thoughts on history repeating? On a personal note, I hope that your family problems from a year ago resolved themselves for the better.

Sent from my SM-G892A using TSP Talk Forums mobile app

Interesting comparison. Very similar to a year ago. As I've said in the past, we don't want to get complacent about the gains. Even NAAIM realizes that this party is not going to go on forever. But, they also realize you don't make money sitting on the sidelines (or shorting) when the market is moving higher. I would not be surprised if a top of some sort is approaching, but it's very hard to predict.

rangerray

TSP Pro

- Reaction score

- 209

NAAIM only dropped from 110 to 108, so I am hoping this is just a short correction before resuming an upward trend. Staying calm and riding it out...

I am staying put as well, hoping the market reacts like is has the last few times.

coolhand

TSP Legend

- Reaction score

- 530

Yes, NAAIM is almost unchanged from last week. They certainly do not seemed concerned by the current bout of weakness. Sometimes we have to endure some losses to eventually move ahead. It's a bit unnerving though, given how far this market has climbed.

I am remaining bullish for now.

I am remaining bullish for now.

coolhand

TSP Legend

- Reaction score

- 530

Profit taking continued today. It really isn't a surprise given how much the indexes had risen over the past 2 weeks or so. Of course, the question is whether it's just another buying opportunity or is it different this time. Last year at this time it was different. But unlike last year, I haven't sensed any switches being flipped (as yet).

The charts show us dips along the way as price has steadily climbed. So now we have another dip forming. Volume has been average, so that's not a flag. Momentum has turned down. The selling may not be over; especially if the 50 dma is a target for this bout of weakness.

Breadth took an ugly turn lower today. It's still technically bullish, but it's in danger of getting flipped negative if price keeps falling.

The big news is that NAAIM did not change much from last week. They are still pretty bulled up. That usually bodes well for the bulls, but last year at this time they were bulled up when we got that big decline, so we want to pay close attention to the action given how high this market has risen.

I remain bullish for now.

The charts show us dips along the way as price has steadily climbed. So now we have another dip forming. Volume has been average, so that's not a flag. Momentum has turned down. The selling may not be over; especially if the 50 dma is a target for this bout of weakness.

Breadth took an ugly turn lower today. It's still technically bullish, but it's in danger of getting flipped negative if price keeps falling.

The big news is that NAAIM did not change much from last week. They are still pretty bulled up. That usually bodes well for the bulls, but last year at this time they were bulled up when we got that big decline, so we want to pay close attention to the action given how high this market has risen.

I remain bullish for now.

coolhand

TSP Legend

- Reaction score

- 530

The bears won the weekly price war last week. The S&P and DWCPF both closed for losses on the week (less than 1% on the C and S funds). That's not bad at all and actually bolsters the possibility that this is yet another buying opportunity (DWCPF bounced on Friday). It also doesn't hurt that NAAIM remains bulled up.

With the recent weakness the charts don't look any different than what we saw with previous dips. Volume is normal. There doesn't appear to be any serious moves toward the exits right now. That's today. Tomorrow or next week could change the picture, or not.

Cumulative breadth bounced on Friday and remains bullish.

The TSP Talk sentiment survey came in bearish this week. That's diametrically opposed to NAAIM. We don't do that often. In fact, as I've stated in past posts, I don't treat our sentiment survey as dumb money. Not when we are collectively aligned to the NAAIM reading as often as we are. But I trust NAAIM more than TSP Talk sentiment reading. Prove me wrong.

Of course, NAAIM remains heavily bulled up for the new week.

How can I get bearish on these readings? I can't. Although I understand the angst about a market that seems to be move in just one direction. Eventually, it will be different this time. Is it this time? Maybe. But I have to go with the balance of evidence and that means I remain bullish.

With the recent weakness the charts don't look any different than what we saw with previous dips. Volume is normal. There doesn't appear to be any serious moves toward the exits right now. That's today. Tomorrow or next week could change the picture, or not.

Cumulative breadth bounced on Friday and remains bullish.

The TSP Talk sentiment survey came in bearish this week. That's diametrically opposed to NAAIM. We don't do that often. In fact, as I've stated in past posts, I don't treat our sentiment survey as dumb money. Not when we are collectively aligned to the NAAIM reading as often as we are. But I trust NAAIM more than TSP Talk sentiment reading. Prove me wrong.

Of course, NAAIM remains heavily bulled up for the new week.

How can I get bearish on these readings? I can't. Although I understand the angst about a market that seems to be move in just one direction. Eventually, it will be different this time. Is it this time? Maybe. But I have to go with the balance of evidence and that means I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The bears hit the gates running today, but the bulls countered with buying pressure by late morning into early afternoon. It was not enough. Buying pressure peaked in mid-afternoon and price fell all the way into the close.

The selling is still out of the ordinary. The charts are showing a short term (to this point) dip after a multi-day rally starting at the beginning of the month. The 50 dma is still below and may be a target for a turn. Volume was a bit more elevated from previous days.

Cumulative breadth barely dipped and is moving sideways.

So the market is continuing to consolidate gains after the recent run-up in price. The selling may not be over and we'll have to keep an eye on the 50 dma should price fall that far.

I remain bullish overall.

The selling is still out of the ordinary. The charts are showing a short term (to this point) dip after a multi-day rally starting at the beginning of the month. The 50 dma is still below and may be a target for a turn. Volume was a bit more elevated from previous days.

Cumulative breadth barely dipped and is moving sideways.

So the market is continuing to consolidate gains after the recent run-up in price. The selling may not be over and we'll have to keep an eye on the 50 dma should price fall that far.

I remain bullish overall.

coolhand

TSP Legend

- Reaction score

- 530

The bears got an early jump on the bulls again today, taking price lower at the open, but the bulls didn't wait long to bottom out the selling pressure and slowly push price higher.

By the end of the day, the S&P 500 had erased all losses (on the day) and actually closed modestly positive. The DWCPF came close to doing the same thing, but closed moderately lower. Both indexes show price coming near the 50 dma before reversing. It looks like a bottom may be in given the action, but we could see a second test of that key average. We'll have to see. Momentum is still falling. Volume has been rising of late, but it's still not significantly elevated.

Breadth, while not rising, isn't falling apart either. The signal is still technically bullish given it remains above the 2 tracking EMAs, but we can also look at it as neutral overall over the past couple of weeks or so.

We'll have to see if a bottom is indeed in or not. If price heads back to the 50 dma area then we may be in for another test. A failure in the short term may be a head fake for the bears. But if the selling doesn't stop after the initial failure, we may have something else going on. It could take several days before we know, but it could happen sooner too.

I remain bullish, but wary.

By the end of the day, the S&P 500 had erased all losses (on the day) and actually closed modestly positive. The DWCPF came close to doing the same thing, but closed moderately lower. Both indexes show price coming near the 50 dma before reversing. It looks like a bottom may be in given the action, but we could see a second test of that key average. We'll have to see. Momentum is still falling. Volume has been rising of late, but it's still not significantly elevated.

Breadth, while not rising, isn't falling apart either. The signal is still technically bullish given it remains above the 2 tracking EMAs, but we can also look at it as neutral overall over the past couple of weeks or so.

We'll have to see if a bottom is indeed in or not. If price heads back to the 50 dma area then we may be in for another test. A failure in the short term may be a head fake for the bears. But if the selling doesn't stop after the initial failure, we may have something else going on. It could take several days before we know, but it could happen sooner too.

I remain bullish, but wary.

coolhand

TSP Legend

- Reaction score

- 530

After today's upside follow through of Tuesday big reversal (bottom), the odds just went up that fresh highs may be coming in the days ahead.

Both charts show price poised to challenge previous all-time highs. Momentum looks like it may be getting ready to turn back up. Strength has certainly turned higher and volume was on the robust side. It sure looks like a bottom is in. Now price has to test overhead resistance.

Cumulative breadth turned back and is looking more bullish after its sideways dance.

I think the bulls have retaken control. We'll get a fresh NAAIM reading tomorrow.

I remain bullish.

Both charts show price poised to challenge previous all-time highs. Momentum looks like it may be getting ready to turn back up. Strength has certainly turned higher and volume was on the robust side. It sure looks like a bottom is in. Now price has to test overhead resistance.

Cumulative breadth turned back and is looking more bullish after its sideways dance.

I think the bulls have retaken control. We'll get a fresh NAAIM reading tomorrow.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

NAAIM came in less bullish this week, but they are still bullish. Still, the shift is not insignificant. I note that they are not shorting much, so it appears they are tempering levered long positions. The volatility and its underlying causes are likely factors in the reduction of long exposure.

I would say we want to be vigilant about being long right now. In other words, don't get complacent if you're heavy on stocks. There are reasons for this market to head south if the powers that be want it to. Yes, the market may still hit fresh highs, but whether it does or doesn't we want to be ready to take cover. Consider how much risk you are willing to take.

I would say we want to be vigilant about being long right now. In other words, don't get complacent if you're heavy on stocks. There are reasons for this market to head south if the powers that be want it to. Yes, the market may still hit fresh highs, but whether it does or doesn't we want to be ready to take cover. Consider how much risk you are willing to take.

Tsunami

TSP Pro

- Reaction score

- 62

What would that imply with the brokerages I wonder? Sorry still learning.

Since the emergence of Robinhood and all brokerages going to zero commission trading there has been a massive increase in new accounts and people trading like crazy.

It's overwhelming the brokerages and has resulted in lots of problems with most of them. From what I've read Interactive Brokers and TD Ameritrade have had the fewest problems.

If we ever get an all-out crash type of market like we had a year ago it will be more of a problem this time since there are so many new accounts compared to a year ago.

coolhand

TSP Legend

- Reaction score

- 530

Before I get into my usual post, I want to address something I said last week because I find it interesting and perhaps even instructive. When the TSP Talk survey was released last week, I said the following:

"The TSP Talk sentiment survey came in bearish this week. That's diametrically opposed to NAAIM. We don't do that often. In fact, as I've stated in past posts, I don't treat our sentiment survey as dumb money. Not when we are collectively aligned to the NAAIM reading as often as we are. But I trust NAAIM more than TSP Talk sentiment reading. Prove me wrong."

Well now, given how the bears trampled the bulls last week, I have to say that it appears I was proven wrong on who I should trust more. Or at least give equal weight.

I did say I consider us smart money as far as the survey goes, but as infrequently as we are misaligned with NAAIM, my default is NAAIM, which is why I remained bullish for the week. It's still a judgement call when you are looking at signals that are not in alignment, but in the future I would give more credence to where we stand collectively on TSP Talk.

Now back to your regularly scheduled program.

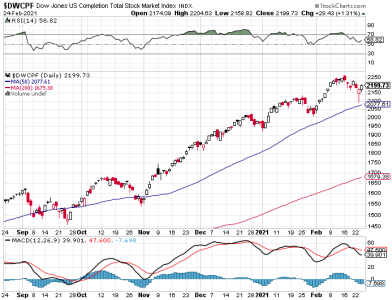

The market gave us what for all the world looked like a pretty good set-up for fresh highs after back-to-back rallies on Tuesday and Wednesday. But then Thursday we got selling in spades and that called into question where this market was really headed. Friday's action was mixed and still a bit volatile. The week saw both the C and S funds shed 2.41% on C and 4.39% on the S fund.

That puts price back at or near the 50 dma on both charts. Support held (so far). So, we now have a 2nd test. Will it hold? I don't know. Momentum is falling hard. The DWCPF did bounce off its 50 dma, but I can't hang my hat on a bottom with it. More or less the same for the C fund, but price is sitting right on support on that index.

Cumulative breadth has now gone bearish, but we've seen this before too, so we can't assume the market is ready to roll over.

This week's TSP Talk survey is pretty neutral. Although NAAIM was bullish with their reading on Thursday (cautiously so), the action that day may have changed that reading. I warned that the fact the bullishness fell as much as it did, even if they weren't embracing the bearish case, was a potential warning.

So, all things considered above I am moving from bullish to neutral. The bears haven't proven anything yet (other than they haven't gone away) and we're still in a bull market. But I would not be surprised if this market goes in either direction next week (or both). The volatility may continue. There are games being played (gamestop, etc.), brokerage outages, banking glitches, etc. happening, which gives me pause as well. Both NAAIM and TSP Talk are either neutral or at least showing respect for potential downside. I don't think this is quite the same market right now and I think I have company with that line of thinking.

"The TSP Talk sentiment survey came in bearish this week. That's diametrically opposed to NAAIM. We don't do that often. In fact, as I've stated in past posts, I don't treat our sentiment survey as dumb money. Not when we are collectively aligned to the NAAIM reading as often as we are. But I trust NAAIM more than TSP Talk sentiment reading. Prove me wrong."

Well now, given how the bears trampled the bulls last week, I have to say that it appears I was proven wrong on who I should trust more. Or at least give equal weight.

I did say I consider us smart money as far as the survey goes, but as infrequently as we are misaligned with NAAIM, my default is NAAIM, which is why I remained bullish for the week. It's still a judgement call when you are looking at signals that are not in alignment, but in the future I would give more credence to where we stand collectively on TSP Talk.

Now back to your regularly scheduled program.

The market gave us what for all the world looked like a pretty good set-up for fresh highs after back-to-back rallies on Tuesday and Wednesday. But then Thursday we got selling in spades and that called into question where this market was really headed. Friday's action was mixed and still a bit volatile. The week saw both the C and S funds shed 2.41% on C and 4.39% on the S fund.

That puts price back at or near the 50 dma on both charts. Support held (so far). So, we now have a 2nd test. Will it hold? I don't know. Momentum is falling hard. The DWCPF did bounce off its 50 dma, but I can't hang my hat on a bottom with it. More or less the same for the C fund, but price is sitting right on support on that index.

Cumulative breadth has now gone bearish, but we've seen this before too, so we can't assume the market is ready to roll over.

This week's TSP Talk survey is pretty neutral. Although NAAIM was bullish with their reading on Thursday (cautiously so), the action that day may have changed that reading. I warned that the fact the bullishness fell as much as it did, even if they weren't embracing the bearish case, was a potential warning.

So, all things considered above I am moving from bullish to neutral. The bears haven't proven anything yet (other than they haven't gone away) and we're still in a bull market. But I would not be surprised if this market goes in either direction next week (or both). The volatility may continue. There are games being played (gamestop, etc.), brokerage outages, banking glitches, etc. happening, which gives me pause as well. Both NAAIM and TSP Talk are either neutral or at least showing respect for potential downside. I don't think this is quite the same market right now and I think I have company with that line of thinking.

Similar threads

- Replies

- 0

- Views

- 149

- Replies

- 0

- Views

- 165

- Replies

- 0

- Views

- 115

- Replies

- 0

- Views

- 126

- Replies

- 0

- Views

- 78