coolhand

TSP Legend

- Reaction score

- 530

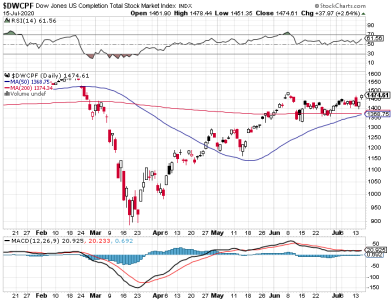

Things were going swimmingly for the bulls for a good part of the trading day, but as price hit the previous top on the S&P the bears came in and swamped the boat. Price fell well into negative territory as a result of the ambush.

So, nothing has really changed. The bulls and bears continue their tug-of-war (literally).

Breadth fell, but not by much and remains technically bullish.

The bears are not going to make it easy, which will get frustrating for many of us. But the smart money isn't betting on the downside and that's a big deal. Sure, things can change, but they aren't smart money for nothing. Sooner or later one side or the other is going to get pulled into the mud and I'm betting it's the bears. I just don't know the timing.

That's where things stand with the current indicators. I remain bullish.

So, nothing has really changed. The bulls and bears continue their tug-of-war (literally).

Breadth fell, but not by much and remains technically bullish.

The bears are not going to make it easy, which will get frustrating for many of us. But the smart money isn't betting on the downside and that's a big deal. Sure, things can change, but they aren't smart money for nothing. Sooner or later one side or the other is going to get pulled into the mud and I'm betting it's the bears. I just don't know the timing.

That's where things stand with the current indicators. I remain bullish.