tom4jean

TSP Strategist

- Reaction score

- 6

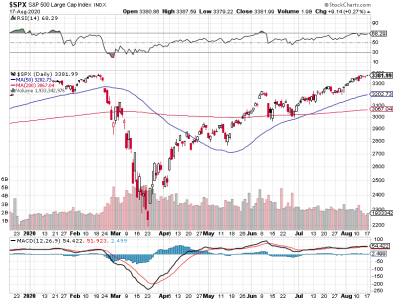

What do you think of the golden cross in the Dow a couple days ago? Surprised I haven't seen any chatter about it on the forums.

https://www.google.com/amp/s/www.ma...is-forming-in-the-dow-industrials-11596740412

Sent from my Pixel 2 XL using Tapatalk

https://www.google.com/amp/s/www.ma...is-forming-in-the-dow-industrials-11596740412

Sent from my Pixel 2 XL using Tapatalk