-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

bmneveu

TSP Pro

- Reaction score

- 91

Something's afoot. Watch silver. I'm seeing panic buying in some circles. I am even seeing 100oz bars on ebay for $600 to $1,000/oz. I think these folks are early, but the financial system is being tested. Money Metals Exchange has halted all silver sales till tomorrow morning. They are out of inventory under heavy demand this weekend. Just something to think about and investigate.

I have a sleeve of TSP Talk 1oz silver coins that I would be willing to let go for $1,000 each. Hate to do it, but I suppose I'll let them go if you twist my arm....

coolhand

TSP Legend

- Reaction score

- 530

coolhand

TSP Legend

- Reaction score

- 530

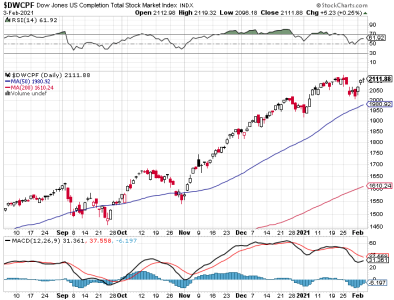

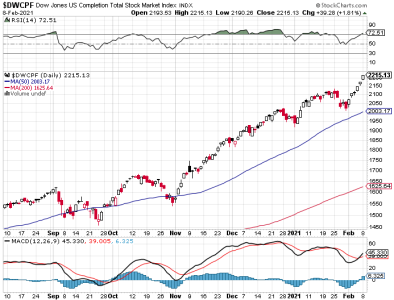

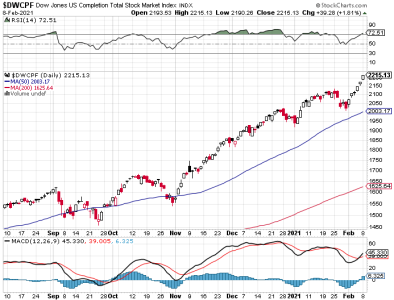

The bulls bounced the market Monday to start out the week on the positive side.

The biggest takeaway I see here is that the 50 dma held (so far) on the S&P 500. That certainly doesn't mean the market is out of the woods; especially when we see headlines regarding short squeezes that are forcing the powers that be to shut down trading and change the rules to protect themselves (not you). One thing I am certain of is that we'll see more headlines like these down the road. And I don't think we'll be waiting long either.

And the silver short squeeze is more dangerous as the big banks are heavily short that metal. Physical metal is almost gone and that is very likely going to break the paper/physical price point (spot). Isn't it interesting how physical disappeared very quickly (over the weekend in many cases). If the banks lose control of the price of silver (I'm betting they will), their shorts are going to get infinitely expensive. How might this affect the market? It won't be a positive thing, that's for sure.

Breadth flipped positive on today's positive action.

So, as I've described above, it's going to be interesting to see how things play out in the days/weeks ahead. Risk remains elevated in my opinion. I remain modestly bearish.

The biggest takeaway I see here is that the 50 dma held (so far) on the S&P 500. That certainly doesn't mean the market is out of the woods; especially when we see headlines regarding short squeezes that are forcing the powers that be to shut down trading and change the rules to protect themselves (not you). One thing I am certain of is that we'll see more headlines like these down the road. And I don't think we'll be waiting long either.

And the silver short squeeze is more dangerous as the big banks are heavily short that metal. Physical metal is almost gone and that is very likely going to break the paper/physical price point (spot). Isn't it interesting how physical disappeared very quickly (over the weekend in many cases). If the banks lose control of the price of silver (I'm betting they will), their shorts are going to get infinitely expensive. How might this affect the market? It won't be a positive thing, that's for sure.

Breadth flipped positive on today's positive action.

So, as I've described above, it's going to be interesting to see how things play out in the days/weeks ahead. Risk remains elevated in my opinion. I remain modestly bearish.

coolhand

TSP Legend

- Reaction score

- 530

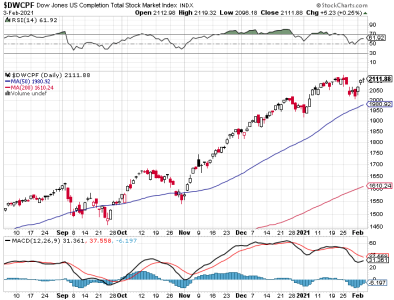

The bulls made it 2 in a row on Tuesday. Much of the previous losses have now been erased and price is not far from the peak now. However, there may be resistance as price tries to move higher.

We've seen this before too. Every bout of weakness of some size gets reversed at some point with new highs eventually being hit. Are we going to see fresh highs again? Let's just say I'm not betting against the bulls after today's rally. Momentum is now starting to turn up.

Breadth also got well in a hurry and is back to a more solid bullish reading.

There are many reasons to be cautious right now. Certainly the bears might take back control, but they might not either. We do have resistance above, but we're still in a bull market. I was leaning bearish given the action in certain market segments, which were not typical market activity (gamestop, silver short squeeze, etc.). We also saw the smart money pull back on their bullishness last week, which meant they saw the potential for selling pressure in the short term. Now, we have 2 solid up-days of action, which in the past has meant new highs were eventually hit.

I am moving back to a neutral stance. Monday's rally was simply a bounce off support. Today's follow up rally now calls into question the bearish argument. Can the bulls now push past resistance? Probably. But I can't get bullish just yet. I'd like to see another day or 2 of action (by then we'll have a fresh NAAIM reading).

We've seen this before too. Every bout of weakness of some size gets reversed at some point with new highs eventually being hit. Are we going to see fresh highs again? Let's just say I'm not betting against the bulls after today's rally. Momentum is now starting to turn up.

Breadth also got well in a hurry and is back to a more solid bullish reading.

There are many reasons to be cautious right now. Certainly the bears might take back control, but they might not either. We do have resistance above, but we're still in a bull market. I was leaning bearish given the action in certain market segments, which were not typical market activity (gamestop, silver short squeeze, etc.). We also saw the smart money pull back on their bullishness last week, which meant they saw the potential for selling pressure in the short term. Now, we have 2 solid up-days of action, which in the past has meant new highs were eventually hit.

I am moving back to a neutral stance. Monday's rally was simply a bounce off support. Today's follow up rally now calls into question the bearish argument. Can the bulls now push past resistance? Probably. But I can't get bullish just yet. I'd like to see another day or 2 of action (by then we'll have a fresh NAAIM reading).

coolhand

TSP Legend

- Reaction score

- 530

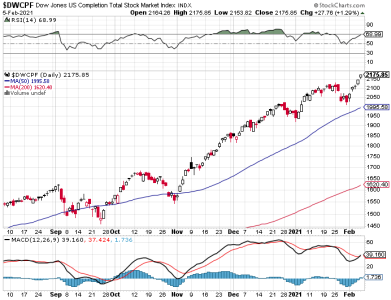

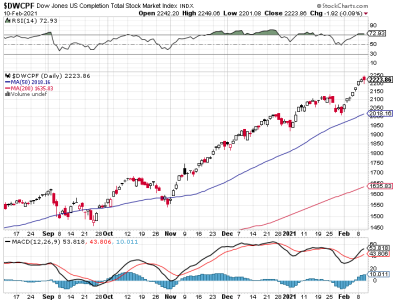

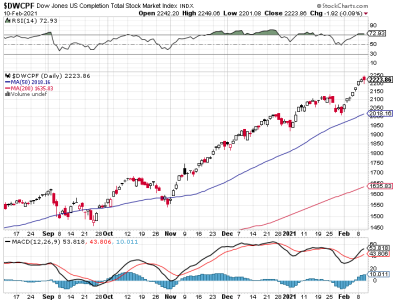

The bulls pushed price higher today for the 3rd day in a row. The action was up and down and the gains on the day were somewhat modest.

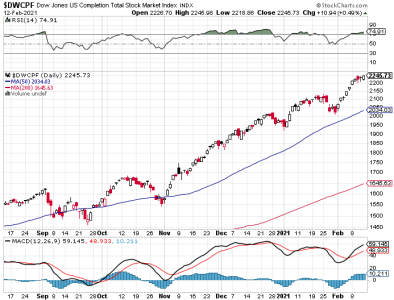

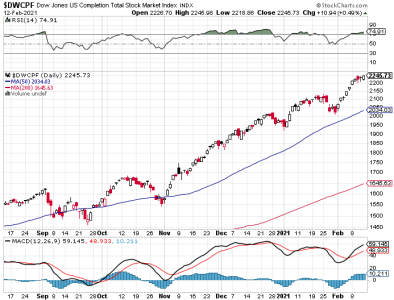

Price on the DWCPF closed in the area of its previous all-time high (give or take). Price on the S&P has yet to hit its previous peak. So, we haven't started a new up-leg yet, which means resistance is holding for now.

Breadth ticked higher and remains bullish.

It still remains to be seen if new highs are coming or not. Why should there be any doubt? It was one thing to predict a bull run in mid-November. I largely saw it coming as did NAAIM. I don't have the same confidence now, though I'm not doubting necessarily that it can't happen. I need more evidence. NAAIM reports tomorrow. Let's see where the smart money stands and what futures does heading into tomorrow's open.

I remain neutral.

Price on the DWCPF closed in the area of its previous all-time high (give or take). Price on the S&P has yet to hit its previous peak. So, we haven't started a new up-leg yet, which means resistance is holding for now.

Breadth ticked higher and remains bullish.

It still remains to be seen if new highs are coming or not. Why should there be any doubt? It was one thing to predict a bull run in mid-November. I largely saw it coming as did NAAIM. I don't have the same confidence now, though I'm not doubting necessarily that it can't happen. I need more evidence. NAAIM reports tomorrow. Let's see where the smart money stands and what futures does heading into tomorrow's open.

I remain neutral.

coolhand

TSP Legend

- Reaction score

- 530

NAAIM came in a bit less bullish today. I would say they are modestly bullish overall. They are not shorting the market much, but they are not buying with both hands either. There seems to be some degree of skepticism among them, but they are acknowledging that the bull remains alive (that's why they are still long overall).

coolhand

TSP Legend

- Reaction score

- 530

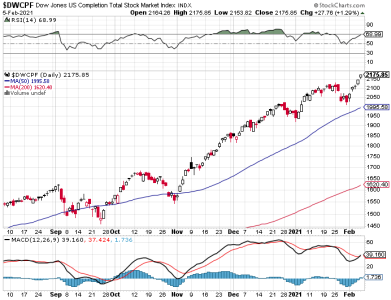

I suppose we got our confirmation today as to what the market's intent was. Fresh closing all-time highs on the S&P and DWCPF both.

Momentum is rising. There is a chance that the breakout is a head fake, but that would be a hard sell in this bull market (no pun intended).

Cumulative breadth is rising quickly and remains bullish.

NAAIM came in a bit less bullish today with an overall reading of what I would call modestly bullish. That's just north of neutral. They are generally not shorting very much (financial suicide), but they are not nearly as bullish as they've been, which tells me that some of these money managers are harboring some reservations. Still, they are bullish overall.

I am shifting modestly bullish myself (from neutral), but as you've heard me say a number of times in the past, I am not complacent. Take the gains while they are offering them, but don't get married to your position. This is not a normal market.

Momentum is rising. There is a chance that the breakout is a head fake, but that would be a hard sell in this bull market (no pun intended).

Cumulative breadth is rising quickly and remains bullish.

NAAIM came in a bit less bullish today with an overall reading of what I would call modestly bullish. That's just north of neutral. They are generally not shorting very much (financial suicide), but they are not nearly as bullish as they've been, which tells me that some of these money managers are harboring some reservations. Still, they are bullish overall.

I am shifting modestly bullish myself (from neutral), but as you've heard me say a number of times in the past, I am not complacent. Take the gains while they are offering them, but don't get married to your position. This is not a normal market.

coolhand

TSP Legend

- Reaction score

- 530

The bulls put up big gains last week, up 4.67% on the C fund and up 7.52% on the S fund.

Both charts sport fresh all-time highs. Momentum is moving higher.

Breadth is starting to stretch it out to the upside. The chart is obviously bullish.

The TSP Talk sentiment survey saw participants get bulled up this week after being neutral last week. NAAIM is modestly bullish, but perhaps more important is that they are not showing much inclination to short the market. Just don't forget they are not as bullish as they've been, so we don't want to get complacent.

How high can this market go? That's a question many traders are wondering. It's all about liquidity and we're hearing that liquidity is being injected into the market (to this point). How long it plays out is a guessing game, so we might as well take advantage of the rally while we can. I remain modestly bullish.

Both charts sport fresh all-time highs. Momentum is moving higher.

Breadth is starting to stretch it out to the upside. The chart is obviously bullish.

The TSP Talk sentiment survey saw participants get bulled up this week after being neutral last week. NAAIM is modestly bullish, but perhaps more important is that they are not showing much inclination to short the market. Just don't forget they are not as bullish as they've been, so we don't want to get complacent.

How high can this market go? That's a question many traders are wondering. It's all about liquidity and we're hearing that liquidity is being injected into the market (to this point). How long it plays out is a guessing game, so we might as well take advantage of the rally while we can. I remain modestly bullish.

coolhand

TSP Legend

- Reaction score

- 530

The bulls picked up where they left off last week with more impressive gains to start a new week.

Does anyone remember that bump in the road a little over a week ago? Just what was that all about really? Now, we have 6 up days in a row on the charts with fresh all-time highs each of the past 3 days. The DWCPF is back in overbought territory again. Momentum continues to rise and volume is only average. Where are the bears (not that I really care)?

Look at cumulative breadth. It's going vertical again.

I know many were pounding the table that this market was toast (I was leaning that way for a bit too), but we can see that the bull was only wounded. Now he's mad. I wonder how far this train is going?

I am now bullish (from modestly so).

Does anyone remember that bump in the road a little over a week ago? Just what was that all about really? Now, we have 6 up days in a row on the charts with fresh all-time highs each of the past 3 days. The DWCPF is back in overbought territory again. Momentum continues to rise and volume is only average. Where are the bears (not that I really care)?

Look at cumulative breadth. It's going vertical again.

I know many were pounding the table that this market was toast (I was leaning that way for a bit too), but we can see that the bull was only wounded. Now he's mad. I wonder how far this train is going?

I am now bullish (from modestly so).

coolhand

TSP Legend

- Reaction score

- 530

The market started out the trading session on the weak side today, but the bulls fought back to bring price near to or over the neutral line over the course of the day.

The DWCPF notched its 7th straight winning session, while the S&P saw its string of 6 wins broken, but not by all that much. The action was not particularly notable in my opinion. Some selling was due, but we see how liquidity appeared to send price much higher prior to noon EST.

Breadth was up again and remains bullish.

Not much else to add this evening. I remain bullish.

The DWCPF notched its 7th straight winning session, while the S&P saw its string of 6 wins broken, but not by all that much. The action was not particularly notable in my opinion. Some selling was due, but we see how liquidity appeared to send price much higher prior to noon EST.

Breadth was up again and remains bullish.

Not much else to add this evening. I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The string of gains was broken to day, but not by much. Trading was up and down, often around the neutral line.

It isn't much of a pullback, which makes me think we may have more weakness in the short term. Momentum is starting to weaken a bit; especially on the S&P. Nothing dramatic, certainly, but the market may be topping for the moment. The problem is, the bottom may not be far off either (should the bears manage to keep some pressure on). This is one bull that really does need to be respected even as we try not to be complacent about the gains.

Cumulative breadth leveled off today. It's still very bullish, but is also showing possible fatigue.

The market is due for some measure of consolidation, so I'd not be surprised with more weakness in the short term. Maybe we get it, maybe the bulls hold off the bears for a while longer yet, we'll have to see. NAAIM reports tomorrow.

I remain bullish, but anticipate weakness in the short term.

It isn't much of a pullback, which makes me think we may have more weakness in the short term. Momentum is starting to weaken a bit; especially on the S&P. Nothing dramatic, certainly, but the market may be topping for the moment. The problem is, the bottom may not be far off either (should the bears manage to keep some pressure on). This is one bull that really does need to be respected even as we try not to be complacent about the gains.

Cumulative breadth leveled off today. It's still very bullish, but is also showing possible fatigue.

The market is due for some measure of consolidation, so I'd not be surprised with more weakness in the short term. Maybe we get it, maybe the bulls hold off the bears for a while longer yet, we'll have to see. NAAIM reports tomorrow.

I remain bullish, but anticipate weakness in the short term.

coolhand

TSP Legend

- Reaction score

- 530

The market was choppy again today, but this time it manged to remain on the positive side at the close.

Price was up only marginally on the S&P today, but fared better on the DWCPF with almost a 0.5% gain. Momentum has gone flat on the S&P and the DWCPF, but both remain on the positive side. There is a toppy feel to this action, but this market has been very deceptive in the past.

Breadth also looks toppy, but remains bullish.

The big news (always on Thursday), is that NAAIM got bulled up once again. We could still see some weakness in the short term given the toppy looking charts, but with the smart money as bulled up they are then any downside we get is likely going to be limited. I really looks like risk remains to the upside.

I remain bullish.

Price was up only marginally on the S&P today, but fared better on the DWCPF with almost a 0.5% gain. Momentum has gone flat on the S&P and the DWCPF, but both remain on the positive side. There is a toppy feel to this action, but this market has been very deceptive in the past.

Breadth also looks toppy, but remains bullish.

The big news (always on Thursday), is that NAAIM got bulled up once again. We could still see some weakness in the short term given the toppy looking charts, but with the smart money as bulled up they are then any downside we get is likely going to be limited. I really looks like risk remains to the upside.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The bulls ended Friday and the week in positive territory. The DWCPF continues to lead the way.

It was a bit of a roller coaster on Friday, but the bulls pushed price higher by the close. In fact, price rallied rather hard in the final minutes of Friday's trading session. Momentum is still positive. We can also see that price remains well above the 50 dma on both charts.

Cumulative breadth has been largely sideways for a few trading days now, but the signal is still bullish.

The TSP Talk sentiment survey saw a drop in bullishness and now more neutral that bullish. However, NAAIM is very bulled up heading into the new week.

Futures are positive (so far) this evening. We may be in for more of the same boring upward bias .

.

I remain bullish.

It was a bit of a roller coaster on Friday, but the bulls pushed price higher by the close. In fact, price rallied rather hard in the final minutes of Friday's trading session. Momentum is still positive. We can also see that price remains well above the 50 dma on both charts.

Cumulative breadth has been largely sideways for a few trading days now, but the signal is still bullish.

The TSP Talk sentiment survey saw a drop in bullishness and now more neutral that bullish. However, NAAIM is very bulled up heading into the new week.

Futures are positive (so far) this evening. We may be in for more of the same boring upward bias

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The market had another somewhat volatile and choppy day to start the new trading week.

This time, the bulls came up short, but not by much. But really, some measure of a pullback is needed, though this is pretty shallow for a potential pullback. Perhaps the selling isn't done.

Breadth continues to track sideways, but remains bullish.

Futures are modestly lower this evening. We may see more of the same for Wednesday's action.

I remain bullish overall, but anticipate selling in the very short term.

This time, the bulls came up short, but not by much. But really, some measure of a pullback is needed, though this is pretty shallow for a potential pullback. Perhaps the selling isn't done.

Breadth continues to track sideways, but remains bullish.

Futures are modestly lower this evening. We may see more of the same for Wednesday's action.

I remain bullish overall, but anticipate selling in the very short term.

Similar threads

- Replies

- 0

- Views

- 149

- Replies

- 0

- Views

- 165

- Replies

- 0

- Views

- 115

- Replies

- 0

- Views

- 125

- Replies

- 0

- Views

- 77