coolhand

TSP Legend

- Reaction score

- 530

In my last post, I said that sentiment was suggesting that weakness may be dead ahead and gave the bears the nod for a few days. Despite Friday's rally, that weakness may still manifest, though if we don't see much weakness in evidence on Monday, the odds of any significant selling would begin to diminish. I also mentioned that breadth and trend were still very much bullish. Friday's rally was not a surprise under the circumstance.

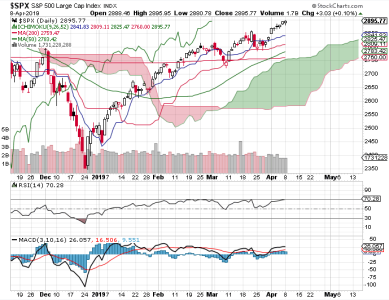

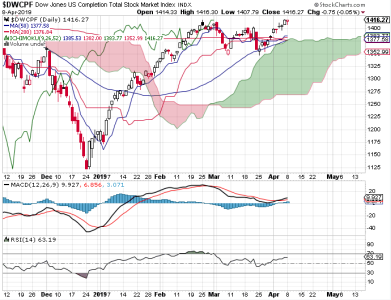

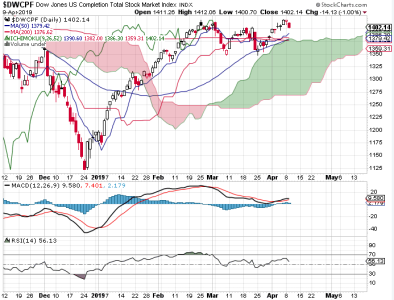

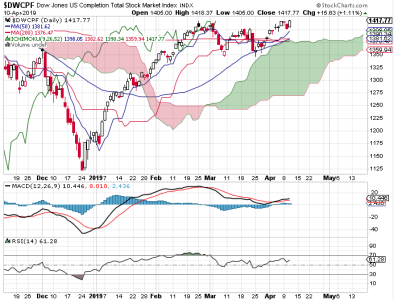

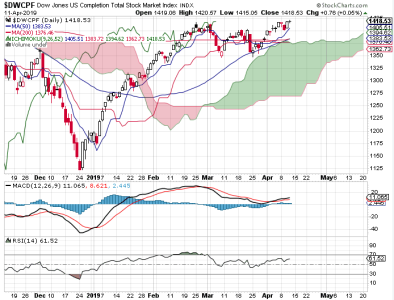

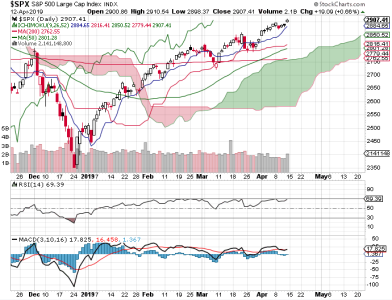

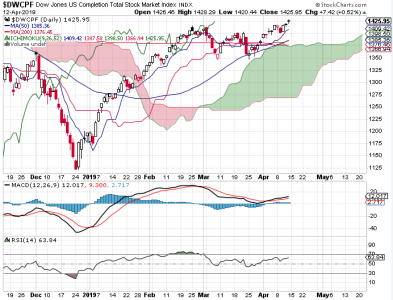

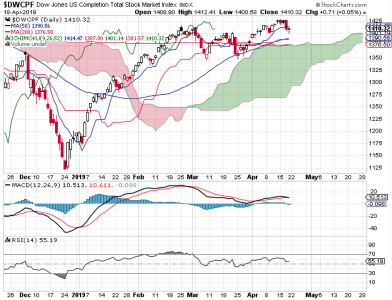

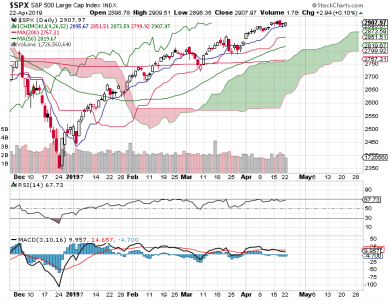

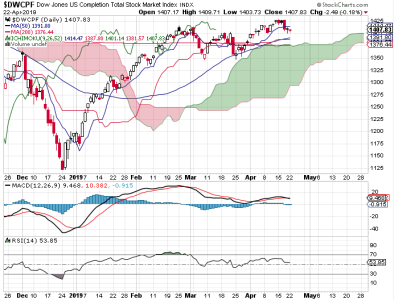

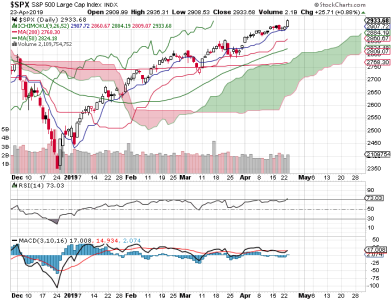

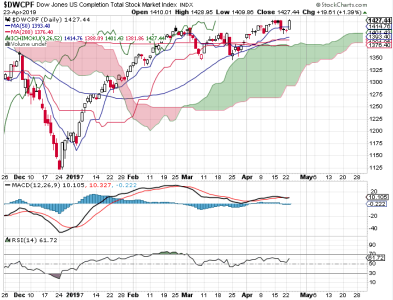

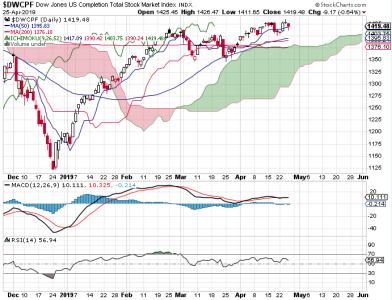

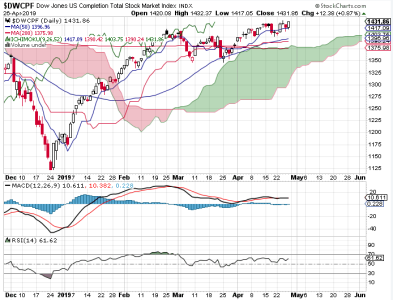

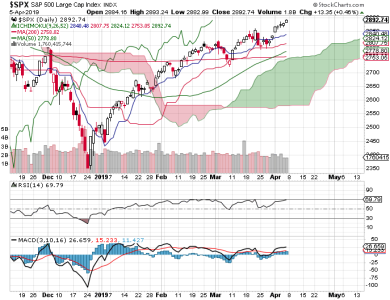

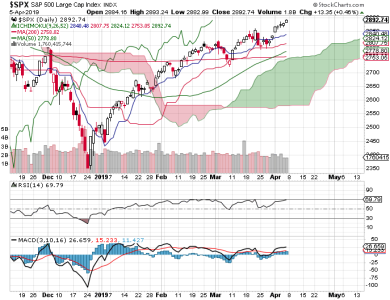

The DWCPF finally closed at a fresh high on this rally. It took almost 6 weeks for that to happen, but that was my expected outcome out of the sideways consolidation. The S&P 500 continued to push ever higher. RSI is now pretty much in bearish territory (not a big deal in this market).

So, NAAIM came in pretty bullish last week, which is bullish in my book beyond a few days (a bulled up NAAIM is historically bearish in the short term, but not always). With breadth as bullish as it is maybe I shouldn't be looking for weakness at all. But, the OEX was bearish (smart money) as was the CBOE last Friday. For Monday, the OEX is still bearish. The CBOE is on the neutral side. TSP Talk is bulled up, which is bearish. So, sentiment is still telling me that weakness is likely, but trend and breadth could very well dictate price direction still. My intermediate term system flipped positive on Friday.

I'm on the fence here and can see it either way in the short term. Longer term, I'm bullish.

The DWCPF finally closed at a fresh high on this rally. It took almost 6 weeks for that to happen, but that was my expected outcome out of the sideways consolidation. The S&P 500 continued to push ever higher. RSI is now pretty much in bearish territory (not a big deal in this market).

So, NAAIM came in pretty bullish last week, which is bullish in my book beyond a few days (a bulled up NAAIM is historically bearish in the short term, but not always). With breadth as bullish as it is maybe I shouldn't be looking for weakness at all. But, the OEX was bearish (smart money) as was the CBOE last Friday. For Monday, the OEX is still bearish. The CBOE is on the neutral side. TSP Talk is bulled up, which is bearish. So, sentiment is still telling me that weakness is likely, but trend and breadth could very well dictate price direction still. My intermediate term system flipped positive on Friday.

I'm on the fence here and can see it either way in the short term. Longer term, I'm bullish.