-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

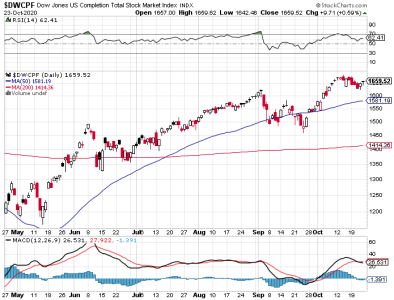

As difficult as this market has seemed at times, the indexes were only down moderately last week (about 0.5% or less). They still sport significant gains on the month.

Friday saw the market make it 2 up days in a row. Momentum is flattening. I'd like to see price on the S&P 500 make a run at the September high and break to the upside from there. I suspect that will eventually happen.

Breadth moved higher and remains bullish.

TSP Talk sentiment came in neutral with an almost even split between bulls and bears. Of course, NAAIM remains bullish.

I just can't get bearish on this market (not that I want to). Especially when the smart money is long. Don't forget about the wall of worry.

I remain bullish.

Friday saw the market make it 2 up days in a row. Momentum is flattening. I'd like to see price on the S&P 500 make a run at the September high and break to the upside from there. I suspect that will eventually happen.

Breadth moved higher and remains bullish.

TSP Talk sentiment came in neutral with an almost even split between bulls and bears. Of course, NAAIM remains bullish.

I just can't get bearish on this market (not that I want to). Especially when the smart money is long. Don't forget about the wall of worry.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

It's very unusual for NAAIM to be as bullish as they are and the market manifesting weakness at the same time. I attribute this to the "big event" approaching in early November. I still believe the market eventually turns up (as long as NAAIM remains bullish).

Just my thoughts.

Just my thoughts.

tom4jean

TSP Strategist

- Reaction score

- 6

I'm sure people read the headlines and know that futures turned down because of the covid surge in Europe last evening. I know there's a lot of things in the mix but personally I think the possibility of another covid surge and shut down and uncertainty on how the future elected officials will handle it is driving this more than the usual pre-election nerves at this point.

Sent from my Pixel 4a using Tapatalk

Sent from my Pixel 4a using Tapatalk

Last edited:

coolhand

TSP Legend

- Reaction score

- 530

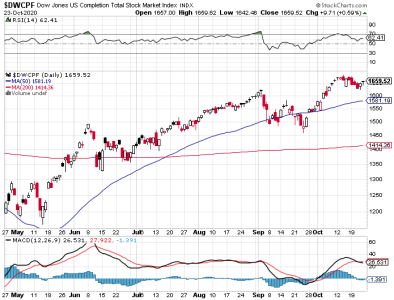

The bears started off the week with another attack on price that sent the indexes lower, though the market did close well off the lows of the day.

The most notable thing about the charts is that price on the S&P 500 closed under the 50 dma today. The question is, will it stick? The DWCPF remains in better shape, but it too has been under pressure. Momentum took a turn lower.

Breadth technically flipped bearish, but it's not a strong signal as yet.

As I said earlier today, the smart money isn't usually wrong for very long. Normally, they get right within 3 days, but we're well past that point. Up to this point, technical damage has been very limited, but now we see the S&P 500 testing the 50 dma and closing under that key average. I'm still not bearish, but this market may challenge weak bulls.

Let's see how the bulls respond to the S&P 500 support being tested. I am remaining bullish given that is where the smart money is and the fact that the DWCPF remains in decent shape despite the weakness.

The most notable thing about the charts is that price on the S&P 500 closed under the 50 dma today. The question is, will it stick? The DWCPF remains in better shape, but it too has been under pressure. Momentum took a turn lower.

Breadth technically flipped bearish, but it's not a strong signal as yet.

As I said earlier today, the smart money isn't usually wrong for very long. Normally, they get right within 3 days, but we're well past that point. Up to this point, technical damage has been very limited, but now we see the S&P 500 testing the 50 dma and closing under that key average. I'm still not bearish, but this market may challenge weak bulls.

Let's see how the bulls respond to the S&P 500 support being tested. I am remaining bullish given that is where the smart money is and the fact that the DWCPF remains in decent shape despite the weakness.

coolhand

TSP Legend

- Reaction score

- 530

The bears made it 2 in a row today. The market wasn't hammered, but it's been trending lower now for over 2 weeks. And NAAIM has been bullish for most of that time. At this point, I have to say that the smart money was too early this time.

Price on the S&P edged a bit further below the 50 dma. It's still not far from that key average and hopefully it won't stay below it for much longer. Price on the DWCPF edged lower as well, but still remains above that same key average. Momentum continues to fall. Volume has only been average overall through the decline.

Breadth was modestly bearish yesterday, but after today it's more bearish. Still, it's been below the 39 day EMA before. And it doesn't generally stay below that level for long (unless it's different this time). I don't expect it to be different, but I can't say the selling is over.

Breadth was modestly bearish yesterday, but after today it's more bearish. Still, it's been below the 39 day EMA before. And it doesn't generally stay below that level for long (unless it's different this time). I don't expect it to be different, but I can't say the selling is over.

My personal market sentiment generally follows NAAIM sentiment. And because they were bulled up almost 2 weeks ago it was a no-brainer to follow their lead. That's where the money has been for quite some time. But no one bats 1,000.00 (unless you're a central bank).

At this point, I think the odds that the market is nearer the bottom than the top is about even.

I am going neutral. That means that I suspect a bottom is not yet in, but that most of the downside may be behind us. Getting out now could mean missing a big rally off the bottom. NAAIM reports again in 2 days.

Price on the S&P edged a bit further below the 50 dma. It's still not far from that key average and hopefully it won't stay below it for much longer. Price on the DWCPF edged lower as well, but still remains above that same key average. Momentum continues to fall. Volume has only been average overall through the decline.

Breadth was modestly bearish yesterday, but after today it's more bearish. Still, it's been below the 39 day EMA before. And it doesn't generally stay below that level for long (unless it's different this time). I don't expect it to be different, but I can't say the selling is over.

Breadth was modestly bearish yesterday, but after today it's more bearish. Still, it's been below the 39 day EMA before. And it doesn't generally stay below that level for long (unless it's different this time). I don't expect it to be different, but I can't say the selling is over.My personal market sentiment generally follows NAAIM sentiment. And because they were bulled up almost 2 weeks ago it was a no-brainer to follow their lead. That's where the money has been for quite some time. But no one bats 1,000.00 (unless you're a central bank).

At this point, I think the odds that the market is nearer the bottom than the top is about even.

I am going neutral. That means that I suspect a bottom is not yet in, but that most of the downside may be behind us. Getting out now could mean missing a big rally off the bottom. NAAIM reports again in 2 days.

coolhand

TSP Legend

- Reaction score

- 530

The bears really took it to the bulls today. Neither a bullish smart money reading nor the wall of worry has kept this market from probing lower.

We'll, price on the S&P 500 is now approaching the September low. Will that act as support or do the bears have other ideas like testing the 200 dma? Price on the DWCPF closed below its 50 dma today. Volume was a bit elevated. Momentum is hard to the downside.

Breadth is now about as bearish as it gets before a turn higher (in most cases, but not necessarily this time).

With the election still a few days away, I hope the bulls aren't waiting for the results. The Covid thing always ramps up to divert attention as key times too (like now). That's what happened in Florida a few weeks back when our Governor continued to open the state. Covid magically increased (immediately). It's a very smart virus that tracks closely with the political sphere. And then there's the battle over stimulus.

And then there's the battle over stimulus.

My point is that it is near impossible to predict this market under current circumstances. Just ask the smart money.

Speaking of smart money, NAAIM reports tomorrow. I am holding neutral till I see where they are at. Let's see if today's pounding shook any of the bulls among them.

We'll, price on the S&P 500 is now approaching the September low. Will that act as support or do the bears have other ideas like testing the 200 dma? Price on the DWCPF closed below its 50 dma today. Volume was a bit elevated. Momentum is hard to the downside.

Breadth is now about as bearish as it gets before a turn higher (in most cases, but not necessarily this time).

With the election still a few days away, I hope the bulls aren't waiting for the results. The Covid thing always ramps up to divert attention as key times too (like now). That's what happened in Florida a few weeks back when our Governor continued to open the state. Covid magically increased (immediately). It's a very smart virus that tracks closely with the political sphere.

My point is that it is near impossible to predict this market under current circumstances. Just ask the smart money.

Speaking of smart money, NAAIM reports tomorrow. I am holding neutral till I see where they are at. Let's see if today's pounding shook any of the bulls among them.

coolhand

TSP Legend

- Reaction score

- 530

NAAIM came in a bit less bullish this week. That's 2 weeks in a row that they've dropped their bullishness. I would say they are now modestly bullish. They are still not taking any serious positions on the short side, which does seem odd given the weakness over the past 2 weeks.

So, what does this tell me?

This is just a guess, but obviously they are still expecting a rally and I don't think it will be a garden variety type. I get the impression they are expecting gains (significant?) on the long side and that any weakness prior to that rally starting is just part of being ready for the real money. Again, this is just a guess, but why else would smart money stay largely long? What happens on the other side of November 3rd? Is there something else that they are waiting for? This is why I follow smart money. I may not know exactly what they are collectively thinking, but they often know things that I do not.

Anyway, those are my thoughts.

So, what does this tell me?

This is just a guess, but obviously they are still expecting a rally and I don't think it will be a garden variety type. I get the impression they are expecting gains (significant?) on the long side and that any weakness prior to that rally starting is just part of being ready for the real money. Again, this is just a guess, but why else would smart money stay largely long? What happens on the other side of November 3rd? Is there something else that they are waiting for? This is why I follow smart money. I may not know exactly what they are collectively thinking, but they often know things that I do not.

Anyway, those are my thoughts.

coolhand

TSP Legend

- Reaction score

- 530

The bulls finally bounced the market today. There is no way to really know if the market has bottomed so I'd not bet on it unless you're positioning yourself for a possible launch (or at least bottom) over the days ahead. Some rallies can manifest quickly and go deep, just like declines. NAAIM is straddling the market between neutral and bullish positions. They are definitely not bearish.

Not much to say about the charts. Price is back at the 50 dma on the DWCPF, but still below it on the S&P 500. Momentum has yet to turn back up. I note that the market is not oversold (not that it needs to be for a turn higher), so that could be reason for remaining at least cautious.

Breadth bounced, but remains bearish.

As I noted earlier today, NAAIM was less bullish, but still bullish (modestly so). It was notable that there is little evidence of any serious shorting with these money managers, so I'd be careful about getting too bearish. These guys appear to be waiting for something and that something may mark a bottom before moving price to the upside. But when? Likely before not much longer as they are still holding significant long side trades.

Now that I've seen how they are positioned heading into next week (with Nov. 3rd in sight) I am moving from neutral to a modestly bullish sentiment. Weakness may still manifest until the market gets whatever it is looking for.

Not much to say about the charts. Price is back at the 50 dma on the DWCPF, but still below it on the S&P 500. Momentum has yet to turn back up. I note that the market is not oversold (not that it needs to be for a turn higher), so that could be reason for remaining at least cautious.

Breadth bounced, but remains bearish.

As I noted earlier today, NAAIM was less bullish, but still bullish (modestly so). It was notable that there is little evidence of any serious shorting with these money managers, so I'd be careful about getting too bearish. These guys appear to be waiting for something and that something may mark a bottom before moving price to the upside. But when? Likely before not much longer as they are still holding significant long side trades.

Now that I've seen how they are positioned heading into next week (with Nov. 3rd in sight) I am moving from neutral to a modestly bullish sentiment. Weakness may still manifest until the market gets whatever it is looking for.

DreamboatAnnie

TSP Legend

- Reaction score

- 847

Awesome points and assessment Coolhand! Thank you!

coolhand

TSP Legend

- Reaction score

- 530

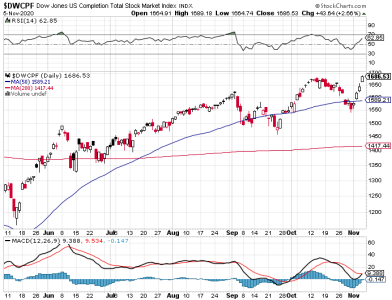

Last week was not pretty for the bulls. All 3 TSP stock funds were down more than 5%.

The charts are now showing significant technical damage with price on both charts sitting below their 50 dma's. Momentum continues to fall. The S&P 500 looks like it may try to test its 200 dma. It's an attractive target for the bears, but that would require another day like we had last Wednesday. Volume has been elevated the past 3 trading days. RSI is still not oversold.

Breadth ticked lower and remains bearish.

NAAIM is modestly bullish. Our TSP Talk survey came in modestly bullish as well.

As difficult as this market has been the past 3 weeks and especially last week, the weakness appears to be driven by numerous elements within the political and financial spheres. All of this is likely going to see an inflection point after November 3rd. Exactly what happens at that point (and how long it takes to happen) will be quite interesting.

As I have said in recent posts, given NAAIM has not been bearish through any of this selling pressure may very well be an indication that a market recovery could come soon and has the potential to be explosive. I am not making predictions. I am just reading the technical and sentiment landscape as I see it. However, the selling may not be over so don't be surprised by continued weakness in the very short term. We need to see what happens on the other side of November 3rd to get a better idea of whether anything changes with the market.

The smart money has been looking higher for 3 weeks, though they have slowly tempered their long side trades as the selling increased. But they never got bearish. They certainly seem intent on not missing out on a turn higher. Even though loses over the past 3 weeks have been significant, the gains off a bottom could be much more so. That's what I think they are telling us.

I remain modestly bullish despite the potential for more selling in the very short term.

The charts are now showing significant technical damage with price on both charts sitting below their 50 dma's. Momentum continues to fall. The S&P 500 looks like it may try to test its 200 dma. It's an attractive target for the bears, but that would require another day like we had last Wednesday. Volume has been elevated the past 3 trading days. RSI is still not oversold.

Breadth ticked lower and remains bearish.

NAAIM is modestly bullish. Our TSP Talk survey came in modestly bullish as well.

As difficult as this market has been the past 3 weeks and especially last week, the weakness appears to be driven by numerous elements within the political and financial spheres. All of this is likely going to see an inflection point after November 3rd. Exactly what happens at that point (and how long it takes to happen) will be quite interesting.

As I have said in recent posts, given NAAIM has not been bearish through any of this selling pressure may very well be an indication that a market recovery could come soon and has the potential to be explosive. I am not making predictions. I am just reading the technical and sentiment landscape as I see it. However, the selling may not be over so don't be surprised by continued weakness in the very short term. We need to see what happens on the other side of November 3rd to get a better idea of whether anything changes with the market.

The smart money has been looking higher for 3 weeks, though they have slowly tempered their long side trades as the selling increased. But they never got bearish. They certainly seem intent on not missing out on a turn higher. Even though loses over the past 3 weeks have been significant, the gains off a bottom could be much more so. That's what I think they are telling us.

I remain modestly bullish despite the potential for more selling in the very short term.

coolhand

TSP Legend

- Reaction score

- 530

Was today's positive action a precursor to a bigger move? Early positioning? I don't want to read too much into it, but it's possible. We know the smart money has not been embracing weakness either.

The charts are not much changed, but is momentum ready to turn up? It looks like it might be.

Breadth remains bearish, but it has been trending up the past few trading days.

Well, the big day is upon us. It's going to be crazy. While I remain modestly bullish I also know that things can get chaotic. There is a lot of emotion out there and how that affects the markets will be interesting, if not unnerving. I am not talking about tomorrow's action so much as the days and weeks ahead. Buckle up.

The charts are not much changed, but is momentum ready to turn up? It looks like it might be.

Breadth remains bearish, but it has been trending up the past few trading days.

Well, the big day is upon us. It's going to be crazy. While I remain modestly bullish I also know that things can get chaotic. There is a lot of emotion out there and how that affects the markets will be interesting, if not unnerving. I am not talking about tomorrow's action so much as the days and weeks ahead. Buckle up.

coolhand

TSP Legend

- Reaction score

- 530

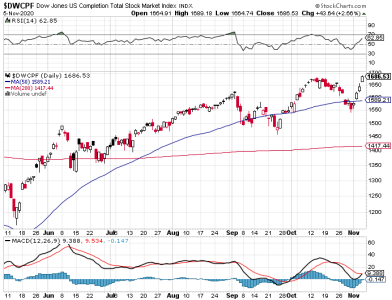

Monday's positive action seemed to suggest a bigger move may be near. Tuesday's rally confirmed it.

Price on the S&P 500 surged upward and almost tested the 50 dma. Price on the DWCPF blew past and closed sell above its 50 dma. Volume was only average. Momentum is starting to turn back up.

Breadth on the NYSE surged to the upside and flipped bullish in the process.

We may be seeing the early stages of a solid rally. I am not sure if it will be challenged by the bears or not. I also suspect the bears could get overwhelmed (smart money is bullish), but for how long?

I remain bullish.

Price on the S&P 500 surged upward and almost tested the 50 dma. Price on the DWCPF blew past and closed sell above its 50 dma. Volume was only average. Momentum is starting to turn back up.

Breadth on the NYSE surged to the upside and flipped bullish in the process.

We may be seeing the early stages of a solid rally. I am not sure if it will be challenged by the bears or not. I also suspect the bears could get overwhelmed (smart money is bullish), but for how long?

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The rally continued today, even as uncertainty appeared to reign over the political sphere. Market generally do not like uncertainty, so I thought the rally was interesting for that reason. Of course, the smart money may not be as surprised.

Price on the S&P 500 retook its 50 dma today. Price on the DWCPF moved further past its own 50 dma. Volume was above average and momentum has now turned up. Potential resistance at the previous peak is not far off on either chart.

Breadth was not as impressive today, but did eke a bit higher and does remain technically bullish.

At some point, the market is likely to pause or consolidate gains if this rally continues. Any unexpected news could also turn the market around, so I can't rule that out. NAAIM reports tomorrow and that will be an important reading given all of the uncertainty. We'll see how the smart money is positioned heading into next week.

I remain bullish.

Price on the S&P 500 retook its 50 dma today. Price on the DWCPF moved further past its own 50 dma. Volume was above average and momentum has now turned up. Potential resistance at the previous peak is not far off on either chart.

Breadth was not as impressive today, but did eke a bit higher and does remain technically bullish.

At some point, the market is likely to pause or consolidate gains if this rally continues. Any unexpected news could also turn the market around, so I can't rule that out. NAAIM reports tomorrow and that will be an important reading given all of the uncertainty. We'll see how the smart money is positioned heading into next week.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

NAAIM came in a bit less bullish for the 3rd week in a row today. I'd say they are now neutral. However, I still do not see any serious shorting going on with these money managers. They appear to be either neutral or long, so the risk remains to the upside in my opinion. Having said that, the caution that they are showing may be short term given the extent of the rally as a pullback could come at any time. Some of them may be keeping powder dry to buy in at a lower price point. That's my educated guess.

coolhand

TSP Legend

- Reaction score

- 530

A few days ago I said -

"...given NAAIM has not been bearish through any of this selling pressure may very well be an indication that a market recovery could come soon and has the potential to be explosive. I am not making predictions. I am just reading the technical and sentiment landscape as I see it."

I like to think I do a good job of capturing market action most of the time by using the smart money to frame my analysis. I know many of you find it well worth consideration and while I don't post for the purpose of gather "likes" they do tell me how my analysis is being received, so thank for that.

The market rallied hard once again today. The market is really telling us that it is not confused about current events, otherwise it likely be moving in the other direction. It already knows the outcome and is apparently betting on it.

Price on the DWCPF closed at an all-time high today. Price on the S&P 500 is not far behind, but does have some resistance to push through before it can (hopefully) join the DWCPF. Momentum continues to rise.

Breadth is looking good and remains bullish.

Earlier today I said that the smart money (NAAIM) went neutral, but that they are not shorting in any serious measure, which keeps risk to the upside. I think it may very well be possible they are allowing for a pullback to reenter the market, but they may also feel the need to reduce risk for some other reason.

I remain bullish, but anticipate some profit taking and consolidation at any time.

"...given NAAIM has not been bearish through any of this selling pressure may very well be an indication that a market recovery could come soon and has the potential to be explosive. I am not making predictions. I am just reading the technical and sentiment landscape as I see it."

I like to think I do a good job of capturing market action most of the time by using the smart money to frame my analysis. I know many of you find it well worth consideration and while I don't post for the purpose of gather "likes" they do tell me how my analysis is being received, so thank for that.

The market rallied hard once again today. The market is really telling us that it is not confused about current events, otherwise it likely be moving in the other direction. It already knows the outcome and is apparently betting on it.

Price on the DWCPF closed at an all-time high today. Price on the S&P 500 is not far behind, but does have some resistance to push through before it can (hopefully) join the DWCPF. Momentum continues to rise.

Breadth is looking good and remains bullish.

Earlier today I said that the smart money (NAAIM) went neutral, but that they are not shorting in any serious measure, which keeps risk to the upside. I think it may very well be possible they are allowing for a pullback to reenter the market, but they may also feel the need to reduce risk for some other reason.

I remain bullish, but anticipate some profit taking and consolidation at any time.

Similar threads

- Replies

- 0

- Views

- 152

- Replies

- 0

- Views

- 169

- Replies

- 0

- Views

- 119

- Replies

- 0

- Views

- 129

- Replies

- 0

- Views

- 84