coolhand

TSP Legend

- Reaction score

- 530

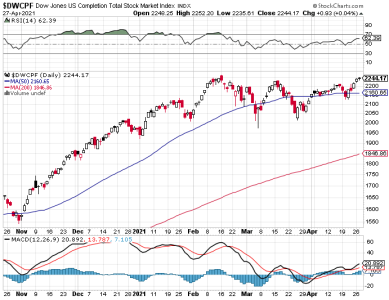

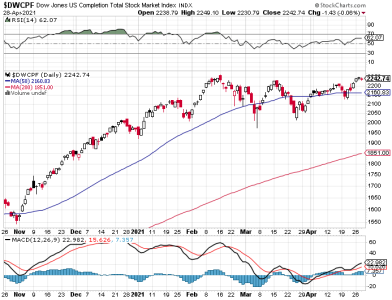

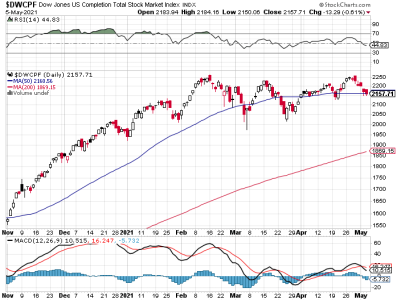

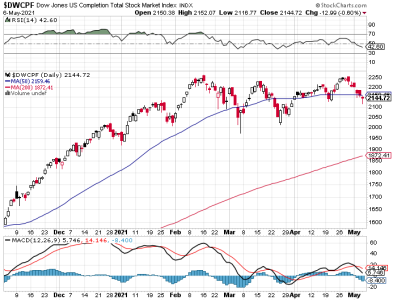

It looks like the market has reached one of those intermediate term points where price needs to reverse before pushing price up. Both the S&P and the DWCPF were thrown for losses on the day. That's 2 in a row for the S&P and 3 for the DWCPF

Support at the 50 dma failed on the DWCPF today. This index, which is not exactly falling apart, has not been able to hit a new all-time high since mid-February. And we now have 2 lower highs. But while resistance above is keeping the index in check, support below has keep it afloat. Really, price has gone nowhere in about 2 months (on average).

Momentum has turned down on both charts. The S&P isn't dealing with resistance like the DWCPF is, but we can see it has marched higher for almost a month with only minor dips along the way, so it shouldn't be a surprise if we get more than token selling after that stretch. Volume is only average.

Breadth is also signaling that a turn lower for a few days may be upon us. It's just barely bullish right now.

It's interesting to me that NAAIM got bullish at a time when the indexes (especially the S&P) were vulnerable to a turn down. I don't want to make much of it because so far this selling in within the norm for the market. I suspect that breadth will turn bearish for a bit before a bottom is in. That's how it's been. The indicators have to get bearish first (typically). We'll see.

I am going neutral on both the S&P and the DWCPF. I suspect more downside is in store, but I can't be sure of it.

Support at the 50 dma failed on the DWCPF today. This index, which is not exactly falling apart, has not been able to hit a new all-time high since mid-February. And we now have 2 lower highs. But while resistance above is keeping the index in check, support below has keep it afloat. Really, price has gone nowhere in about 2 months (on average).

Momentum has turned down on both charts. The S&P isn't dealing with resistance like the DWCPF is, but we can see it has marched higher for almost a month with only minor dips along the way, so it shouldn't be a surprise if we get more than token selling after that stretch. Volume is only average.

Breadth is also signaling that a turn lower for a few days may be upon us. It's just barely bullish right now.

It's interesting to me that NAAIM got bullish at a time when the indexes (especially the S&P) were vulnerable to a turn down. I don't want to make much of it because so far this selling in within the norm for the market. I suspect that breadth will turn bearish for a bit before a bottom is in. That's how it's been. The indicators have to get bearish first (typically). We'll see.

I am going neutral on both the S&P and the DWCPF. I suspect more downside is in store, but I can't be sure of it.