coolhand

TSP Legend

- Reaction score

- 530

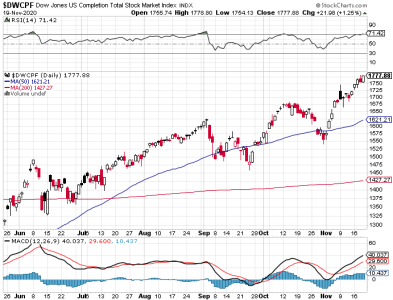

The TSP stock funds were all up more than 7% each, last week. Friday's action saw a modest dip to cap the huge rally.

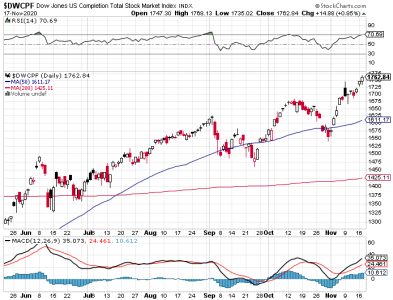

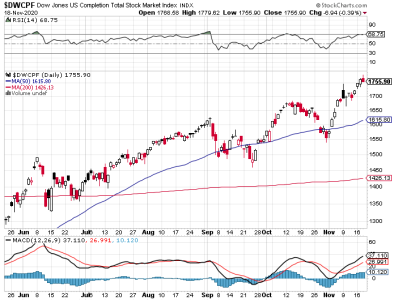

The S&P 500 is still pushing against resistance at the October peak and there is more resistance just above that at the September peak. Price on the DWCPF needs to show us it can hold its all-time high hit last Thursday. Volume was lackluster on Friday.

Breadth fell on Friday, but the signal remains bullish.

The TSP Talk sentiment survey came in bullish (assuming we are now smart money). NAAIM was rather neutral, but showed little evidence of bearish leanings.

The neutral NAAIM reading may be profit taking prior to a pullback, or it could also mean the smart money is waiting for something else to happen before they commit (bullish or bearish). I am not sure. And there is still uncertainty for the market to deal with in general right now.

I am leaning modestly bullish, but would not be surprised with a pullback at any time.

The S&P 500 is still pushing against resistance at the October peak and there is more resistance just above that at the September peak. Price on the DWCPF needs to show us it can hold its all-time high hit last Thursday. Volume was lackluster on Friday.

Breadth fell on Friday, but the signal remains bullish.

The TSP Talk sentiment survey came in bullish (assuming we are now smart money). NAAIM was rather neutral, but showed little evidence of bearish leanings.

The neutral NAAIM reading may be profit taking prior to a pullback, or it could also mean the smart money is waiting for something else to happen before they commit (bullish or bearish). I am not sure. And there is still uncertainty for the market to deal with in general right now.

I am leaning modestly bullish, but would not be surprised with a pullback at any time.