It would be nice to have warnings before "they" decide to whack the market, but we don't get warnings (unless you include the ones we see every single day for years on end). Those are really helpful, aren't they? There's always those who are warning us of dire consequences and those who are telling us the exact opposite. That's the battle between bulls and bears (that's actually a superficial reference, but I don't want to go there).

Of course, if you're an insider (which we aren't)...

Such is life in the big casino. As George Carlin once said, "It's a big club and you ain't in it".

Now back to your regularly scheduled market analysis. :smile:

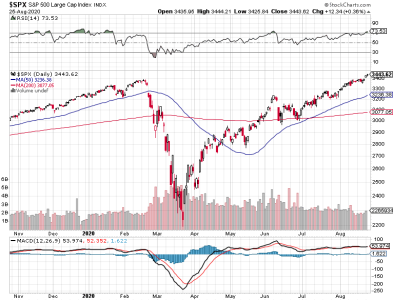

Okay, so they smacked the market today (along with precious metals are crypto), where does that put us? Has anything changed?

Yes, the sell-off erased the past week or so of gains. But look at the RSI. It fell significantly, so now we don't have to worry about being overbought (for now). Futures are pointing to more losses on Friday, but that may change by the open.

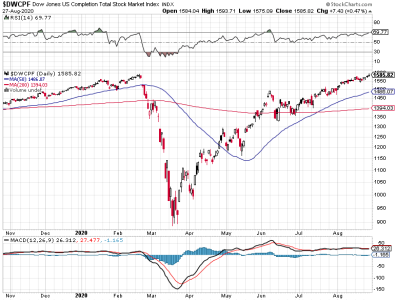

Breadth is now neutral as it continues to bob up and down.

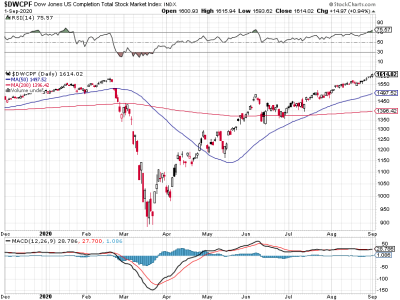

The main indicator is that NAAIM, while not as bullish as last week, is still pretty bulled up. I can't ignore that, but the market might. We'll have to see.

I really don't like these hard 180 degree turns, because they generally are not organic. And they don't always mean a change in market direction that goes on for a few days. Technicians like to see harder evidence of a change for that very reason.

And since the smart money isn't flinching very much, I am going to remain bullish for now.