coolhand

TSP Legend

- Reaction score

- 530

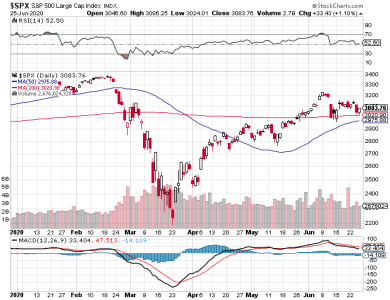

It wasn't an exciting trading day, but the bulls did manage to post gains by the close.

Price is tracking sideways right now, but as long as the 200 dma holds it won't be a problem. Note the rising 50 dma approaching the 200. We could see fireworks if it crosses or gets close to crossing. The bears don't want to see a bullish sign like that as it would likely create additional headwinds for them.

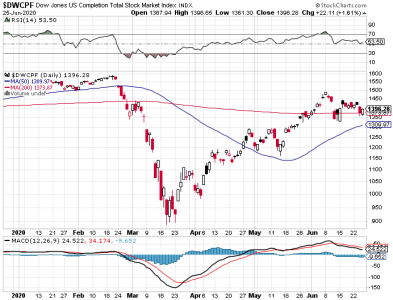

Breath ticked up a bit and remains bullish.

I remain bullish given the recent NAAIM reading and the successful test of support at the 200 dma more than a week ago.

Price is tracking sideways right now, but as long as the 200 dma holds it won't be a problem. Note the rising 50 dma approaching the 200. We could see fireworks if it crosses or gets close to crossing. The bears don't want to see a bullish sign like that as it would likely create additional headwinds for them.

Breath ticked up a bit and remains bullish.

I remain bullish given the recent NAAIM reading and the successful test of support at the 200 dma more than a week ago.