coolhand

TSP Legend

- Reaction score

- 530

I would like to start out today's commentary by quoting something I said yesterday as follows:

"...there is a lot happening in the financial system and I doubt many money managers are comfortable right now regardless of their sentiment. It just isn't business as usual."

Why am I pointing this out?

I suspect most or at least many of you saw what happened in the oil sector today. A historic plunge to negative prices occurred. That is a first. I can't help but think a fuse of some sort has now been lit.

Is this why NAAIM isn't embracing the rally? I won't speculate on the fallout because I suspect that the expected ramifications of such an occurrence may not manifest the way many money professionals may think.

For now, let's just say that this event could make the rest of this week very interesting in financial markets.

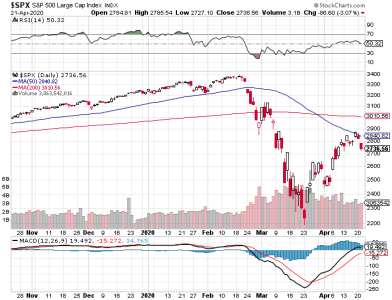

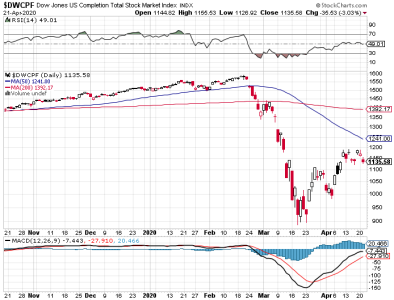

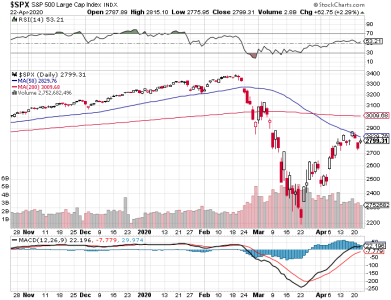

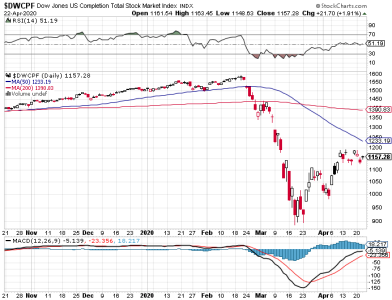

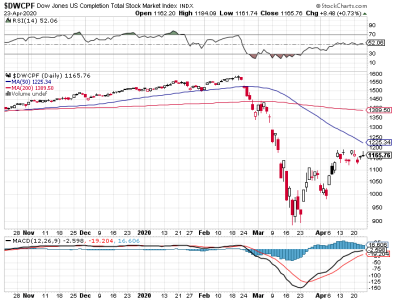

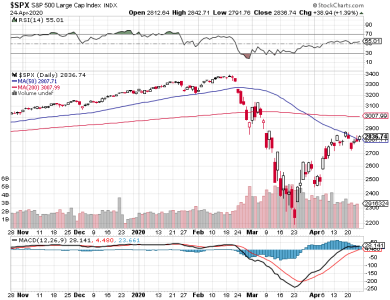

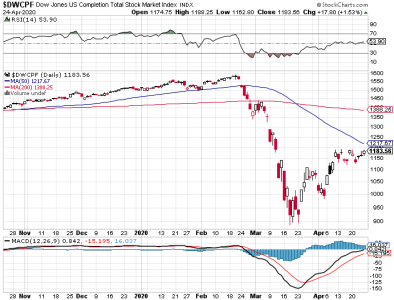

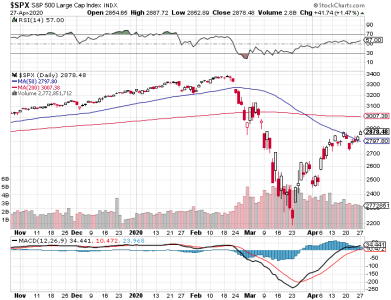

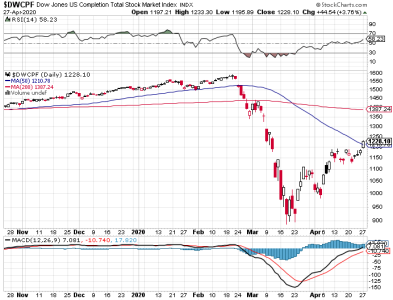

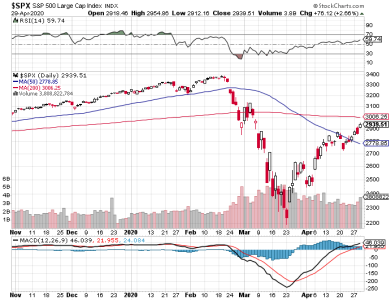

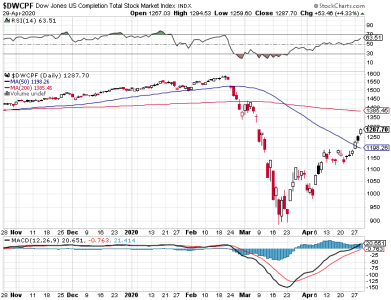

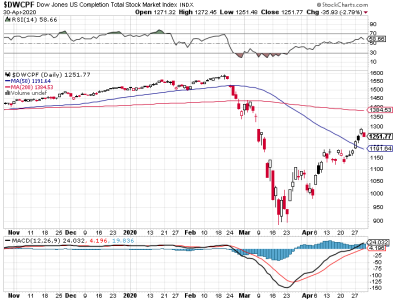

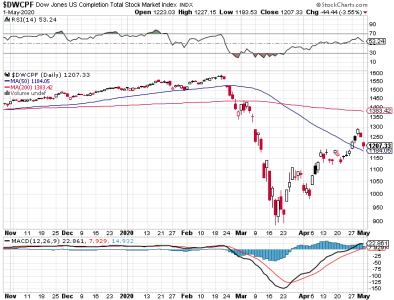

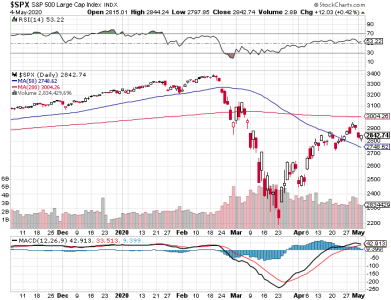

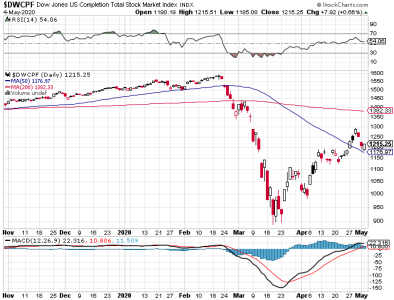

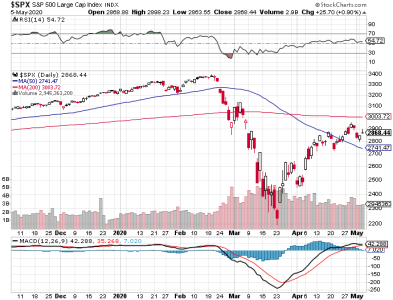

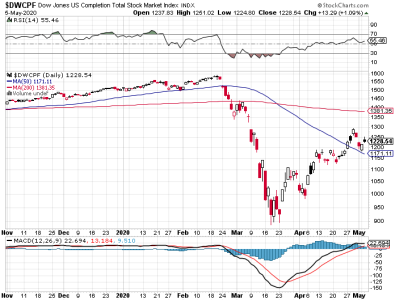

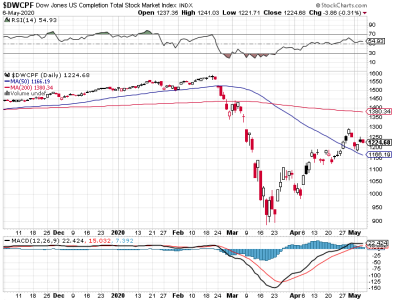

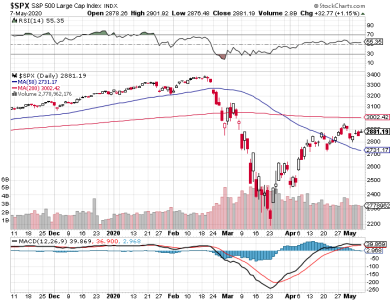

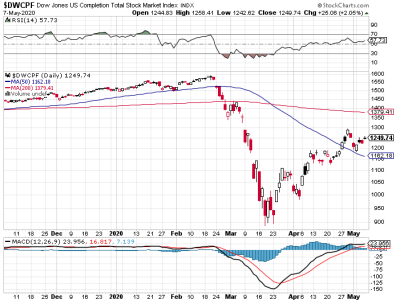

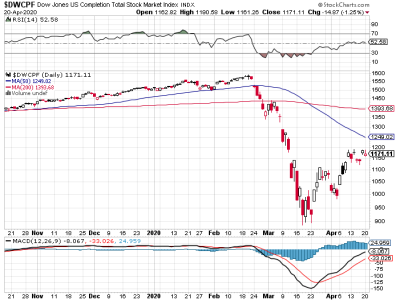

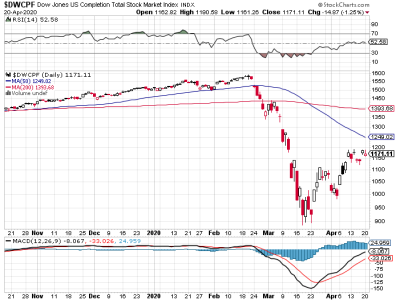

Looking at the charts, you'd never know something major occurred as price, which did go negative today, merely gave back a portion of last week's gains, and that isn't unexpected or unusual.

Breadth continues to flip back and forth and is now negative once more. Perhaps we can look at this reading as neutral given the action.

Futures are positive as I write this, but who knows how the market opens tomorrow. It would not surprise me if the market rallies. It is perverse enough to do something like that.

I remain modestly bullish.

"...there is a lot happening in the financial system and I doubt many money managers are comfortable right now regardless of their sentiment. It just isn't business as usual."

Why am I pointing this out?

I suspect most or at least many of you saw what happened in the oil sector today. A historic plunge to negative prices occurred. That is a first. I can't help but think a fuse of some sort has now been lit.

Is this why NAAIM isn't embracing the rally? I won't speculate on the fallout because I suspect that the expected ramifications of such an occurrence may not manifest the way many money professionals may think.

For now, let's just say that this event could make the rest of this week very interesting in financial markets.

Looking at the charts, you'd never know something major occurred as price, which did go negative today, merely gave back a portion of last week's gains, and that isn't unexpected or unusual.

Breadth continues to flip back and forth and is now negative once more. Perhaps we can look at this reading as neutral given the action.

Futures are positive as I write this, but who knows how the market opens tomorrow. It would not surprise me if the market rallies. It is perverse enough to do something like that.

I remain modestly bullish.