coolhand

TSP Legend

- Reaction score

- 530

The sellers have been trying to mount some downside action in recent trading, but it hasn't been nearly enough to offset the buyers. For the week, the S fund almost doubled the gains of the C fund, which is saying something given that the C fund was up near 2.5%.

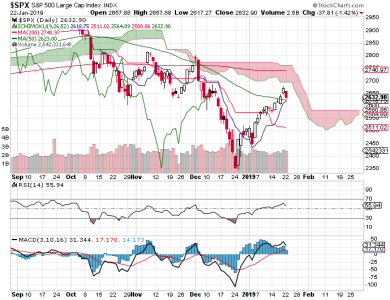

Upside momentum is slowing on the S&P 500, but not as much on DWCPF. We can see that price is struggling with the falling 50 dma and has yet to push past that key average. Price on the S&P 500 has yet to tag its 50 dma and it's already slowing down.

The OEX is leaning bearish for Monday. TSP Talk saw a big jump in bullishness, which could bring some weakness (coupled with the OEX). NAAIM is leaning bullish as of late last week, so that would seem to indicate some degree of support of price in the short term.

My intermediate term system remains positive, but showing subtle signs of being toppy. Breadth and volume are still bullish, though stretched.

I remain bullish in the shorter and intermediate term, but bearish in the long term. The sellers may return on Monday, given the OEX and TSP Talk sentiment.

Upside momentum is slowing on the S&P 500, but not as much on DWCPF. We can see that price is struggling with the falling 50 dma and has yet to push past that key average. Price on the S&P 500 has yet to tag its 50 dma and it's already slowing down.

The OEX is leaning bearish for Monday. TSP Talk saw a big jump in bullishness, which could bring some weakness (coupled with the OEX). NAAIM is leaning bullish as of late last week, so that would seem to indicate some degree of support of price in the short term.

My intermediate term system remains positive, but showing subtle signs of being toppy. Breadth and volume are still bullish, though stretched.

I remain bullish in the shorter and intermediate term, but bearish in the long term. The sellers may return on Monday, given the OEX and TSP Talk sentiment.