While I've maintained my bullishness for some now, I've cautioned that I am wary of this market even as the indicators (and smart money) were still largely bullish. Market character can change quickly under the right (or wrong) circumstance. In this case, a new administration was a potential circumstance because the market is always looking ahead and if sees something it doesn't like it will let everyone know it. Is this what we are seeing now? Perhaps.

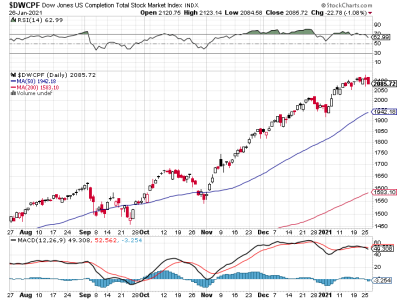

We got a deep decline today (for one day) and some technical lines were broken to the downside. Price on the S&P is not far from testing its rising 50 dma. Volume was not high, which is interesting. Momentum on both charts is falling.

Cumulative breadth went negative today.

We've seen this kind of action before on a number of occasions, though not recently. I'd like to think that the market is going to bottom and turn back up and maybe it will, but there may be more going on than is obvious (behind the scenes). NAAIM reports tomorrow and that will help a little bit to see what they think moving forward. But early last year it took them an extended time to react to bearish action so I don't want get complacent.

I am inclined to get bearish here even without a fresh NAAIM reading. I do have a bearish breadth reading and it comes on a long-in-the-tooth bull market with a new administration in charge. We also have technical damage, which is still not severe, but notable as all deep declines have start somewhere.

For now, I am going neutral until I see the futures tomorrow morning along with tomorrow's NAAIM reading. It's certainly possible that the market comes back, but I have a feeling that market changes may be starting to manifest. It may still take a few days or more before the market's true intent is known.