coolhand

TSP Legend

- Reaction score

- 530

Re: Market Snaps Back - Posted by Coolhand

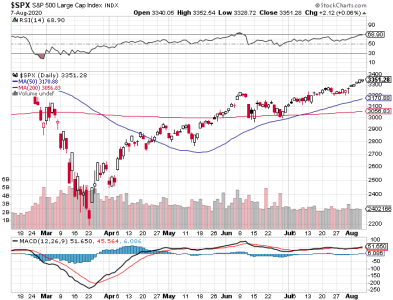

Today's pullback was not unusual. The market had advanced enough over the past few trading days to expect one.

It appears that price is testing support at the February peak (was resistance) on the S&P 500. The DWCPF had not established itself above the February peak for very long, so I would not call it support yet. I will say that the DWCPF held up better than the S&P today, so that's a bullish aspect for today's trading action.

Breadth dipped, but remains bullish.

NAAIM came in a bit more bullish this week. Aside from anticipated pullbacks here and there, I continue to expect price to bias to the upside.

I remain bullish.

Today's pullback was not unusual. The market had advanced enough over the past few trading days to expect one.

It appears that price is testing support at the February peak (was resistance) on the S&P 500. The DWCPF had not established itself above the February peak for very long, so I would not call it support yet. I will say that the DWCPF held up better than the S&P today, so that's a bullish aspect for today's trading action.

Breadth dipped, but remains bullish.

NAAIM came in a bit more bullish this week. Aside from anticipated pullbacks here and there, I continue to expect price to bias to the upside.

I remain bullish.