Yesterday, I said that there were promising signs that the market was beginning to gather some bullish momentum (in so many words). I cautioned that resistance was still overhead, but there were indicators that were becoming more favorable to the bulls.

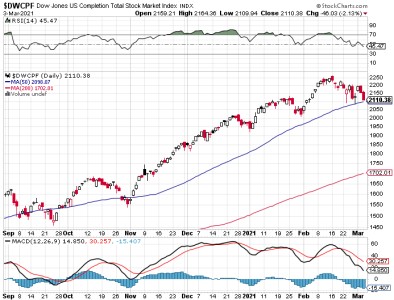

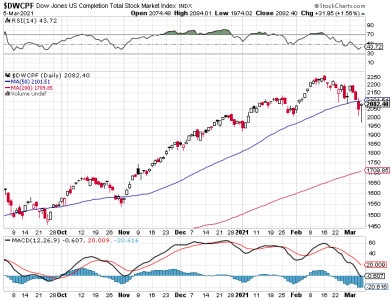

Price rose on both charts today. The S&P 500 closed at an all-time high, but also closed well off its high of the day. Price on the DWCPF also had a good, but is still well off its all-time high. Momentum continues to rise on both charts. Volume is about normal now.

Breadth is looking flat-out bullish once again. It's rising quickly.

All of this is looking pretty good for the bulls, but the smart money (NAAIM) got more defensive and is now leaning bearish. The preliminary TSP Talk Sentiment survey was very bulled, but the official reading has not been released as yet. Both readings are obviously at odds. Recently, I sided with NAAIM when both surveys were opposite another and TSP won.

I have to say that while I normally do not bet against NAAIM, I also know that they don't always get it right (just most of the time). Now, keep in mind that the TSP survey may come in over-the-top bullish and that may be a problem.

So, it's decision time. There are reasons to buy this market right now, but I'd not be complacent about it.

I am going from neutral to modestly bullish.