hotwings

Market Tracker

- Reaction score

- 2

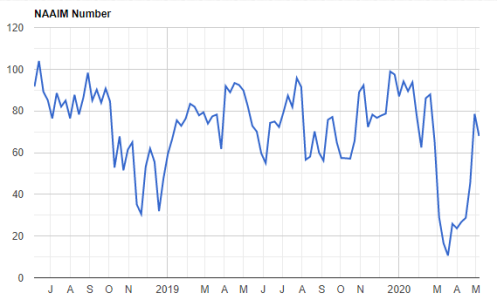

Just found this read....thoughts?

https://financestrategysystem.com/naaim-exposure-index/

https://financestrategysystem.com/naaim-exposure-index/

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

I don't agree with their premise that this is a contrarian indicator except in very short time frames. In fact, if anyone followed that advice when these managers were long (for years) they would have done poorly.

Smart money is generally never contrarian.

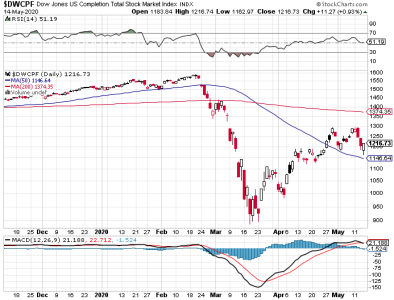

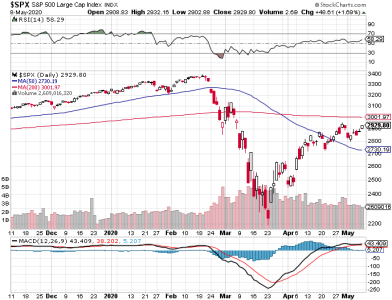

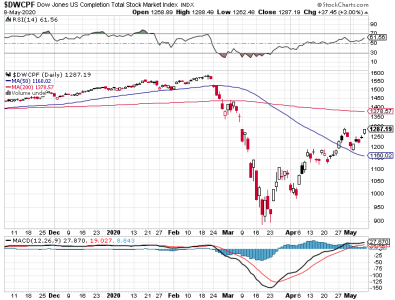

It should also be pointed out that this sentiment reading should not be used all by itself. Other indicators should be used to help validate a market perspective.

So, what's going on with the selling? POTUS made a comment yesterday about the "rich guys" betting against the stock market. When POTUS makes public comments, they are not idle statements. The stock market is at times a major target of big money for the purpose of using it as a form of psychological optics in the never ending political war between good and evil.

https://www.cnbc.com/2020/05/13/tru...d-be-talking-down-stock-market-to-profit.html

Yes, I think you're right on the volatility, and maybe for some time to come. Basically, I think we're in a battle between those who think there will be an economic recovery and those who don't. Who do you think wins in the end?