coolhand

TSP Legend

- Reaction score

- 530

Isn't it interesting that a market that supposedly has zero sideline money keeps finding a way to power higher? And that the smart money has been aligned with this? NAAIM is not a contrarian indicator. I've said this several times. No, like all indicators it isn't perfect, but the last time I checked on Ebay there were no crystal balls for sale (functional). NAAIM tends to be right much more often than not. Especially on timelines longer than a week.

Also, the central bank is not limited to the amount of fiat creation ever since Nixon took the dollar off the gold standard. That means very few of us around today have participated in a market that was at least somewhat sound up until that time. That change was enacted in August 1971. FDR also took us off the standard for a time back in June of 1933. A bank that can print to infinity does not run out of money unless they desire such.

I was asked yesterday if the S&P would make a new high by next week and I said that it was highly likely if NAAIM remained bullish that it would do so perhaps even sooner. And just 24 hours later we have a new high on that index.

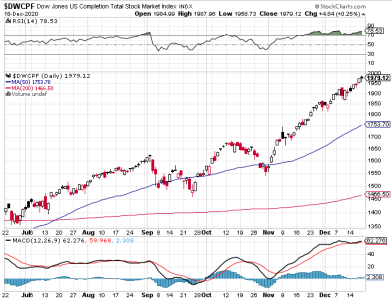

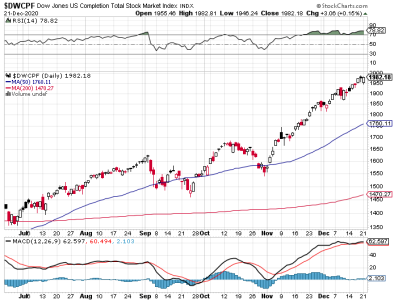

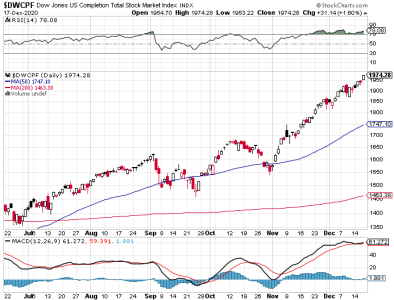

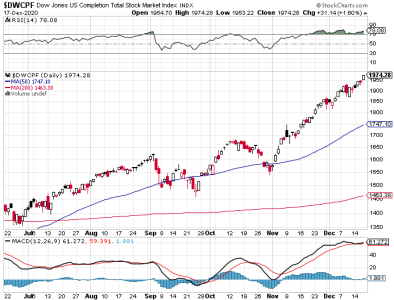

Aside from being extended, these charts are bullish. I said more than a month ago that this market had a good chance of getting silly to the upside. Was I wrong?

Here's another silly chart getting even sillier.

NAAIM is not my only indicator. It's just one that I trust more than most. And they are bulled up again.

I remain bullish.

Also, the central bank is not limited to the amount of fiat creation ever since Nixon took the dollar off the gold standard. That means very few of us around today have participated in a market that was at least somewhat sound up until that time. That change was enacted in August 1971. FDR also took us off the standard for a time back in June of 1933. A bank that can print to infinity does not run out of money unless they desire such.

I was asked yesterday if the S&P would make a new high by next week and I said that it was highly likely if NAAIM remained bullish that it would do so perhaps even sooner. And just 24 hours later we have a new high on that index.

Aside from being extended, these charts are bullish. I said more than a month ago that this market had a good chance of getting silly to the upside. Was I wrong?

Here's another silly chart getting even sillier.

NAAIM is not my only indicator. It's just one that I trust more than most. And they are bulled up again.

I remain bullish.