coolhand

TSP Legend

- Reaction score

- 530

The market was mixed last week, with major averages posting gains and losses depending on the index. We are seeing what appears to be stock rotation going from larger caps to smaller caps, but that's just what I see on a superficial level. I am not looking "under the hood" so-to-speak as I like to keep my commentary fairly simple.

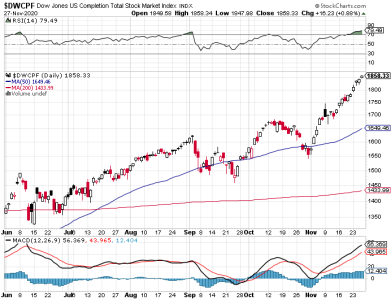

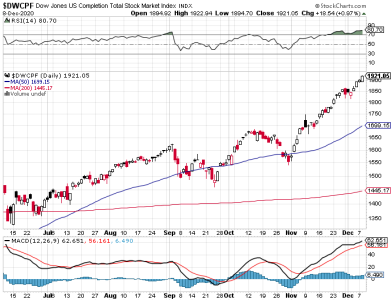

In the loss column you have the S&P 500, which shed less than 1% last week. On the positive side you have the DWCPF, which posted a weekly gains well above 3%. It's a tale of 2 indexes right now. I tend to believe that this disparity may continue for the time being.

Cumulative breadth remains bullish.

The latest TSP Talk sentiment survey shows a small increase in bullishness, but I still see the reading as neutral overall. We have a bullish NAAIM reading heading into the new week.

I expect the market to continue acting much like it has of late. That is, the DWCPF is likely to outpace the S&P in the short term. I'll take it a week at a time and see how it plays out.

I remain bullish (S Fund). I am neutral on the C Fund.

In the loss column you have the S&P 500, which shed less than 1% last week. On the positive side you have the DWCPF, which posted a weekly gains well above 3%. It's a tale of 2 indexes right now. I tend to believe that this disparity may continue for the time being.

Cumulative breadth remains bullish.

The latest TSP Talk sentiment survey shows a small increase in bullishness, but I still see the reading as neutral overall. We have a bullish NAAIM reading heading into the new week.

I expect the market to continue acting much like it has of late. That is, the DWCPF is likely to outpace the S&P in the short term. I'll take it a week at a time and see how it plays out.

I remain bullish (S Fund). I am neutral on the C Fund.