coolhand

TSP Legend

- Reaction score

- 530

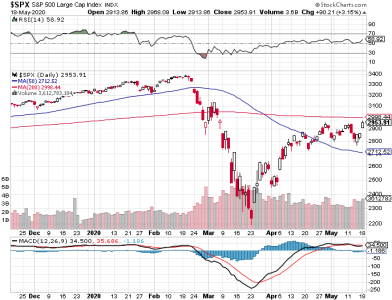

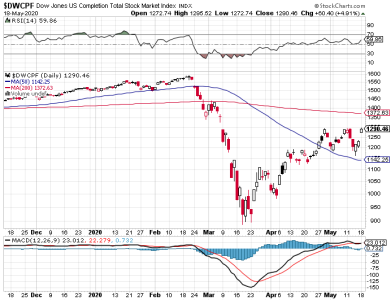

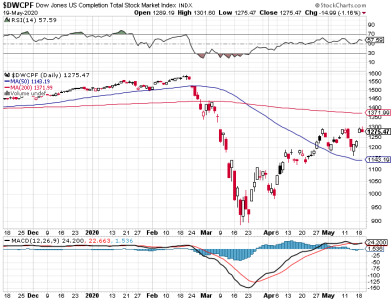

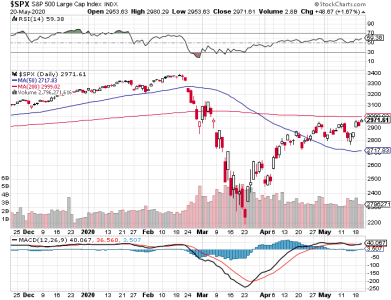

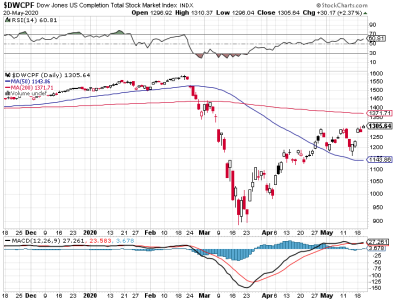

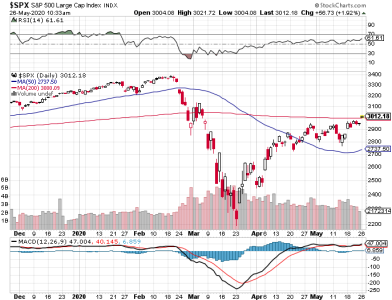

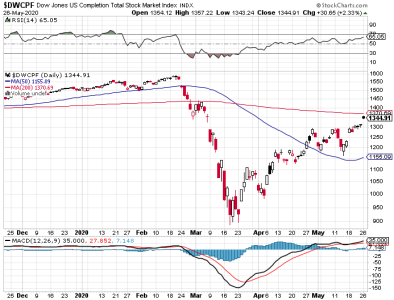

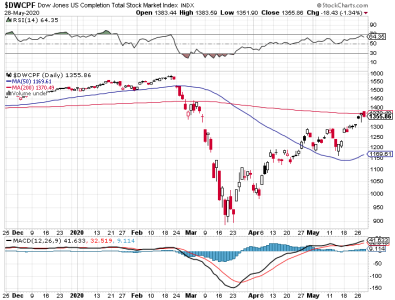

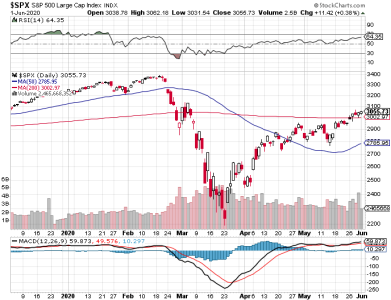

The bulls gave up ground last week, but the good news is that the 50 dma appears to be support (to this point).

Yes, it was a lower low that formed, but the 50 dma was not tested. We'll have to see if the bulls can provide some follow through upside action early this week. Momentum is rather flat.

Breadth remains negative, but not by much.

As I pointed out last Thursday, NAAIM went neutral, which means the market may see up/down action for a few days. TSP Talk sentiment got more bearish and is leaning bearish overall.

Since NAAIM is my anchor reading for my overall perspective, I am also neutral at this time. The indicators favor neither bulls or bears. But remember, the trend is still up overall.

Yes, it was a lower low that formed, but the 50 dma was not tested. We'll have to see if the bulls can provide some follow through upside action early this week. Momentum is rather flat.

Breadth remains negative, but not by much.

As I pointed out last Thursday, NAAIM went neutral, which means the market may see up/down action for a few days. TSP Talk sentiment got more bearish and is leaning bearish overall.

Since NAAIM is my anchor reading for my overall perspective, I am also neutral at this time. The indicators favor neither bulls or bears. But remember, the trend is still up overall.