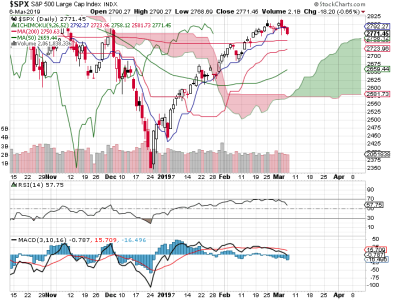

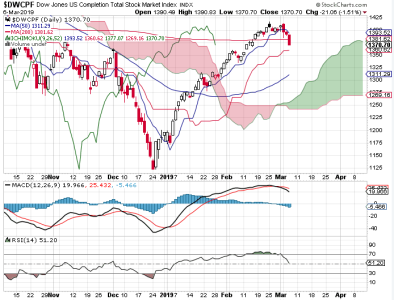

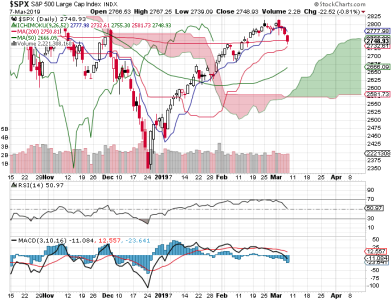

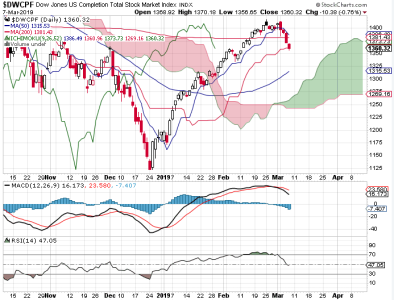

Last week was a big win for the bears as all 3 TSP stock funds got hammered.

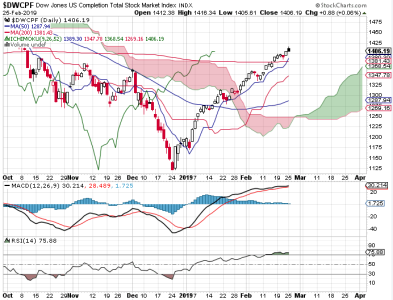

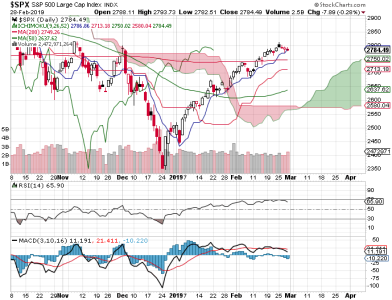

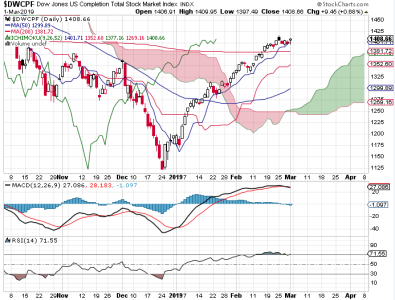

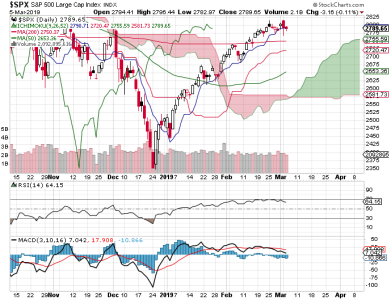

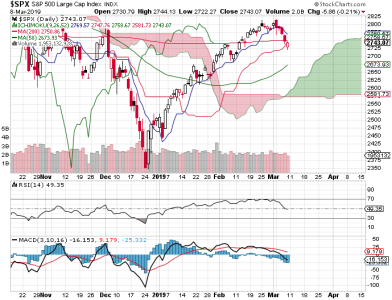

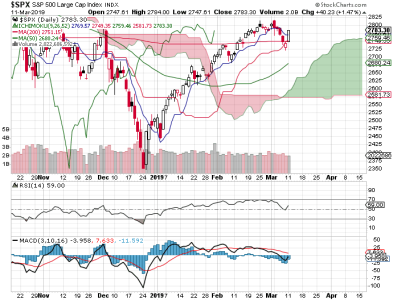

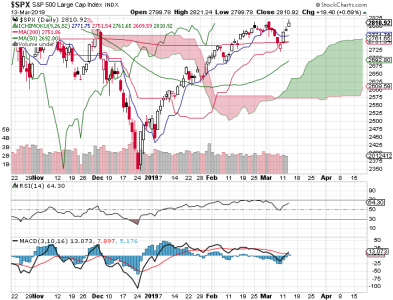

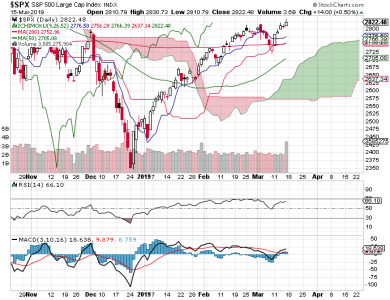

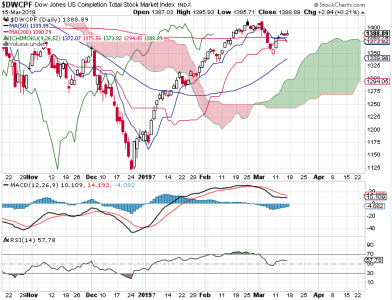

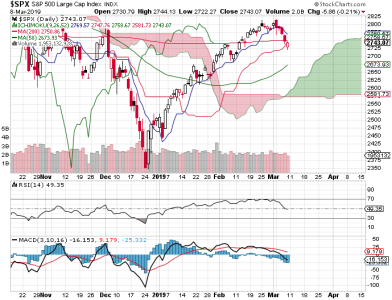

Both charts clearly show that price in now below the 200 dma. RSI has fallen below the neutral line. Momentum is decidedly to the downside. Note though, that the rising 50 dma is not too far below and may provide support should the selling continue.

My intermediate term system is still positive, but not far from flipping negative. Sentiment shows the options leaning a bit bullish for Monday. NAAIM is leaning bullish as well, but have tempered their long positions. TSP Talk got more bearish, but overall is neutral.

Breadth is neutral, but still looking weak in the short term.

Overall, the indicators are leaning bearish, but we've seen enough selling to look for at least a bounce. The 50 dma should be watched for support.

There are some geopolitical events taking place (power outage in Venezuela, etc.) that may be pointing to a significant future event and this could be why we are seeing some selling to this point. While that may sound bearish, it may actually be bullish. I am leaning toward the bullish outcome (for what it's worth). Aside from that this aspect of my worldview, the technical and sentiment pictures support a rally in the days ahead.