-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com ...

Or you can now use TapaTalk again!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

coolhand

TSP Legend

- Reaction score

- 530

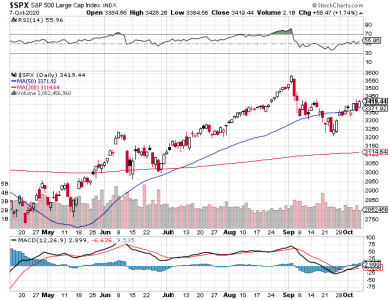

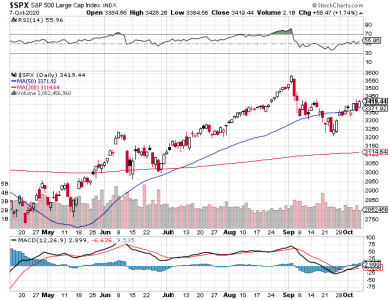

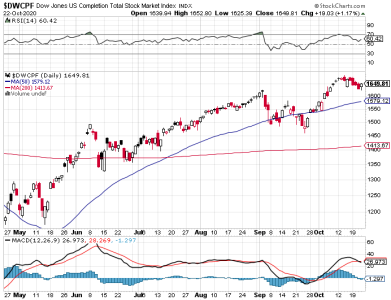

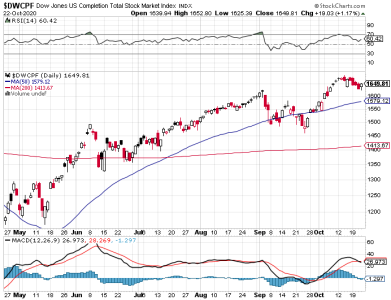

Price on the S&P 500 reversed yesterday's losses and closed at another high for this up-leg. It's in an area of resistance, but given the DWCPF just hit an all-time high I suspect the S&P 500 will find a way to push past this resistance.

Maybe the market doesn't exactly feel bullish, but these charts (especially the DWCPF) say that it really is on the bullish side to this point. The all-time high achieved by the DWCPF is hard to argue with. Perhaps it the wall of worry keeping the market on an upward track.

Breadth is hard to argue with too and we can see that it is stretching to the upside.

NAAIM reports tomorrow and it will very interesting to see how they are now positioned given they were leaning bearish late last week.

I am moving from modestly bullish to bullish.

Maybe the market doesn't exactly feel bullish, but these charts (especially the DWCPF) say that it really is on the bullish side to this point. The all-time high achieved by the DWCPF is hard to argue with. Perhaps it the wall of worry keeping the market on an upward track.

Breadth is hard to argue with too and we can see that it is stretching to the upside.

NAAIM reports tomorrow and it will very interesting to see how they are now positioned given they were leaning bearish late last week.

I am moving from modestly bullish to bullish.

coolhand

TSP Legend

- Reaction score

- 530

The bulls are having a great week this week and Thursday saw the rally continue.

Price on the DWCPF is starting to stretch to the upside. The S&P 500 has a lot of catching up to day, but at least it's heading in the right direction. Momentum is rising. The DWCPF is getting close to being overbought.

Breadth is looking very bullish and often when it gets this stretched it's usually time for a pullback, but that could still be days away (or not).

NAAIM went from modestly bearish last week to modestly bullish today. That's a good sign and is suggestive of more gains down the road.

As I mentioned above, a pullback could come soon, but with the DWCPF hitting all-time highs and breadth stretching to the upside a pullback may only be a reload for the bulls.

I remain bullish.

Price on the DWCPF is starting to stretch to the upside. The S&P 500 has a lot of catching up to day, but at least it's heading in the right direction. Momentum is rising. The DWCPF is getting close to being overbought.

Breadth is looking very bullish and often when it gets this stretched it's usually time for a pullback, but that could still be days away (or not).

NAAIM went from modestly bearish last week to modestly bullish today. That's a good sign and is suggestive of more gains down the road.

As I mentioned above, a pullback could come soon, but with the DWCPF hitting all-time highs and breadth stretching to the upside a pullback may only be a reload for the bulls.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The bulls closed out a great week with even more gains on Friday.

Price on the S&P 500 is pulling away from the 50 dma, but resistance looms at the previous peak. Price on the DWCPF has already sliced through resistance at its previous peak and continues to probe higher with no overhead resistance. Upside momentum continues to rise.

Breadth ticked higher on Friday and remains bullish.

I have a strong feeling the bulls may find a way to continue driving price higher as we push toward the November elections. That doesn't mean straight up, but the timing of this rally is interesting. NAAIM came in modestly bullish yesterday and that is what we want to see if we're long stocks.

I remain bullish.

Price on the S&P 500 is pulling away from the 50 dma, but resistance looms at the previous peak. Price on the DWCPF has already sliced through resistance at its previous peak and continues to probe higher with no overhead resistance. Upside momentum continues to rise.

Breadth ticked higher on Friday and remains bullish.

I have a strong feeling the bulls may find a way to continue driving price higher as we push toward the November elections. That doesn't mean straight up, but the timing of this rally is interesting. NAAIM came in modestly bullish yesterday and that is what we want to see if we're long stocks.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The S&P 500 outpaced the DWCPF today as both indexes posted gains to start the new week.

Price on the S&P 500 is very close to testing resistance at the previous peak. I am guessing that it will eventually push past resistance given the DWCPF did so several trading days ago. There is no overhead resistance on the DWCPF. Momentum continues to rise on both charts. I should point out that the DWCPF is now overbought according to RSI.

Breadth continues to go vertical on this rally and remains bullish.

The market is due a pullback, but if this action has anything to do with the elections in early November any pullbacks may not be deep or last too long.

I remain bullish.

Price on the S&P 500 is very close to testing resistance at the previous peak. I am guessing that it will eventually push past resistance given the DWCPF did so several trading days ago. There is no overhead resistance on the DWCPF. Momentum continues to rise on both charts. I should point out that the DWCPF is now overbought according to RSI.

Breadth continues to go vertical on this rally and remains bullish.

The market is due a pullback, but if this action has anything to do with the elections in early November any pullbacks may not be deep or last too long.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

Yesterday, I said the market was due a pullback, but it may not be deep or last long. Today, we got a pullback and it wasn't deep, but whether there is more weakness remains to be seen.

The charts still look very bullish, though the S&P 500 still has overhead resistance at the September peak.

Breadth dipped, but remains bullish.

We'll have to see if the bears can continue to put pressure on price, but I have a feeling there may be a floor under this market right now. Where that floor is I don't know, but I doubt it's lower than the 50 dma; if price can even be driven that far (I doubt it). In fact, we could see the bulls turn the market back up before long. The DWCPF hitting all-time highs this past week is not something I can ignore and I still think the S&P 500 joins that index sooner or later with new highs.

I remain bullish.

The charts still look very bullish, though the S&P 500 still has overhead resistance at the September peak.

Breadth dipped, but remains bullish.

We'll have to see if the bears can continue to put pressure on price, but I have a feeling there may be a floor under this market right now. Where that floor is I don't know, but I doubt it's lower than the 50 dma; if price can even be driven that far (I doubt it). In fact, we could see the bulls turn the market back up before long. The DWCPF hitting all-time highs this past week is not something I can ignore and I still think the S&P 500 joins that index sooner or later with new highs.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The bears managed to pull the market back bit more today, but so far the pullback has been measured and not inconsistent with a healthy one at that.

So, we may have potential bulls flags forming. Momentum has leveled off.

Breadth fell along with the market, but remains bullish.

NAAIM reports tomorrow. It's always interesting to see what the smart money is doing on a week to week basis. They were modestly bullish last week.

I remain bullish.

So, we may have potential bulls flags forming. Momentum has leveled off.

Breadth fell along with the market, but remains bullish.

NAAIM reports tomorrow. It's always interesting to see what the smart money is doing on a week to week basis. They were modestly bullish last week.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The market fell hard at the open today, but the bulls immediately countered and eventually turned price back up. It took the entire trading day, but the bulls did close the market mixed, which was a victory in itself.

Still no serious technical damage, but are the bears done? They might be (see below).

Breadth ticked higher on the day and remains bullish.

NAAIM came in heavily bulled up today. The bears have thrown in the towel in this survey. That's a huge clue because it suggests that the uptrend may be about to resume.

I remain bullish.

Still no serious technical damage, but are the bears done? They might be (see below).

Breadth ticked higher on the day and remains bullish.

NAAIM came in heavily bulled up today. The bears have thrown in the towel in this survey. That's a huge clue because it suggests that the uptrend may be about to resume.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

For all the downside pressure the bears tried to put on last week, the C and S funds still managed to eke out modest gains on the week. Friday's action, coming just 1 day after a decisively bullish NAAIM reading, saw more back and forth price movement that resulted in largely a mixed close on the day. Keep in mind that NAAIM readings are not daily readings. They are weekly readings, so instant gratification is not a given.

Still no real technical damage on these charts. The market was overbought on the DWCPF, so a pullback was certainly not unexpected. But also notice that price on the DWCPF is only modestly below its all-time closing high. This does seem to suggest underlying strength in the overall market.

Breadth remains weak of late, but is still bullish.

The TSP Talk sentiment came in less bullish than last week, but still leaning bullish.

NAAIM, as we know, came in bulled up last Thursday. That reading is likely to get right soon. I'd say within the next couple of trading days. These readings should be used to give one an overall sense of how the smart money is not only feeling, but how they are positioning. Remember, they are smart money for a reason. They often have access to information that we do not. I feel more strongly about this sentiment reading than any other and right now they are positioned for gains on the long side.

I remain bullish.

Still no real technical damage on these charts. The market was overbought on the DWCPF, so a pullback was certainly not unexpected. But also notice that price on the DWCPF is only modestly below its all-time closing high. This does seem to suggest underlying strength in the overall market.

Breadth remains weak of late, but is still bullish.

The TSP Talk sentiment came in less bullish than last week, but still leaning bullish.

NAAIM, as we know, came in bulled up last Thursday. That reading is likely to get right soon. I'd say within the next couple of trading days. These readings should be used to give one an overall sense of how the smart money is not only feeling, but how they are positioning. Remember, they are smart money for a reason. They often have access to information that we do not. I feel more strongly about this sentiment reading than any other and right now they are positioned for gains on the long side.

I remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

Well, It's obvious that the bears have not gone away as yet. The market started out positive, but could not maintain that positive start.

Looking at the charts, we can see that the S&P 500 is now getting close to testing its 50 dma. Price on the DWCPF appears to be weathering the weakness a bit better than the S&P. Neither chart is showing any serious technical damage, but if the S&P 500 doesn't firm up soon, it's possible that it may violate support at its 50 dma. That still won't be cause to get overly bearish, but it would embolden the bears. Momentum is falling, but is not bearish as yet.

Breadth flipped bearish on the NYSE today.

There are bearish forces out there that have trying hard to take this market down since the September peak, but the bulls have not been inclined to simply step aside. It is also not unusual to have a big bullish shift in NAAIM and then see immediate weakness for up to 3 days or so, but that isn't a given every time it occurs. Unfortunately, it's happening in this case to this point. I still expect the bulls to counter this downside attack. If they do not turn the market back up soon however, we may see NAAIM back off their bullish disposition at least to some extent (emphasis "may").

I remain bullish, but if the S&P 500 closes below its 50 dma, I may go neutral. The relative strength of the DWCFP is still encouraging, but it's the S&P 500 that has better visibility among traders.

Looking at the charts, we can see that the S&P 500 is now getting close to testing its 50 dma. Price on the DWCPF appears to be weathering the weakness a bit better than the S&P. Neither chart is showing any serious technical damage, but if the S&P 500 doesn't firm up soon, it's possible that it may violate support at its 50 dma. That still won't be cause to get overly bearish, but it would embolden the bears. Momentum is falling, but is not bearish as yet.

Breadth flipped bearish on the NYSE today.

There are bearish forces out there that have trying hard to take this market down since the September peak, but the bulls have not been inclined to simply step aside. It is also not unusual to have a big bullish shift in NAAIM and then see immediate weakness for up to 3 days or so, but that isn't a given every time it occurs. Unfortunately, it's happening in this case to this point. I still expect the bulls to counter this downside attack. If they do not turn the market back up soon however, we may see NAAIM back off their bullish disposition at least to some extent (emphasis "may").

I remain bullish, but if the S&P 500 closes below its 50 dma, I may go neutral. The relative strength of the DWCFP is still encouraging, but it's the S&P 500 that has better visibility among traders.

coolhand

TSP Legend

- Reaction score

- 530

Once again, the market started out on the strong side only to see selling pressure manifest later in the trading session.

The selling pressure erased sizable gains on the S&P 500, but that index still managed to post moderate gains by the close. The DWCPF closed with a modest loss. Overall, it wasn't a bad day for the bulls, but they have not been able to mount an upside attack without the bears countering their efforts.

Breadth ticked higher and is leaning bullish once more.

So far, the bullish NAAIM reading hasn't resulted in the kind of action I generally expect to see within the first 3 days of the survey, but that doesn't mean the signal is a bust (necessarily). It just may need more time, but another reading is only a couple of days away.

I remain bullish for now.

The selling pressure erased sizable gains on the S&P 500, but that index still managed to post moderate gains by the close. The DWCPF closed with a modest loss. Overall, it wasn't a bad day for the bulls, but they have not been able to mount an upside attack without the bears countering their efforts.

Breadth ticked higher and is leaning bullish once more.

So far, the bullish NAAIM reading hasn't resulted in the kind of action I generally expect to see within the first 3 days of the survey, but that doesn't mean the signal is a bust (necessarily). It just may need more time, but another reading is only a couple of days away.

I remain bullish for now.

coolhand

TSP Legend

- Reaction score

- 530

The relief bill back and forth may be throwing a wrench in the works.

I would not be surprised. Narratives are often crafted or leveraged to explain market action.

coolhand

TSP Legend

- Reaction score

- 530

Wednesday's market action wasn't much different than we've seen of late; early strength followed by weakness. Price was up and down, but by the close the indexes were down on the day.

It's obvious there's a battle going, but so far the bulls have contained any serious technical damage to the charts. It's worth noting that overbought conditions more than a week ago are well out of overbought territory now.

Breadth is still technically bullish, but like the charts it's under pressure.

Am I surprised by the weakness? Yes. And I suspect the money managers at NAAIM may be too. They report tomorrow with the fresh sentiment reading.

I am remaining bullish, but that may change depending on the NAAIM reading.

It's obvious there's a battle going, but so far the bulls have contained any serious technical damage to the charts. It's worth noting that overbought conditions more than a week ago are well out of overbought territory now.

Breadth is still technically bullish, but like the charts it's under pressure.

Am I surprised by the weakness? Yes. And I suspect the money managers at NAAIM may be too. They report tomorrow with the fresh sentiment reading.

I am remaining bullish, but that may change depending on the NAAIM reading.

coolhand

TSP Legend

- Reaction score

- 530

The latest NAAIM reading revealed a small decrease in bullishness among these money managers, but make no mistake this reading is still bullish. It appears that those that reduced long exposure went neutral rather than bearish (for the most part). These managers are basically telling us that they expect prices to rise once current bouts of weakness dissipate.

coolhand

TSP Legend

- Reaction score

- 530

The bulls turned things around today as stocks started out mixed, but began to rally by mid-morning eventually closing out the day with good gains.

I note that price on the S&P 500 came very close to testing the 50 dma before reversing. Price on the DWCPF has held its position well above its respective 50 dma.

Breadth ticked higher and remains bullish.

To this point, it remains uncertain if today's rally finally broke the string of weak trading days, but the smart money remains long stocks.

NAAIM came in bullish today, though not quite as bullish as last week. I do not see much shorting going on by this group, so that's telling as well. Based on this reading, it seems it may simply be a matter of time before the market finds its feet once again. Maybe today was the beginning. I get the impression that the market may be waiting for something to happen.

I remain bullish.

I note that price on the S&P 500 came very close to testing the 50 dma before reversing. Price on the DWCPF has held its position well above its respective 50 dma.

Breadth ticked higher and remains bullish.

To this point, it remains uncertain if today's rally finally broke the string of weak trading days, but the smart money remains long stocks.

NAAIM came in bullish today, though not quite as bullish as last week. I do not see much shorting going on by this group, so that's telling as well. Based on this reading, it seems it may simply be a matter of time before the market finds its feet once again. Maybe today was the beginning. I get the impression that the market may be waiting for something to happen.

I remain bullish.

Similar threads

- Replies

- 0

- Views

- 113

- Replies

- 0

- Views

- 127

- Replies

- 0

- Views

- 213