- Reaction score

- 821

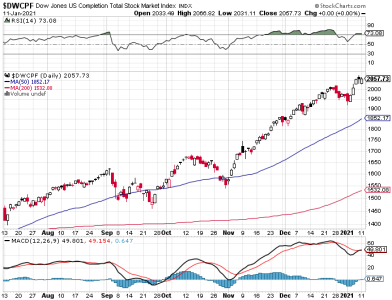

Last week saw somewhat of a reversal of fortune between the S&P and the DWCPF. For the week, the S&P was up more than 1%, while the DWCPF was down more than 1%. What do we make of that? I can't read much into it given that last week was the last trading week of year and the quarter. Now we start a new year and a new quarter.

Friday's action was modestly negative for both indexes, but the yearly gains were impressive; especially for the DWCPF, which was up more than 31%.

As January goes, so goes the year is an often quoted axiom among traders. I remain bullish as we head into the new trading year.

Interesting for January 2020 the "F" fund was a positive 0.38 while the "C, S & I" funds were negative 0.02, 0.35 & 0.89 respectively. Of course the "C, S & I" funds tanked in February and March. But all funds ended up positive by the end of the year.