Friday's trading session saw the bulls rally the market hard, which erased a good deal of the earlier losses, but not all of the losses. The S&P and DWCPF both fell more than 1% on the week. Not bad, considering.

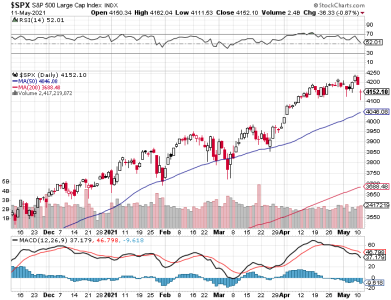

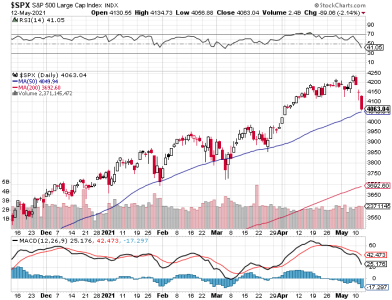

We can see that price on the S&P bounced near its 50 dma and retraced more than half of its losses earlier in the week. It's back in its trading range again. Momentum is trying to turn up. The chart itself does not look all that bad from a technical standpoint. Price on the DWCPF also erased more than half of its losses, but this index is a little different because price remains below its 50 dma. This index remains a possible warning of bigger problems for the market down the road if it doesn't recapture a bullish stance; and it's a long way from doing that without some serious rally time. Momentum is trying to turn back up on this chart too.

Cumulative breadth bounced hard and is back to a bullish configuration.

Our TSP Talk sentiment came in neutral overall. I said that the previous one was neutral, but after looking at last week's reading again I'd say it was more like modestly bullish. That doesn't change anything, I just want to update my perception of the reading.

NAAIM came in decidedly bearish and that cannot be taken lightly. Yes, they may flip bullish again quickly if the action in the market dictates such, but it's a guessing game of sorts what they are thinking in between readings.

So, we have a mixed picture. The S&P rallied smartly off support at its 50 dma, but the DWCPF remains below that key average. I keep wondering if this a canary in the coalmine. We do have a bullish breadth reading again, which is usually a solid indicator.

You can get bullish on this picture and justify it, but you can get bearing and justify that too. It is not unusual for a snap back rally to occur after a hard sell-off. But this is also still a bull market. The question is, is this bull market running on empty?

I cannot get bullish yet on this collective data. The snap back rally may or may not hold. At best I can only be neutral right now because of the struggling DWCPF and a bearish NAAIM. The market could steady itself and appear to be doing at least somewhat well in the short term, but that doesn't mean all is well. Remember, the big money doesn't usually get caught on the wrong side of the market and their pockets are deeper than ours. They can rally this market to trap the bulls and then send it lower (not saying they will).

I am going to remain bearish for now, but that could change early next week depending on how the market trades.