coolhand

TSP Legend

- Reaction score

- 530

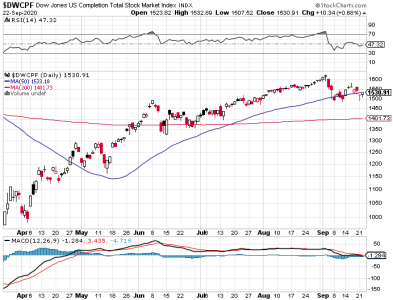

After 3 days of hard selling in a row, the market bounced on Wednesday. The bounce comes in the area of the 50 dma. Will that act as support? Maybe, but I'm not betting on it.

We can see that the 200 dma is still well under the 50 dma. That may be a target area for the bears (assuming the 50 doesn't hold).

Breadth bounced, but remains bearish.

Considering the speed at which the market declined (from all-time highs) I think it is too soon to look for a bottom. The bears may be looking to trap any dip-buying bulls in here with this rally.

NAAIM reports tomorrow. Let's see what changes the smart money may have made since their last reading.

I remain bearish.

We can see that the 200 dma is still well under the 50 dma. That may be a target area for the bears (assuming the 50 doesn't hold).

Breadth bounced, but remains bearish.

Considering the speed at which the market declined (from all-time highs) I think it is too soon to look for a bottom. The bears may be looking to trap any dip-buying bulls in here with this rally.

NAAIM reports tomorrow. Let's see what changes the smart money may have made since their last reading.

I remain bearish.