12/18/25

Stocks declined sharply again on Wednesday as the S&P 500 now has a 4-day losing streak, and Tuesday's gains in the Nasdaq were quickly given back. The seasonality calendar is still in the mid-December lull period for stocks, but a lull is not typically a major sell off like we are seeing. Small caps were up nicely early on, but they could not hold onto gains when big tech is continuing to get sold. Some positive earnings after the bell may help today.

The market continued to keep the bulls off balance as we head into the most bullish part of the year. Those who have been set up for a year end rally are watching the losses mount. Is this the market trying to get investors leaning the wrong way, or was the big rally off the November lows overdone in a market that some feel is overvalued?

There are nine trading days left in December and as investors get more and more concerned and defensive, will the market pull a fast one, and jump higher into the end of the year, or has the fundamental picture changed enough to keep the door shut on Santa? Monday is the 22nd and there won't be anymore excuses.

When the market swats back every bullish set up the charts and indicators are giving us, is it time to give up?

I forget if I said this here in the free daily market commentary, or just in my TSP Talk Plus report, but my biggest concern a week ago was how bullish I was getting, and that was spot on analysis. Too bad I didn't act on it. Sentiment is a powerful indicator, but it has to be used correctly or it could distract you. It's difficult to sell everything when you are feeling very bullish, but it is usually a pretty good idea to consider getting a little more defensive. But how do we feel now? Is anybody feeling extremely bullish heading into the holidays after what has been happening? Probably not, and that could be a good thing.

Can this stop the bleeding in tech? Micron, a semiconductor company which was down 3% yesterday, posted earnings after the bell yesterday and was trading up 7% after hours. The semiconductor sector was crush yesterday, taking down most of the tech heavy indices, so perhaps Micron can fuel some kind over oversold rally in these beaten down semiconductor stocks.

SOXX was up just 1% after hours so its a long way from regaining yesterday's losses.

The S&P 500 (C-fund) fell through two key support levels filling in one open gap this week, and one is still technically open near 6600, although that's one of those stealth gaps that can be considered filled already. It is now just about in the middle of the red trading range.

The PMO indicator continues to signal a negative divergence after another move below its average, and another lower high despite the S&P 500 coming off its highest close of the year. I still think Santa could save December, but early 2026 may have some issues to deal with, and perhaps some investors are not waiting around for an end of year rally.

I see some signs that bitcoin may be getting ready to stabilize after a horrible sell off, and perhaps if it can start the rally, the stock market will get in better mood.

The DWCPF Index (S-Fund) not only lost anther 1% yesterday, but it also created a negative outside reversal day because of the early gains we saw on Wednesday. The left shoulder of the bullish inverted head and shoulders pattern held that the 50-day EMA. The rally after hours in Micron could be a catalyst for small caps, but right now this chart is getting cringy, but perhaps cringy enough to pull off a reversal.

The F-flag on ACWX (I-fund) finally broke down. I had hoped that flag would drag on until the end of the year, but that was probably too optimistic. Now it could just be forming a right shoulder and if one H&S pattern breaks out (C and S funds) this one will likely as well. It may even be the first since it is still the fund with the most relative strength.

BND (bonds / F-fund) was basically flat yesterday as it negotiates the 50-day average and the support line, which unfortunately looks like the neckline of a bearish head and shoulders pattern. Just a reminder: Head and shoulders = generally bearish for a chart. Inverted head and shoulders = generally bullish.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks declined sharply again on Wednesday as the S&P 500 now has a 4-day losing streak, and Tuesday's gains in the Nasdaq were quickly given back. The seasonality calendar is still in the mid-December lull period for stocks, but a lull is not typically a major sell off like we are seeing. Small caps were up nicely early on, but they could not hold onto gains when big tech is continuing to get sold. Some positive earnings after the bell may help today.

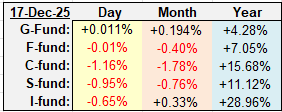

| Daily TSP Funds Return More returns |

The market continued to keep the bulls off balance as we head into the most bullish part of the year. Those who have been set up for a year end rally are watching the losses mount. Is this the market trying to get investors leaning the wrong way, or was the big rally off the November lows overdone in a market that some feel is overvalued?

There are nine trading days left in December and as investors get more and more concerned and defensive, will the market pull a fast one, and jump higher into the end of the year, or has the fundamental picture changed enough to keep the door shut on Santa? Monday is the 22nd and there won't be anymore excuses.

When the market swats back every bullish set up the charts and indicators are giving us, is it time to give up?

I forget if I said this here in the free daily market commentary, or just in my TSP Talk Plus report, but my biggest concern a week ago was how bullish I was getting, and that was spot on analysis. Too bad I didn't act on it. Sentiment is a powerful indicator, but it has to be used correctly or it could distract you. It's difficult to sell everything when you are feeling very bullish, but it is usually a pretty good idea to consider getting a little more defensive. But how do we feel now? Is anybody feeling extremely bullish heading into the holidays after what has been happening? Probably not, and that could be a good thing.

Can this stop the bleeding in tech? Micron, a semiconductor company which was down 3% yesterday, posted earnings after the bell yesterday and was trading up 7% after hours. The semiconductor sector was crush yesterday, taking down most of the tech heavy indices, so perhaps Micron can fuel some kind over oversold rally in these beaten down semiconductor stocks.

SOXX was up just 1% after hours so its a long way from regaining yesterday's losses.

The S&P 500 (C-fund) fell through two key support levels filling in one open gap this week, and one is still technically open near 6600, although that's one of those stealth gaps that can be considered filled already. It is now just about in the middle of the red trading range.

The PMO indicator continues to signal a negative divergence after another move below its average, and another lower high despite the S&P 500 coming off its highest close of the year. I still think Santa could save December, but early 2026 may have some issues to deal with, and perhaps some investors are not waiting around for an end of year rally.

I see some signs that bitcoin may be getting ready to stabilize after a horrible sell off, and perhaps if it can start the rally, the stock market will get in better mood.

The DWCPF Index (S-Fund) not only lost anther 1% yesterday, but it also created a negative outside reversal day because of the early gains we saw on Wednesday. The left shoulder of the bullish inverted head and shoulders pattern held that the 50-day EMA. The rally after hours in Micron could be a catalyst for small caps, but right now this chart is getting cringy, but perhaps cringy enough to pull off a reversal.

The F-flag on ACWX (I-fund) finally broke down. I had hoped that flag would drag on until the end of the year, but that was probably too optimistic. Now it could just be forming a right shoulder and if one H&S pattern breaks out (C and S funds) this one will likely as well. It may even be the first since it is still the fund with the most relative strength.

BND (bonds / F-fund) was basically flat yesterday as it negotiates the 50-day average and the support line, which unfortunately looks like the neckline of a bearish head and shoulders pattern. Just a reminder: Head and shoulders = generally bearish for a chart. Inverted head and shoulders = generally bullish.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.