-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

Beester15

Rising Member

- Reaction score

- 3

"The market has been propped up by the Fed for many years. Money printed out of thin air. It's all a scam, but things are going to change and those changes are in progress.."

YEP!

clue me in? what am I missing?

Rod

Market Veteran

- Reaction score

- 403

Mcqlives

Market Veteran

- Reaction score

- 24

I can't find the post now but someone on here posted a site that has pdf of it a while back.

Mcqlives

Market Veteran

- Reaction score

- 24

I just downloaded from Amazon audible for one credit, love being read to since I was a child!

Oh wait, I’m still a child lol!

Thanks Rod for the link...Sent from my iPhone using Tapatalk

Just a warning for you...you will never look at currency the same. At least I don't, which has its good and bad points. Main thing is get as informed as you can and let your eyes be open. The only thing that I believe will happen for sure is your trust in "things" will go way down.

Rod

Market Veteran

- Reaction score

- 403

I just downloaded from Amazon audible for one credit, love being read to since I was a child!

Oh wait, I’m still a child lol!

Thanks Rod for the link...

Sent from my iPhone using Tapatalk

Listen to the first chapter...

https://www.youtube.com/watch?v=Di8MvCpTZ5M

coolhand

TSP Legend

- Reaction score

- 530

That book, which I read about 15 years ago, was what opened my eyes to the matrix. Who recommended it to me? Some of you old timers might remember Teknobucks. He and I got to be good friends (we both lived in Florida) and I'd met him on several occasions over the years, though I have not heard from him in some time now. He had a large following on TSP Talk back in the day.

coolhand

TSP Legend

- Reaction score

- 530

Here is a link to a videotaped appearance by the Author of that book.

https://www.youtube.com/watch?v=lu_VqX6J93k

https://www.youtube.com/watch?v=lu_VqX6J93k

Rod

Market Veteran

- Reaction score

- 403

That book, which I read about 15 years ago, was what opened my eyes to the matrix. Who recommended it to me? Some of you old timers might remember Teknobucks. He and I got to be good friends (we both lived in Florida) and I'd met him on several occasions over the years, though I have not heard from him in some time now. He had a large following on TSP Talk back in the day.

I remember him. Especially his profile pic... now that my memory has been jogged. Looks like his last post was 9 Sep 2009. So, it has indeed been awhile.

Last edited:

Rod

Market Veteran

- Reaction score

- 403

Here is a link to a videotaped appearance by the Author of that book.

https://www.youtube.com/watch?v=lu_VqX6J93k

This guy has read/recorded 19 of the book's 26 chapters. Just found him today. Might want to ignore his other vids.

https://www.youtube.com/user/TheMorgile/videos

coolhand

TSP Legend

- Reaction score

- 530

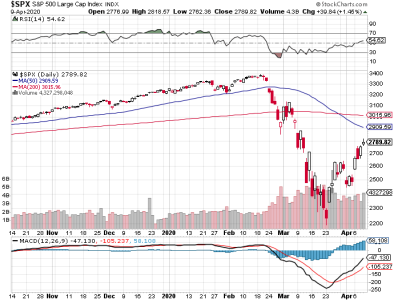

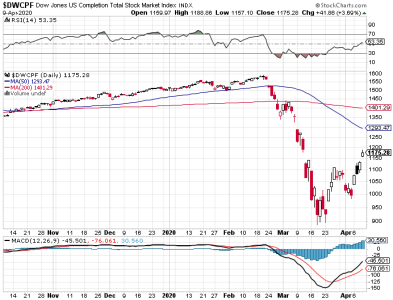

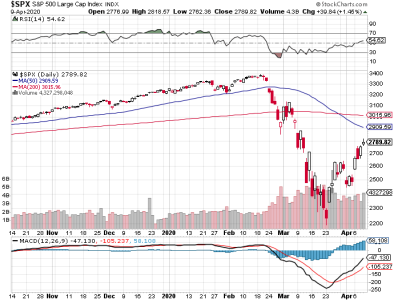

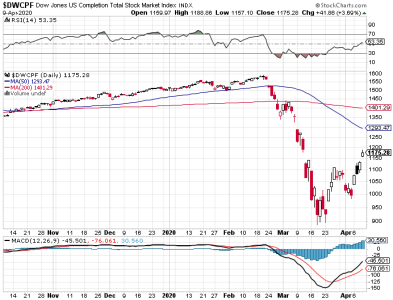

The bulls kept it going today as price rose for the 2nd day in a row. And 4 days in a row for the DWCPF.

So the charts are improving, but they still have overhead resistance to contend with. Momentum looks good.

Breadth is now positive.

We have to remember that the selling that began in late February and didn't bottom until mid-March did a lot technical damage. The rally that is currently in progress has only retraced not even half of those losses (especially the DWCPF). It would be easy to get bullish here (especially with breadth flipping positive), but the smart money is not embracing this rally. NAAIM remains bearish.

Keep in mind that NAAIM was bullish for a long, long time when the market was rising. Are they any less smart now? Probably not, but I need to point out the risk. They may be waiting to see if price can break through the 50 and 200 dma's (or whatever other resistance areas they are watching). Remember that this market is not taking prisoners on either side of the trade (bulls or bears). Price can move very fast and deep in both directions.

I remain neutral. I won't bet against the smart money; especially with so many negatives in play.

So the charts are improving, but they still have overhead resistance to contend with. Momentum looks good.

Breadth is now positive.

We have to remember that the selling that began in late February and didn't bottom until mid-March did a lot technical damage. The rally that is currently in progress has only retraced not even half of those losses (especially the DWCPF). It would be easy to get bullish here (especially with breadth flipping positive), but the smart money is not embracing this rally. NAAIM remains bearish.

Keep in mind that NAAIM was bullish for a long, long time when the market was rising. Are they any less smart now? Probably not, but I need to point out the risk. They may be waiting to see if price can break through the 50 and 200 dma's (or whatever other resistance areas they are watching). Remember that this market is not taking prisoners on either side of the trade (bulls or bears). Price can move very fast and deep in both directions.

I remain neutral. I won't bet against the smart money; especially with so many negatives in play.

Beester15

Rising Member

- Reaction score

- 3

I am on page 38 of the book and all I can think about is that given our current situation something has to give. If the fed and treasury are fully committed to propping up the entire financial infrastructure, how could the market ever go back down?

I will keep reading.

DreamboatAnnie

TSP Legend

- Reaction score

- 838

clue me in? what am I missing?

I can't find the post now but someone on here posted a site that has pdf of it a while back.

I just downloaded from Amazon audible for one credit, love being read to since I was a child!

Oh wait, I’m still a child lol!

Thanks Rod for the link...

Sent from my iPhone using Tapatalk

Hi... Mcqlives, I had posted a link to PDF of the Creature of Jekyll Island last year. Here is the Link to PDF and Book. This is a Must read book.

Hi CoolHand, Thanks for turning us on to this book long ago. It's very informative! Best book on Federal Reserve. I have passed it on to several friends. I'm Also enjoying the youtube link to video speech by the Author. (your post 7633)…only about half way through, but should complete viewing it this weekend.

Best wishes to everyone, and hope you all* have a Blessed and Happy Easter!!! :smile:!!

Book Link

https://archive.org/details/pdfy--Pori1NL6fKm2SnY/mode/2up

Link to PDF, but Book Link is better. If you click on pdf you get it but not the most friendly format. So click at top right where it says "See Other Formats" . This takes you to the Book link. Scroll down below book and you will see several other formats including downloadable pdf, Kindle, etc. Enjoy!

https://archive.org/stream/pdfy--Pori1NL6fKm2SnY/The%20Creature%20From%20Jekyll%20Island_djvu.txt

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 838

Our market could go back down...and even further if don't get back to work and allow our national debt to get so high that we can't pay it down to a reasonable level before the baby boomers die....and leave it to a smaller population of our children. I mean, the debt we are racking up will need to be paid back and the interest is mounting. We are lucky the interest is so low right now...just imagine if it were higher. But our currency could get massively devalued. Then inflation could rise to levels we've never seen....and a start down that road could already be in play.

I'm thinking about how the actions taken to deal with the Wuhan virus are at the same time killing our economy, killing jobs...and killing off small businesses. As small business dies, this could cause a rise and larger take over by corporations....of which it seems many do not care about America. That's all possible, but I am hopeful it will not end this way. I am hopeful countering actions taken will save many small businesses, but many will never come back. I am hopeful President Trump will end this shut down soon! …. even without the medical experts blessings.... I am hopeful he will be advised well on how to ramp the economy back up and fix this over the next four years, but after that all bets are off! Still too many persons in positions of power who just want to line their pockets at our expense... God help us!!!

I'm thinking about how the actions taken to deal with the Wuhan virus are at the same time killing our economy, killing jobs...and killing off small businesses. As small business dies, this could cause a rise and larger take over by corporations....of which it seems many do not care about America. That's all possible, but I am hopeful it will not end this way. I am hopeful countering actions taken will save many small businesses, but many will never come back. I am hopeful President Trump will end this shut down soon! …. even without the medical experts blessings.... I am hopeful he will be advised well on how to ramp the economy back up and fix this over the next four years, but after that all bets are off! Still too many persons in positions of power who just want to line their pockets at our expense... God help us!!!

I am on page 38 of the book and all I can think about is that given our current situation something has to give. If the fed and treasury are fully committed to propping up the entire financial infrastructure, how could the market ever go back down?

I will keep reading.

Similar threads

- Replies

- 0

- Views

- 150

- Replies

- 0

- Views

- 166

- Replies

- 0

- Views

- 116

- Replies

- 0

- Views

- 128

- Replies

- 0

- Views

- 79